Summary of Federal Form 1099 R Statements Tax NY Gov 2023

Understanding the Summary of Federal Form 1099 R Statements

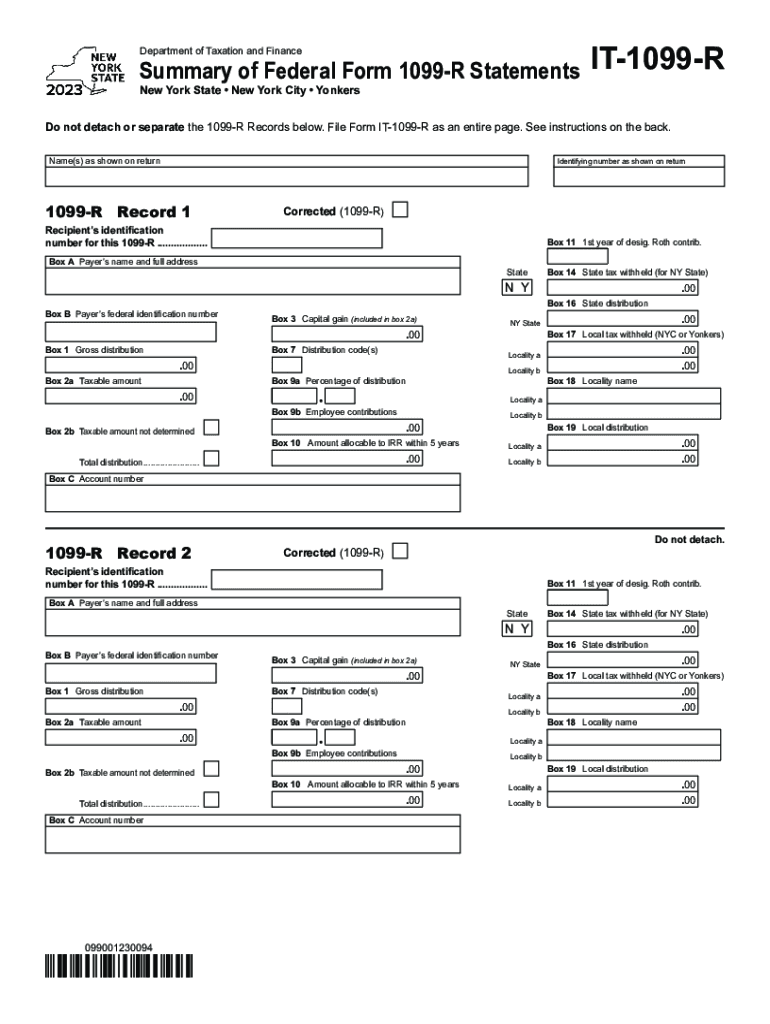

The Summary of Federal Form 1099 R is a crucial document for reporting distributions from pensions, annuities, retirement plans, and other similar sources. It provides a comprehensive overview of the total distributions made to an individual during the tax year. This summary is essential for both taxpayers and the IRS, as it helps ensure accurate tax reporting and compliance.

Typically, the form includes details such as the total amount distributed, the taxable amount, and any federal income tax withheld. Understanding this summary can help taxpayers accurately report their income and avoid potential penalties for underreporting.

Steps to Complete the Summary of Federal Form 1099 R Statements

Completing the Summary of Federal Form 1099 R requires careful attention to detail. Here are the key steps:

- Gather all relevant documents, including previous tax returns and any forms related to retirement distributions.

- Identify the total amount of distributions received during the tax year, ensuring to include any taxable and non-taxable amounts.

- Check for any federal income tax withheld from the distributions, as this will need to be reported on your tax return.

- Fill out the form accurately, ensuring all information matches the supporting documents.

- Review the completed form for any errors before submission to ensure compliance with IRS guidelines.

Filing Deadlines and Important Dates

Timely filing of the Summary of Federal Form 1099 R is essential to avoid penalties. The IRS typically requires that this form be filed by January thirty-first of the year following the tax year in question. Additionally, recipients must receive their copies by the same date. Keeping track of these deadlines helps ensure that all necessary forms are submitted on time, facilitating a smoother tax filing process.

