it 1099 R 2019

What is the IT 1099-R?

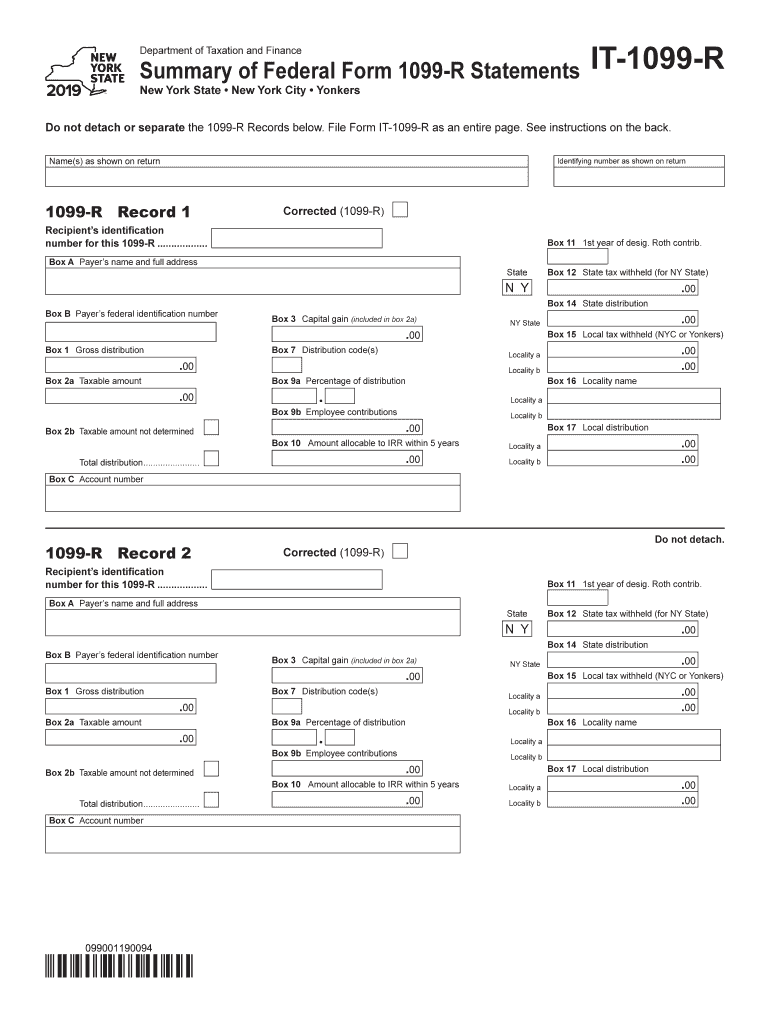

The IT 1099-R is a tax form used in the United States to report distributions from retirement plans, pensions, and other similar financial arrangements. This form is essential for taxpayers who have received distributions during the tax year, as it provides crucial information for accurately reporting income to the Internal Revenue Service (IRS). The form includes details such as the amount distributed, the type of distribution, and any taxes withheld. Understanding this form is vital for ensuring compliance with tax obligations.

How to Use the IT 1099-R

Using the IT 1099-R involves several steps to ensure accurate reporting of retirement income. First, taxpayers should review the information provided on the form, including the payer's details and the total distribution amount. Next, individuals should report this income on their federal tax return, typically on Form 1040. It is important to keep a copy of the IT 1099-R for personal records and to verify the accuracy of the information reported. If there are discrepancies, taxpayers should contact the issuer for corrections.

Steps to Complete the IT 1099-R

Completing the IT 1099-R requires careful attention to detail. Here are the general steps involved:

- Gather necessary documents, including previous tax returns and any related forms.

- Fill in the payer's information, including name, address, and taxpayer identification number.

- Enter the recipient's details accurately, ensuring the name and Social Security number match IRS records.

- Report the total distribution amount in the appropriate box.

- Indicate any federal income tax withheld, if applicable.

- Review the completed form for accuracy before submission.

Legal Use of the IT 1099-R

The IT 1099-R is legally binding when completed correctly and submitted to the IRS. To ensure its legality, the form must be filled out accurately, reflecting true and complete information regarding distributions. Additionally, it must be submitted by the specified deadlines to avoid penalties. Compliance with IRS regulations is crucial, as inaccuracies can lead to audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the IT 1099-R are critical for compliance. Typically, the form must be sent to the IRS by the end of January following the tax year in which the distributions were made. Recipients should receive their copies by the same date. It is advisable to check the IRS website for any updates or changes to these deadlines, as they can vary from year to year.

Who Issues the Form

The IT 1099-R is issued by financial institutions, pension plans, and other entities that manage retirement accounts. This includes banks, insurance companies, and employers who provide retirement benefits. It is important for recipients to ensure they receive this form from all relevant sources to accurately report their income.

Quick guide on how to complete form it 1099 r taxnygov

Prepare It 1099 R effortlessly on any device

Online document management has increasingly become popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, as you can access the needed form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage It 1099 R on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign It 1099 R with ease

- Find It 1099 R and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and eSign It 1099 R and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 1099 r taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form it 1099 r taxnygov

How to generate an eSignature for your Form It 1099 R Taxnygov online

How to generate an eSignature for the Form It 1099 R Taxnygov in Google Chrome

How to make an electronic signature for putting it on the Form It 1099 R Taxnygov in Gmail

How to make an electronic signature for the Form It 1099 R Taxnygov from your smartphone

How to create an electronic signature for the Form It 1099 R Taxnygov on iOS

How to make an electronic signature for the Form It 1099 R Taxnygov on Android

People also ask

-

What is the instruction for it 1099 r?

The instruction for it 1099 r provides detailed guidelines on how to report distributions from pensions, annuities, retirement plans, or IRAs. Understanding these instructions is crucial for accurately filing your taxes and ensuring compliance with IRS regulations. By utilizing airSlate SignNow, you can easily access and share these essential documents.

-

How can airSlate SignNow assist with obtaining instruction for it 1099 r?

airSlate SignNow offers a streamlined platform where businesses can quickly send and eSign documents, including the instruction for it 1099 r. This can signNowly enhance your document management process. With our efficient tools, you can gather necessary signatures and maintain organized records without hassle.

-

Are there any costs associated with using airSlate SignNow for instruction for it 1099 r?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, ensuring affordability when handling documents like the instruction for it 1099 r. You can choose a plan that fits your budget while still benefiting from our comprehensive features. Additionally, our platform minimizes costs associated with traditional paper-based processes.

-

What features does airSlate SignNow provide for handling instruction for it 1099 r?

airSlate SignNow includes features such as document templates, electronic signatures, and automated workflows specifically designed to assist with the instruction for it 1099 r. These tools enhance document accuracy and streamline the signing process. You can also easily track the status of your documents in real time.

-

How does using airSlate SignNow benefit my business for document management related to instruction for it 1099 r?

Using airSlate SignNow allows your business to efficiently manage documents related to instruction for it 1099 r by simplifying the entire workflow. With our intuitive interface, you can quickly send, sign, and store documents securely. This not only saves time but also reduces the likelihood of errors in your documentation.

-

Can airSlate SignNow integrate with other software for managing instruction for it 1099 r?

Yes, airSlate SignNow offers integration capabilities with various software solutions that can help streamline the process of managing instruction for it 1099 r. These integrations enhance productivity by linking your existing tools with our eSignature platform. It simplifies the workflow and ensures that all of your documents are easily accessible.

-

Is airSlate SignNow suitable for small businesses needing instruction for it 1099 r?

Absolutely! airSlate SignNow is tailored to meet the needs of small businesses, offering cost-effective solutions for handling instruction for it 1099 r. Our user-friendly platform requires no extensive training, making it accessible for teams of any size. You'll find that our tools can signNowly improve efficiency without straining your budget.

Get more for It 1099 R

- Fun run sponsorship letter form

- Shcachsearshccom form

- Caltrain bike locker application form

- Form it 35 ar union1

- West virginia state tax department form gsr 01

- Cco veridian iowa form

- Arlington independent school district annual residency affidavit form

- Amarillo police department information records r

Find out other It 1099 R

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement