Form it 1099 R Summary of Federal Form 1099 R Statements Tax Year 2024-2026

Understanding the IT 1099 R Summary of Federal Form 1099 R Statements

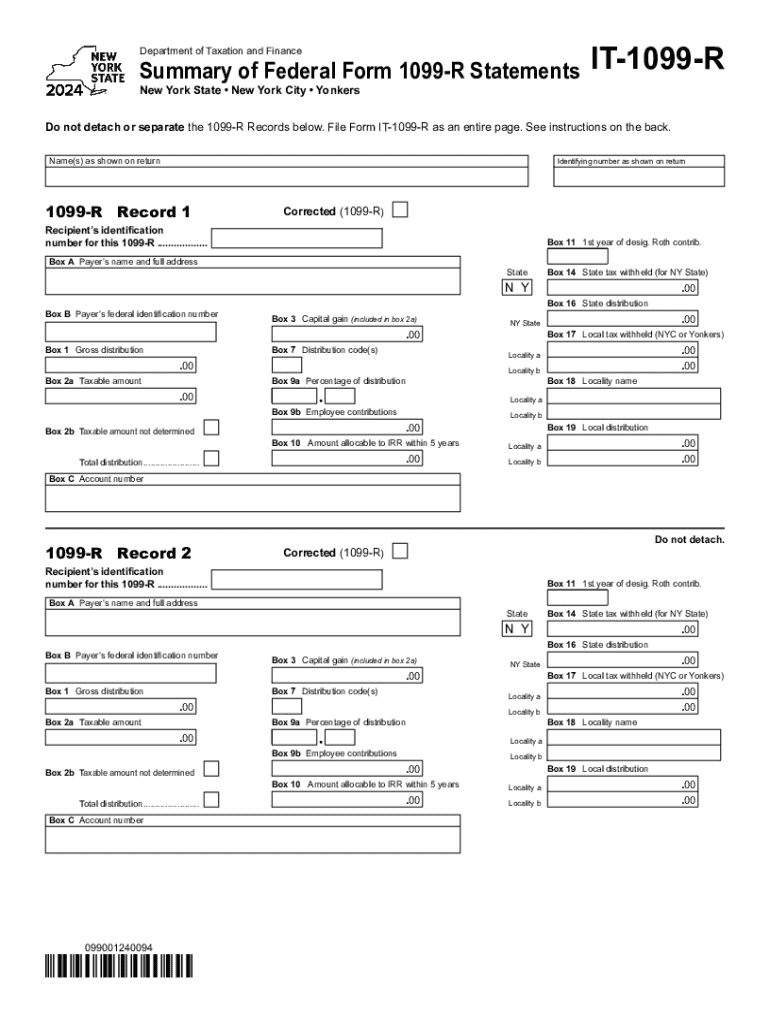

The IT 1099 R is a summary form that consolidates information from Federal Form 1099 R statements. This form is crucial for taxpayers who receive distributions from retirement accounts, pensions, or annuities. It summarizes the taxable amounts, federal income tax withheld, and other essential details that taxpayers need to report accurately on their state tax returns. Understanding this form is vital for ensuring compliance with state tax regulations and for accurately calculating tax liabilities.

Steps to Complete the IT 1099 R Summary of Federal Form 1099 R Statements

Filling out the IT 1099 R involves several key steps:

- Gather Necessary Documents: Collect all relevant 1099 R forms received from various financial institutions.

- Review Information: Ensure that the information on each 1099 R form is accurate, including names, Social Security numbers, and amounts.

- Summarize Data: Aggregate the totals for taxable amounts and federal tax withheld from all 1099 R forms.

- Complete the IT 1099 R Form: Enter the summarized data into the IT 1099 R form accurately.

- Double-Check Entries: Review all entries for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the IT 1099 R is essential to avoid penalties. Generally, the deadline for submitting this form to the New York State Department of Taxation and Finance is the same as the federal deadline for 1099 R forms. This typically falls on January thirty-first of the year following the tax year in question. It is important to stay updated on any changes to deadlines by checking official state resources.