IRS Guidelines for Form 1099 R

The IRS provides specific guidelines for the Summary of Federal Form 1099 R to ensure accurate reporting. These guidelines include:

- Understanding which distributions are reportable and the appropriate tax treatment for each type.

- Ensuring that all amounts reported are accurate and supported by documentation.

- Filing corrections promptly if errors are discovered after submission.

- Staying informed about any changes in tax laws that may affect reporting requirements.

Who Issues the Form 1099 R

The Summary of Federal Form 1099 R is typically issued by financial institutions, pension plans, and other entities that manage retirement accounts. These organizations are responsible for providing accurate information regarding distributions made to individuals. It is important for recipients to verify that they have received the correct form and that it reflects the accurate amounts distributed during the tax year.

Penalties for Non-Compliance with Form 1099 R Requirements

Failure to comply with the reporting requirements of the Summary of Federal Form 1099 R can result in significant penalties. The IRS may impose fines for late filings or inaccuracies in the reported amounts. Additionally, taxpayers who fail to report income from distributions may face further penalties, including interest on unpaid taxes. Understanding these consequences emphasizes the importance of accurate and timely reporting.

Quick guide on how to complete summary of federal form 1099 r statements tax ny gov

Effortlessly Prepare Summary Of Federal Form 1099 R Statements Tax NY gov on Any Device

Online document management has become increasingly favored by both organizations and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Summary Of Federal Form 1099 R Statements Tax NY gov on any device with the airSlate SignNow applications for Android or iOS and enhance any document-oriented workflow today.

How to Edit and Electronically Sign Summary Of Federal Form 1099 R Statements Tax NY gov with Ease

- Obtain Summary Of Federal Form 1099 R Statements Tax NY gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Summary Of Federal Form 1099 R Statements Tax NY gov while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct summary of federal form 1099 r statements tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the summary of federal form 1099 r statements tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IT 1099 R form?

The IT 1099 R form is a document that reports distributions from pensions, annuities, retirement plans, or other sources. This essential form is used by individuals and businesses to ensure accurate tax reporting. Understanding the IT 1099 R is crucial for proper financial management.

-

How can airSlate SignNow assist with IT 1099 R forms?

airSlate SignNow provides a seamless way to send and eSign IT 1099 R forms electronically. With our platform, users can easily create, distribute, and track these crucial tax documents. This streamlines the process and helps keep your compliance on track.

-

What are the pricing options for using airSlate SignNow for IT 1099 R forms?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes, ensuring accessibility for handling IT 1099 R forms. Our cost-effective solution is designed to maximize efficiency while minimizing expenses. You can explore our plans to find the best fit for your needs.

-

Is airSlate SignNow secure for processing IT 1099 R forms?

Yes, airSlate SignNow prioritizes security, using advanced encryption protocols to protect your sensitive information. When processing IT 1099 R forms, you can trust that your data is safe and compliant with security standards. Your peace of mind is our top priority.

-

Can I integrate airSlate SignNow with my existing accounting software for IT 1099 R forms?

Absolutely! airSlate SignNow offers integration with various accounting and tax software that simplifies the management of IT 1099 R forms. This feature ensures that you can streamline your workflow and maintain accurate financial records without any hassle.

-

What features does airSlate SignNow include for managing IT 1099 R forms?

With airSlate SignNow, you can access features such as electronic signatures, document templates, and tracking tools specifically for IT 1099 R forms. These tools enhance your workflow, making it easier to create, send, and manage essential tax documents. Our intuitive platform is designed for efficiency.

-

How does airSlate SignNow improve collaboration on IT 1099 R forms?

airSlate SignNow facilitates seamless collaboration among team members working on IT 1099 R forms. Shared access to documents and real-time updates ensure that everyone is on the same page, reducing the chances of errors. This collaboration feature boosts operational efficiency and accuracy.

Get more for Summary Of Federal Form 1099 R Statements Tax NY gov

Find out other Summary Of Federal Form 1099 R Statements Tax NY gov

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast