Tax Ny 2017

What is the Tax Ny

The Tax Ny form is a specific document used by residents of New York to report their income and calculate their state tax obligations. This form is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The Tax Ny form includes various sections that require detailed information about income sources, deductions, and credits applicable to the taxpayer. Understanding this form is crucial for accurate tax reporting and avoiding penalties.

Steps to complete the Tax Ny

Completing the Tax Ny form involves several key steps to ensure accuracy and compliance:

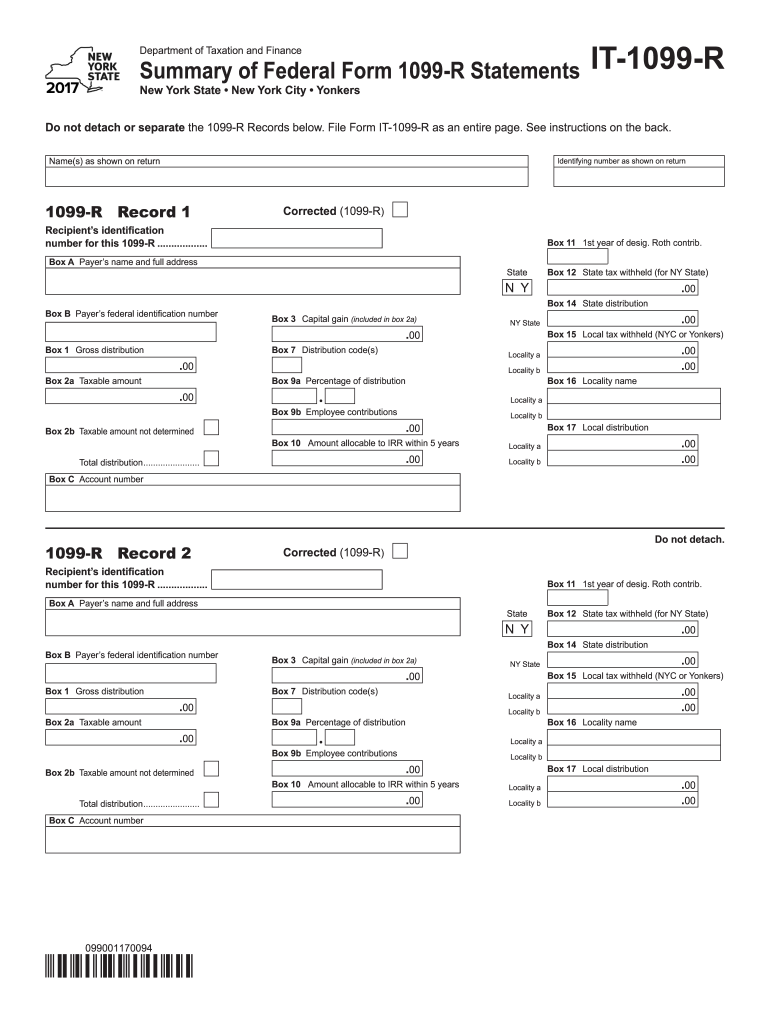

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions specific to the Tax Ny form to understand all required fields.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring you include all relevant earnings.

- Calculate deductions and credits applicable to your situation, which can reduce your taxable income.

- Review the completed form for accuracy before signing and dating it.

- Submit the form electronically or via mail, following the guidelines provided.

Legal use of the Tax Ny

The Tax Ny form is legally recognized as a binding document when completed and submitted according to New York state regulations. It must be filled out truthfully and accurately to avoid legal consequences, including fines or audits. The form can be signed electronically, which is accepted by the state, enhancing the efficiency of the filing process. Taxpayers should retain copies of their submitted forms and any supporting documentation for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Ny form are critical to ensure timely submission and avoid penalties. Typically, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, as well as specific deadlines for estimated tax payments throughout the year.

Form Submission Methods

The Tax Ny form can be submitted through various methods to accommodate different preferences:

- Online Submission: Taxpayers can file electronically using approved e-filing software, which often simplifies the process and reduces errors.

- Mail Submission: Completed forms can be printed and mailed to the appropriate state tax office. It is important to check the mailing address based on the type of return being filed.

- In-Person Submission: Some taxpayers may choose to submit their forms in person at designated tax offices, allowing for immediate confirmation of receipt.

Key elements of the Tax Ny

The Tax Ny form contains several key elements that are essential for proper completion:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Income Reporting: All sources of income must be accurately reported, including wages, dividends, and rental income.

- Deductions and Credits: Taxpayers can claim various deductions and credits that apply to their situation, which can significantly impact their tax liability.

- Signature: A signature is required to validate the form, confirming that all information provided is accurate to the best of the taxpayer's knowledge.

Quick guide on how to complete tax ny

Your assistance manual on how to prepare your Tax Ny

If you’re interested in understanding how to finalize and submit your Tax Ny, here are several brief instructions on how to simplify the tax submission process.

To begin, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editing tools, you can navigate between text, checkboxes, and eSignatures while returning to update details as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the procedures below to complete your Tax Ny in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Tax Ny in our editor.

- Enter the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting on paper can increase errors in returns and delay reimbursements. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tax ny

FAQs

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

What was the turning point of your life that changed you completely?