Legal Use of the IT 1099 R Summary of Federal Form 1099 R Statements

The IT 1099 R is legally required for reporting retirement income and distributions in New York State. Taxpayers must use this form to report any distributions received from retirement accounts, pensions, or annuities. Failure to file this form can lead to penalties and interest on unpaid taxes. It is crucial for taxpayers to understand their obligations regarding this form to ensure compliance with state tax laws.

Who Issues the IT 1099 R Summary of Federal Form 1099 R Statements

The IT 1099 R is issued by the financial institutions or entities that manage retirement accounts, pensions, or annuities. These issuers are responsible for providing accurate information on distributions made to taxpayers. Taxpayers should receive their IT 1099 R forms by January thirty-first each year, allowing them sufficient time to report this information on their tax returns.

Examples of Using the IT 1099 R Summary of Federal Form 1099 R Statements

Taxpayers may encounter various scenarios where the IT 1099 R is applicable:

- Retirement Distributions: Individuals receiving monthly pension payments will report these amounts using the IT 1099 R.

- Early Withdrawals: Those who withdraw funds from retirement accounts before reaching retirement age must report these distributions.

- Rollover Transactions: Taxpayers who roll over retirement funds into another account will also need to summarize this information on the IT 1099 R.

State-Specific Rules for the IT 1099 R Summary of Federal Form 1099 R Statements

New York State has specific rules governing the use of the IT 1099 R. Taxpayers must ensure that they follow state guidelines for reporting retirement income. This includes understanding any exemptions or deductions available for certain types of retirement income. Familiarity with state-specific rules can help taxpayers maximize their benefits and avoid potential issues with tax compliance.

Create this form in 5 minutes or less

Find and fill out the correct form it 1099 r summary of federal form 1099 r statements tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 1099 r summary of federal form 1099 r statements tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny 1099 form online and why do I need it?

The ny 1099 form online is a tax document used to report income received by non-employees, such as freelancers or contractors. It's essential for accurate tax reporting and compliance with New York state regulations. Using airSlate SignNow, you can easily fill out and eSign your ny 1099 form online, ensuring a smooth filing process.

-

How does airSlate SignNow simplify the process of completing the ny 1099 form online?

airSlate SignNow streamlines the completion of the ny 1099 form online by providing an intuitive interface that guides you through each step. You can easily input your information, add signatures, and send the form directly to recipients. This eliminates the hassle of paper forms and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the ny 1099 form online?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that fits your budget while gaining access to features that make completing the ny 1099 form online efficient and secure. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for managing the ny 1099 form online?

Absolutely! airSlate SignNow offers integrations with popular accounting and business management software, allowing you to manage your ny 1099 form online seamlessly. This integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the ny 1099 form online?

Using airSlate SignNow for the ny 1099 form online provides numerous benefits, including enhanced security, ease of use, and time savings. You can eSign documents quickly and securely, reducing the time spent on paperwork. Additionally, our platform ensures compliance with legal requirements.

-

How can I ensure my ny 1099 form online is filed correctly?

To ensure your ny 1099 form online is filed correctly, double-check all entered information for accuracy before submission. airSlate SignNow provides prompts and tips throughout the process to help you avoid common mistakes. Additionally, you can save drafts and review them before finalizing.

-

Is it possible to track the status of my ny 1099 form online once sent?

Yes, airSlate SignNow allows you to track the status of your ny 1099 form online after sending it. You will receive notifications when the document is viewed and signed, giving you peace of mind and ensuring timely follow-ups if needed.

Get more for Form IT 1099 R Summary Of Federal Form 1099 R Statements Tax Year

- Coastal winds and clouds gizmo answer key form

- Priority health prior authorization form pdf

- Wellcare authorization form

- Register my bee hive form

- Runza application form

- Pico question template form

- Publication 1321 rev 10 special instructions for bona fide residents of puerto rico who must file a u s individual income tax form

- Medical history form 765149814

Find out other Form IT 1099 R Summary Of Federal Form 1099 R Statements Tax Year

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer