Obtaining Nonprofit Status Form

What is the Obtaining Nonprofit Status

The obtaining nonprofit status refers to the legal process by which an organization is recognized as a nonprofit entity by the state and federal government. This status allows the organization to operate for charitable, educational, religious, or other purposes that benefit the public. Achieving nonprofit status can provide various benefits, including tax exemptions and eligibility for grants and donations. It is essential for organizations to understand the requirements and implications of this status to ensure compliance with relevant laws and regulations.

Key Elements of the Obtaining Nonprofit Status

Several key elements define the obtaining nonprofit status. These include:

- Mission Statement: A clear description of the organization’s purpose and goals, outlining how it serves the public interest.

- Organizational Structure: A defined structure that includes a board of directors and bylaws governing the organization’s operations.

- Financial Accountability: Commitment to transparency in financial reporting and adherence to regulations regarding fundraising and expenditures.

- Compliance with State and Federal Laws: Understanding and following the specific legal requirements for nonprofit organizations, including registration and reporting obligations.

Steps to Complete the Obtaining Nonprofit Status

Completing the process of obtaining nonprofit status involves several critical steps:

- Define the organization’s mission and purpose clearly.

- Choose a suitable name for the organization that complies with state regulations.

- Draft the bylaws and establish a board of directors.

- File the necessary incorporation documents with the state.

- Apply for federal tax-exempt status by submitting Form 1023 or Form 1023-EZ to the IRS.

- Register with state tax authorities, if applicable, to obtain state-level tax exemptions.

- Maintain ongoing compliance with reporting and operational requirements.

IRS Guidelines

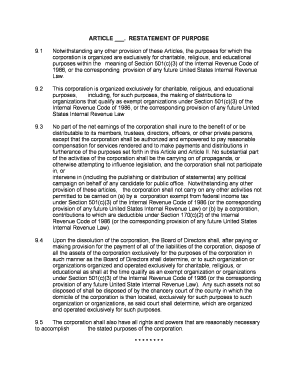

The IRS provides specific guidelines for organizations seeking nonprofit status. These guidelines outline the eligibility criteria, application process, and necessary documentation. Organizations must demonstrate that they operate exclusively for exempt purposes and that their activities do not benefit private interests. It is crucial to familiarize oneself with IRS requirements to ensure a smooth application process and avoid potential delays or denials.

Eligibility Criteria

To qualify for nonprofit status, organizations must meet certain eligibility criteria, including:

- Operating for charitable, educational, religious, or scientific purposes.

- Not engaging in activities that benefit private individuals or shareholders.

- Maintaining a commitment to transparency and accountability in operations.

- Adhering to any additional state-specific requirements for nonprofit organizations.

Required Documents

When applying for nonprofit status, various documents are required to support the application. These typically include:

- Articles of Incorporation that outline the organization's purpose and structure.

- Bylaws that govern the organization’s operations.

- Financial statements or budgets that demonstrate financial viability.

- IRS Form 1023 or Form 1023-EZ, along with any necessary attachments.

Quick guide on how to complete obtaining nonprofit status

Effortlessly complete Obtaining Nonprofit Status on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Obtaining Nonprofit Status on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Obtaining Nonprofit Status without any hassle

- Find Obtaining Nonprofit Status and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Obtaining Nonprofit Status to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the nonprofit purpose of using airSlate SignNow?

The nonprofit purpose of using airSlate SignNow is to streamline document management and enhance operational efficiency without the burden of excessive costs. Nonprofits can utilize this platform to securely send, receive, and sign documents, ensuring that their resources are focused on their mission rather than administrative tasks.

-

How does airSlate SignNow support nonprofits financially?

AirSlate SignNow offers tailored pricing options for nonprofits, making it a cost-effective solution that aligns with the nonprofit purpose. By providing discounts and a user-friendly interface, nonprofits can manage their documents efficiently while keeping their budgets intact.

-

What key features does airSlate SignNow offer for nonprofits?

Features such as customizable templates, bulk sending, and real-time tracking are designed to support the nonprofit purpose. They enable organizations to optimize their document workflows while ensuring compliance and security, which are crucial for nonprofit success.

-

Can airSlate SignNow integrate with other software commonly used by nonprofits?

Yes, airSlate SignNow integrates with various applications commonly used by nonprofits, such as CRM tools and project management software. This integration facilitates a seamless workflow that enhances productivity and aligns with the nonprofit purpose.

-

What are the benefits of using airSlate SignNow for document management?

The benefits of using airSlate SignNow include improved speed of document processing and increased accessibility for remote teams. By adopting this solution, nonprofits can stay focused on their nonprofit purpose while ensuring that essential documents are managed efficiently.

-

Is airSlate SignNow easy to use for nonprofit staff?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for staff of all tech levels in nonprofits. This aligns well with the nonprofit purpose, as it allows teams to get up and running quickly, minimizing training time and maximizing impact.

-

How can airSlate SignNow help nonprofits with compliance?

AirSlate SignNow helps nonprofits maintain compliance by providing secure document storage and tracking features. This assurance is vital for organizations working towards a nonprofit purpose, as it safeguards sensitive information and ensures adherence to regulations.

Get more for Obtaining Nonprofit Status

- Dc corporation form

- Dc intestate form

- Interrogatories 481379345 form

- District of columbia assignment of deed of trust by corporate mortgage holder form

- Dc landlord form

- District of columbia notice of breach of written lease for violating specific provisions of lease with right to cure for form

- District of columbia consent answer to complaint for absolute divorce form

- District of columbia application for allowance of appeal from the small claims and conciliation branch of the civil division form

Find out other Obtaining Nonprofit Status

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free