I was in a relationship with a guy for over 2 years.. I loved him with all my heart! He came into my life during a very difficult time and he was very sweet and loving. He made me laugh, and he made me feel so special.. I felt really loved and I felt that he saved me from something. I felt as if I owed him my life!Though things were great for the first few months, everything started changing so slow that I did not even realize what was happening! I started doing everything for him, and he became the center point of my life-everything revolved around him! He did not like me having other guy friends, so I slowly cut them out of my life. Then he started finding faults with my girl pals- in his words “I was too good to be associating myself with those kids of girls”.. Some of these people had been my friends for more than 10 years! I believed everything he said and I cut all my friends out of my life.. Then he started turning me against my parents.. He said they don’t love me and that he was the only person who truly loved me. I was completely brainwashed and I was stupid enough to believe him! I am a good singer, and I used to go for music lessons (which was a complete stress buster for me), he used to call me on phone and keep talking to me, so that I cannot go to class.Then, I came to know that he was fooling around with another girl, when I confronted him, he told me that he is just fooling around with her and that I am his one and only true love! I started getting very depressed and I stopped talking to anyone. I used to sit in my locked room for hours waiting for him to call.My parents got really worried and they took me on a trip to a place called “Wayanad”. Its a beautiful place in Kerala, India. (Wayanad district - Wikipedia)I did not have cell phone coverage there. I got very restless without being able to talk to my boyfriend.. A few days later, I was staring out of my resort room window and I looked how beautiful it was outside! I told my parents that I am going for a walk. I started walking without a clue as to where I am going.. I kept walking and I started to realize some harsh stuff! I had no savings (I spent it all on my boyfriend, trying to please him), no friends, and no family! I stayed away from everyone who loved me for my boyfriend! I started to realize how he convinced me to push everyone away from my life.. I realized how selfish he was! I thought I could not live without him, but I realized that I was completely happy and content without him! This was the biggest turning point in my life!I spent the next 7 days with my parents and my brother. We had LOTS of fun!! I felt LIBERATED! As though something heavy was lifted from my chest!After I came home, I sent him a text saying that it was over! He called me many times and I did not answer. He sent me a 1000 texts saying how I cannot survive without him. I changed my number, unfriended him from social media sites and I started getting in touch with all my friends!Its been 3 years from then. I now have a Masters Degree in Architecture and a very good job. I am happily married to a guy who truly loves me and respects me!Last I heard, my ex has still not graduated and he is living off his parents money.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the tax ny

How to make an electronic signature for the Tax Ny online

How to make an eSignature for your Tax Ny in Google Chrome

How to make an eSignature for putting it on the Tax Ny in Gmail

How to generate an electronic signature for the Tax Ny right from your mobile device

How to create an electronic signature for the Tax Ny on iOS devices

How to generate an eSignature for the Tax Ny on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Tax NY?

airSlate SignNow is a user-friendly eSignature solution that streamlines document signing processes for businesses in New York. With features tailored for compliance with Tax NY regulations, it ensures that your documents are securely signed and legally binding. Whether you’re dealing with tax forms or business contracts, SignNow simplifies your workflow.

-

How can airSlate SignNow help with tax document management in NY?

airSlate SignNow offers a seamless way to manage tax documents in New York by allowing users to create, send, and eSign important tax forms electronically. This not only saves time but also helps ensure compliance with Tax NY requirements. The platform’s robust tracking features allow you to monitor the status of your documents, ensuring nothing is overlooked.

-

What are the pricing options for airSlate SignNow in New York?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes in New York. Plans start at an affordable rate, allowing you to choose the features that best fit your needs related to Tax NY documentation. Additionally, a free trial is available so you can explore the platform before committing.

-

Does airSlate SignNow integrate with other software for tax preparation in NY?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software popular in New York. This integration allows you to import and export documents easily, facilitating a smooth workflow for handling Tax NY forms. You can connect SignNow with tools like QuickBooks, Xero, and more to enhance your tax management process.

-

What features does airSlate SignNow offer for businesses dealing with Tax NY?

airSlate SignNow includes features such as customizable templates, real-time notifications, and secure storage that are particularly useful for managing Tax NY documents. The platform also supports bulk sending of documents, which is ideal for businesses that need to send multiple tax forms at once. These features streamline the workflow and save valuable time.

-

Is airSlate SignNow compliant with New York tax regulations?

Absolutely! airSlate SignNow is designed to meet the legal standards required for electronic signatures in New York, ensuring compliance with Tax NY regulations. This means your electronically signed documents will hold up in court and during audits, giving you peace of mind.

-

Can I access airSlate SignNow on mobile devices for Tax NY purposes?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage your Tax NY documents on the go. The mobile app offers the same features as the desktop version, enabling you to send and eSign documents anytime, anywhere. This flexibility is perfect for busy professionals looking to streamline their tax processes.

Get more for Tax Ny

- Muscle contraction haspi answer key form

- Notice of clientamp39s right to fee arbitration the state bar of california calbar ca form

- Adverse event reporting form

- The investors quotient pdf form

- Kae was so bored he was pulling his hair out form

- Payment on behalf agreement template form

- Payment plan agreement template form

- Payment plan dental agreement template form

Find out other Tax Ny

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed