Scannable 1099 Form 2020

What is the Scannable 1099 Form

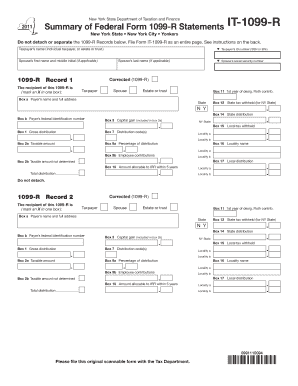

The scannable 1099 form is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is essential for independent contractors, freelancers, and other non-employee workers who receive payments from businesses. Unlike traditional paper forms, the scannable version is designed for easy processing by automated systems, allowing for efficient data capture and reducing the likelihood of errors. It is crucial for both the payer and the recipient to understand the importance of this form in accurately reporting income to the Internal Revenue Service (IRS).

How to Use the Scannable 1099 Form

Using the scannable 1099 form involves several key steps to ensure compliance with IRS regulations. First, the payer must gather the necessary information about the recipient, including their name, address, and taxpayer identification number (TIN). Next, the payer fills out the form, indicating the total amount paid during the tax year. After completing the form, it should be printed on special scannable paper, which is designed to be read by automated systems. Finally, the payer must send the completed form to both the recipient and the IRS by the specified deadlines.

Steps to Complete the Scannable 1099 Form

Completing the scannable 1099 form requires attention to detail. Here are the steps to follow:

- Gather recipient information, including name, address, and TIN.

- Determine the total amount paid to the recipient for the tax year.

- Access the scannable 1099 form template, ensuring it meets IRS specifications.

- Fill out the form accurately, ensuring all information is correct.

- Print the form on scannable paper, ensuring the barcodes and formatting are intact.

- Distribute copies to the recipient and the IRS by the required deadlines.

Legal Use of the Scannable 1099 Form

The legal use of the scannable 1099 form is governed by IRS regulations. It is essential for the payer to issue this form to any individual or entity that has received payments totaling $600 or more in a calendar year for services rendered. Failure to provide this form can result in penalties for the payer. Additionally, recipients must report the income stated on the form when filing their tax returns. Ensuring compliance with these legal requirements helps maintain transparency and accountability in financial transactions.

Filing Deadlines / Important Dates

Filing deadlines for the scannable 1099 form are critical for both payers and recipients. Typically, the payer must provide the completed form to the recipient by January 31 of the year following the tax year in which payments were made. Additionally, the form must be submitted to the IRS by the same date if filed electronically or by February 28 if submitted by mail. It is essential to be aware of these deadlines to avoid penalties and ensure compliance with tax regulations.

Who Issues the Form

The scannable 1099 form is issued by businesses or individuals who have made payments to non-employees throughout the tax year. This includes corporations, partnerships, and sole proprietors who hire independent contractors or freelancers. It is the responsibility of the payer to accurately complete and distribute the form to the appropriate parties, ensuring that all required information is included for proper tax reporting.

Quick guide on how to complete scannable 1099 form

Effortlessly Prepare Scannable 1099 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Scannable 1099 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven procedure today.

How to Edit and eSign Scannable 1099 Form with Ease

- Locate Scannable 1099 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with missing or lost documents, exhausting form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign Scannable 1099 Form and ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct scannable 1099 form

Create this form in 5 minutes!

How to create an eSignature for the scannable 1099 form

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is a scannable 1099 form?

A scannable 1099 form is a specific type of tax form that can be easily scanned and processed by tax software. It contains important information regarding income earned by independent contractors and freelancers. Using a scannable 1099 form helps ensure accurate reporting and compliance with IRS guidelines.

-

How can airSlate SignNow help with scannable 1099 forms?

airSlate SignNow allows businesses to create, send, and electronically sign scannable 1099 forms with ease. Our platform ensures that the forms are filled out correctly and securely sent to recipients. This streamlines the process of collecting vital tax information and reduces the chances of errors.

-

Are there any costs associated with using airSlate SignNow for scannable 1099 forms?

Yes, there are affordable subscription plans for airSlate SignNow that cater to various business sizes and needs. Our transparent pricing structure ensures you can access features specific to handling scannable 1099 forms without hidden fees. You can try our platform with a free trial before committing.

-

What features does airSlate SignNow offer for handling scannable 1099 forms?

airSlate SignNow provides features such as customizable templates for scannable 1099 forms, easy document tracking, and secure e-signature options. Additionally, our user-friendly interface ensures that even non-technical users can manage their forms efficiently. These features make your tax documentation tasks seamless and reliable.

-

Can I integrate airSlate SignNow with my existing software for scannable 1099 forms?

Absolutely! airSlate SignNow offers various integrations with popular accounting and tax software. This allows you to easily import data into scannable 1099 forms and sync information, reducing manual entry. Our integrations can help improve your workflow and save you valuable time.

-

What are the benefits of using airSlate SignNow for scannable 1099 forms?

Using airSlate SignNow for scannable 1099 forms provides signNow benefits like increased efficiency, better document security, and reduced costs associated with paper forms. Our e-signature solution speeds up the signature process, allowing you to collect necessary approvals quickly. Overall, it simplifies tax documentation for businesses.

-

Is airSlate SignNow secure for processing scannable 1099 forms?

Yes, airSlate SignNow prioritizes security and compliance in handling sensitive information on scannable 1099 forms. We implement strong encryption protocols and follow industry-standard security measures to protect your data. You can trust that your tax documents are safe with us.

Get more for Scannable 1099 Form

Find out other Scannable 1099 Form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract