PDF Form 941 Rev March Internal Revenue Service

What is the 941 form 2021 PDF?

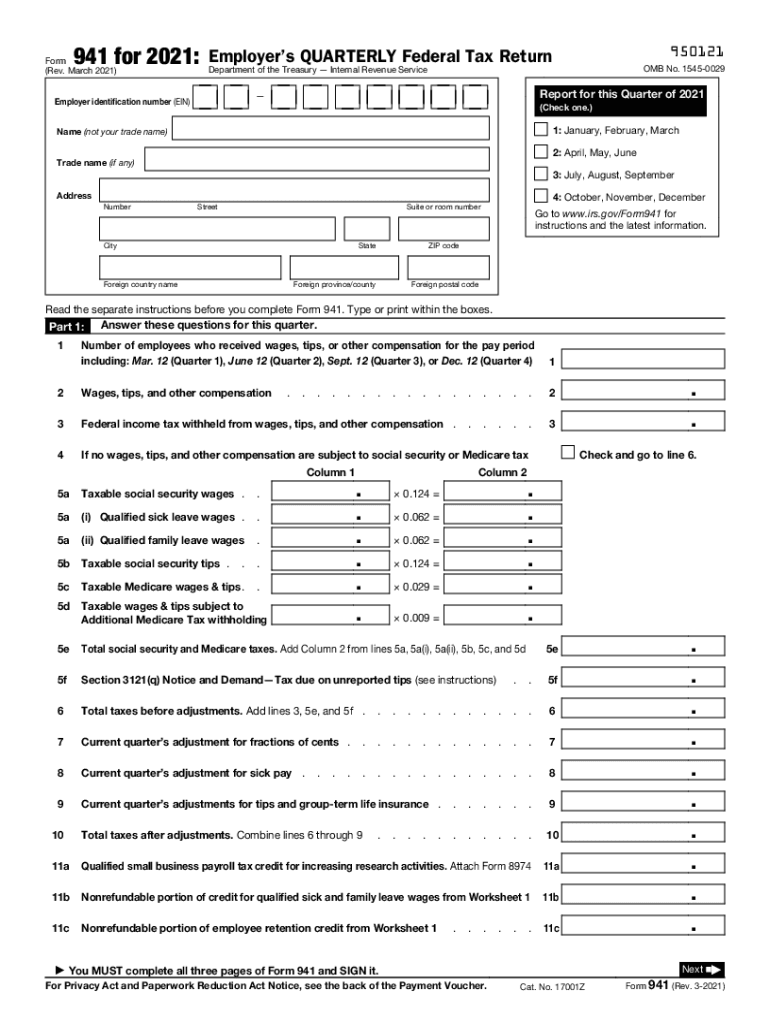

The 941 form 2021 is a quarterly tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax obligations. The form must be filed quarterly, detailing the amount of wages paid and the taxes withheld, allowing the IRS to monitor tax contributions and compliance. The PDF version of the 941 form for 2021 provides a standardized format that can be easily printed and filled out.

How to obtain the 941 form 2021 PDF

To obtain the 941 form 2021 PDF, you can visit the official IRS website, where the form is available for download. Simply search for "941 form 2021 PDF" on the IRS site, and you will find the option to download the form directly. Additionally, many tax preparation software programs include the 941 form, allowing for easier access and completion. Ensure you download the correct version for the specific quarter you are reporting.

Steps to complete the 941 form 2021

Completing the 941 form 2021 involves several key steps:

- Begin by entering your business information, including the name, address, and Employer Identification Number (EIN).

- Report the number of employees who received wages during the quarter.

- Calculate the total wages paid and the taxes withheld for Social Security and Medicare.

- Include any adjustments for the current quarter, such as corrections from previous filings.

- Sign and date the form, certifying that the information provided is accurate.

After completing the form, you can file it either electronically or by mail, depending on your preference and the IRS guidelines.

Legal use of the 941 form 2021

The 941 form 2021 is legally binding when filled out correctly and submitted to the IRS. It serves as an official record of your business's payroll tax obligations. To ensure legal compliance, it is crucial to provide accurate information regarding wages and tax withholdings. Failure to file or inaccuracies can lead to penalties and interest charges from the IRS. Using reliable digital tools for e-signatures can enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the 941 form 2021 are critical for compliance. The form must be filed quarterly, with the following deadlines:

- First quarter (January to March): Due by April 30, 2021

- Second quarter (April to June): Due by July 31, 2021

- Third quarter (July to September): Due by October 31, 2021

- Fourth quarter (October to December): Due by January 31, 2022

It is essential to adhere to these deadlines to avoid penalties and ensure your business remains compliant with IRS regulations.

Penalties for Non-Compliance

Non-compliance with the filing of the 941 form 2021 can result in significant penalties. These penalties may include:

- Failure to file penalty: A percentage of the unpaid tax amount for each month the form is late.

- Failure to pay penalty: A percentage of the unpaid tax amount, accruing from the due date until paid.

- Interest on unpaid taxes: Accumulating from the due date until the tax is paid in full.

To avoid these penalties, it is important to file the form accurately and on time, ensuring all required information is included.

Quick guide on how to complete pdf form 941 rev march 2021 internal revenue service

Effortlessly Prepare PDF Form 941 Rev March Internal Revenue Service on Any Device

The management of documents online has become increasingly popular among businesses and individuals alike. It serves as a superb environmentally friendly alternative to conventional printed and signed paperwork, since you can easily find the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage PDF Form 941 Rev March Internal Revenue Service on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

How to Alter and Electronically Sign PDF Form 941 Rev March Internal Revenue Service with Ease

- Obtain PDF Form 941 Rev March Internal Revenue Service and click Get Form to begin.

- Utilize our available tools to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the specific tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and press the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and electronically sign PDF Form 941 Rev March Internal Revenue Service and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf form 941 rev march 2021 internal revenue service

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the 941 form 2021 pdf used for?

The 941 form 2021 pdf is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. It is essential for businesses to submit this form quarterly to ensure compliance with IRS regulations.

-

How can I download the 941 form 2021 pdf?

You can easily download the 941 form 2021 pdf directly from the IRS website or through our airSlate SignNow platform. Simply navigate to the forms section and search for '941 form 2021 pdf' to get started.

-

Can I eSign the 941 form 2021 pdf using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the 941 form 2021 pdf effortlessly. Our platform ensures secure digital signatures and allows for easy tracking of your form status.

-

What features does airSlate SignNow offer for managing the 941 form 2021 pdf?

AirSlate SignNow offers features like document templates, collaboration tools, and automated workflows specifically for the 941 form 2021 pdf. These features enhance efficiency in completing and submitting necessary forms.

-

Is there a cost associated with using airSlate SignNow for the 941 form 2021 pdf?

AirSlate SignNow provides various pricing plans, allowing you to choose what best suits your business needs. You can access a free trial to explore the platform's capabilities for the 941 form 2021 pdf before committing to a plan.

-

What benefits does airSlate SignNow provide when managing the 941 form 2021 pdf?

Using airSlate SignNow for the 941 form 2021 pdf streamlines the process of document management, making it faster and more efficient. It minimizes errors and enhances security, providing peace of mind for businesses.

-

Does airSlate SignNow integrate with accounting software for the 941 form 2021 pdf?

Yes, airSlate SignNow offers integrations with popular accounting software platforms, making it easier to sync data and manage the 941 form 2021 pdf alongside your financial records. This integration simplifies the filing process for businesses.

Get more for PDF Form 941 Rev March Internal Revenue Service

- Greenshield scholarship form

- Customer satisfaction survey questions qualtrics form

- Atomy thailand form

- Dcf 3031 form

- Wysa medical release form

- School expenditure requisition order chicago public schools clerks cps form

- Kkm physiotherapy assessment form

- Missouri residential real estate sales disclosure statement form

Find out other PDF Form 941 Rev March Internal Revenue Service

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer