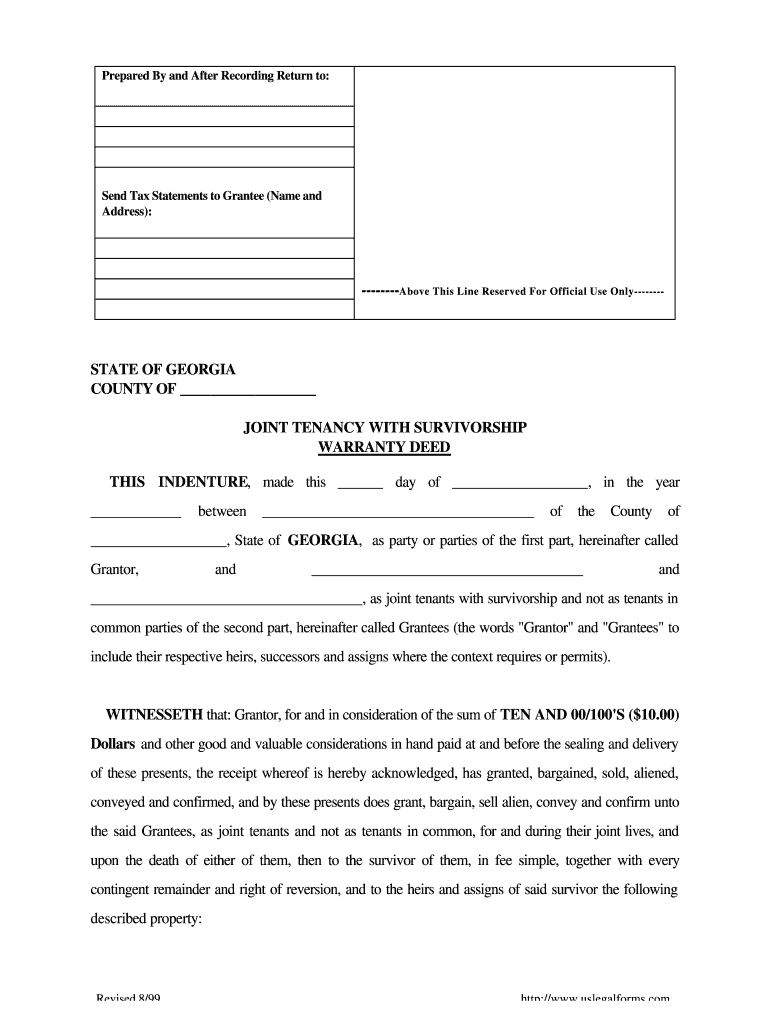

Warranty Deed Joint Tenancy with Right of Survivorship Georgia Form

What is the Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

The Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia is a legal document that establishes joint ownership of property between two or more individuals. This form ensures that if one owner passes away, their share of the property automatically transfers to the surviving owner(s) without going through probate. This type of deed is particularly useful for couples or partners who wish to maintain ownership of their home or other real estate assets together. It provides a clear legal framework for ownership and simplifies the transfer process upon the death of one owner.

Steps to Complete the Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

Completing the Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia involves several key steps:

- Gather necessary information about the property, including the legal description and current ownership details.

- Identify all parties involved in the joint tenancy, ensuring that their names are correctly spelled and match their legal identification.

- Fill out the Warranty Deed form accurately, including the right of survivorship clause, which specifies that ownership will transfer automatically upon death.

- Have the form notarized to validate the signatures of all parties involved.

- File the completed deed with the county clerk's office where the property is located to ensure public record.

Legal Use of the Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

The legal use of the Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia is to create a secure and straightforward method of property ownership among multiple individuals. It is particularly beneficial for married couples, domestic partners, or family members who want to ensure that their property passes directly to the surviving owner(s) upon death. This deed type helps avoid the lengthy probate process, providing peace of mind and clarity regarding property rights. It is essential for all parties to understand their rights and responsibilities under this agreement to prevent future disputes.

Key Elements of the Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

Several key elements define the Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia:

- Joint Ownership: All parties have equal rights to the property.

- Right of Survivorship: Upon the death of one owner, their share automatically transfers to the remaining owner(s).

- Legal Description: The property must be clearly identified with its legal description for the deed to be valid.

- Notarization: The signatures of all parties must be notarized to ensure authenticity.

- Filing Requirement: The deed must be filed with the appropriate county office to be enforceable.

State-Specific Rules for the Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

In Georgia, specific rules govern the use of the Warranty Deed Joint Tenancy With Right Of Survivorship. These include:

- All joint tenants must be individuals, as entities like corporations cannot hold property in joint tenancy.

- The deed must explicitly state the right of survivorship to be valid; otherwise, the property will not automatically transfer upon death.

- Georgia law requires that the deed be executed and recorded in the county where the property is located to ensure it is legally binding.

How to Obtain the Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

To obtain the Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia, individuals can follow these steps:

- Visit the local county clerk's office or their official website to access the necessary forms.

- Consult with a real estate attorney if needed, to ensure that the deed meets all legal requirements.

- Complete the form with accurate information regarding the property and all joint tenants.

- Have the document notarized and file it with the county clerk's office.

Quick guide on how to complete georgia warranty deed joint tenants with right of survivorship form

Complete Warranty Deed Joint Tenancy With Right Of Survivorship Georgia seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Warranty Deed Joint Tenancy With Right Of Survivorship Georgia on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Warranty Deed Joint Tenancy With Right Of Survivorship Georgia effortlessly

- Obtain Warranty Deed Joint Tenancy With Right Of Survivorship Georgia and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and eSign Warranty Deed Joint Tenancy With Right Of Survivorship Georgia and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

In New Jersey, what does "Joint Tenants, with right of survivorship" on a house deed actually mean?

It means that when one of the joint tenants dies, the ownership automatically transfers to the remaining living person or persons. You avoid probate. It is automatic.There can be more than two joint tenants at the same time and it has nothing to do with who actually occupies the propertyIt gets complicated if one tenant wants to sell and the others don’t or if one tenant has his assets seized or goes bankrupt.We had a strange situation a number of years ago. A politician owned his home with his wife in joint tenancy. He was convicted of I think bank fraud and the government wanted his assets. The wife was innocent and had no connection with the fraud, She had contributed to paying for the house. The government got his half of the joint tenancy but could not force the wife to move, sell etc.The wife was stuck .It works on any thing that has a title to ownership such as a house, a car, a bank account.It means the same thing in al of the US even Louisiana which is based on civil rather than common law. It is highly likely to mean the same thing in Canada and the UK.

-

How can property in Texas be transferred if it's owned by joint tenants with right of survivorship (not as tenants in common) and both tenants are living?

Disclaimer: I’m not a lawyer, so this isn’t legal advice. For that, you need a lawyer. However . . .It can be transferred like any other property. “Joint tenants” means they have an undivided interest in the property, while “right of survivorship” means that, if one dies, complete ownership transfers to the other.So: The two owners can sell the property to you. Or give it to you. The main thing—and this applies to any situation in which multiple people own a property—is that both must agree to transfer or sell the property. But if they’re both willing, and all of you agree to the terms, then there’s no problem.

-

Before I married my husband, he and his older sister bought a house in NY. The deed type is joint tenants with rights of survivorship. I am starting worry, what if anything happens to my husband, how can I protect my baby and myself?

You are going to have to learn to live with the house being “Joint Tenancy” and “Right-of-Survivor-ship.” You and baby are no concern whatsoever to your sister-in-law. The house is an amiable investment between your husband and his sister, and they don’t need you waltzing-in and disrupting their venture.You do not want people to view you as an entitled, self-centered, controlling woman. Your husband should be looking after you in other ways. If he isn’t, then perhaps you married the wrong person, and you should not have made a baby together.You might as well learn now the house is off-limits to you. So stop obsessing over the house before you allow it to destroy your marriage. Sadly I’m afraid it is probably already too late, in as much as you have already allowed it to destroy your own personal integrity. That is if you had any integrity to begin with. Which I doubt.

-

Does a Life estate deed resident of a home (in nursing home)'s POA have the right to rent the house out to tenants with a legal lease to stall sale?

This question doesn’t make sense without more facts.The first issue is the “sale”. Regardless of the type of life estate reserved in this scenario (i.e., with full powers or without), while the life tenant is alive, this property can’t be sold without his/her consent. Accordingly, there should be no “sale” to stall. The life tenant has the right to (at a minimum) use this property and collect the rents during his/her lifetime.But yes, a durable power of attorney can be used to act on behalf of the life tenant even if he/she is disabled.You’ll want to hire a lawyer for this one if important enough.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the georgia warranty deed joint tenants with right of survivorship form

How to generate an eSignature for your Georgia Warranty Deed Joint Tenants With Right Of Survivorship Form online

How to generate an eSignature for your Georgia Warranty Deed Joint Tenants With Right Of Survivorship Form in Google Chrome

How to create an eSignature for signing the Georgia Warranty Deed Joint Tenants With Right Of Survivorship Form in Gmail

How to generate an eSignature for the Georgia Warranty Deed Joint Tenants With Right Of Survivorship Form from your mobile device

How to generate an eSignature for the Georgia Warranty Deed Joint Tenants With Right Of Survivorship Form on iOS

How to generate an electronic signature for the Georgia Warranty Deed Joint Tenants With Right Of Survivorship Form on Android

People also ask

-

What is a Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia?

A Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia is a legal document that allows two or more individuals to hold title to a property jointly. This type of deed ensures that if one owner passes away, their share of the property automatically transfers to the surviving owner(s), avoiding the probate process. This arrangement provides a clear path for property ownership transfer and is particularly beneficial for couples or family members.

-

How does airSlate SignNow facilitate the signing of a Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia?

airSlate SignNow offers a simple, user-friendly platform that allows you to easily create, send, and eSign a Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia. With our secure electronic signature feature, you can finalize your documents quickly and ensure they are legally binding. This digital solution saves time and eliminates the hassle of printing and mailing paper documents.

-

What are the benefits of using a Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia?

Using a Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia provides several advantages, including automatic transfer of ownership upon death, which simplifies estate planning. It also allows co-owners to have equal rights to the property, ensuring that decisions regarding the property are made collectively. This type of deed can also help avoid lengthy probate proceedings.

-

How much does it cost to create a Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia using airSlate SignNow?

The cost to create a Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia using airSlate SignNow is affordable and designed to fit various budgets. Our pricing model is transparent, offering pay-as-you-go options or subscription plans that cater to your specific needs. Sign up today to explore our pricing plans and find the best fit for your requirements.

-

Can I customize my Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia to meet your specific legal needs. You can add clauses, adjust terms, and ensure that all parties are accurately represented in the document. This flexibility ensures that your deed reflects your unique circumstances.

-

Is airSlate SignNow compliant with Georgia laws for Warranty Deeds?

Yes, airSlate SignNow is fully compliant with Georgia laws regarding Warranty Deeds, including the Joint Tenancy With Right Of Survivorship. Our platform is designed to meet all legal requirements, ensuring that your documents are valid and enforceable. You can trust our solution to handle the intricacies of Georgia property law.

-

What integrations does airSlate SignNow offer for managing Warranty Deeds?

airSlate SignNow integrates seamlessly with various applications to enhance your document management experience. You can connect with popular tools such as Google Drive, Dropbox, and Microsoft Office, making it easy to access and manage your Warranty Deed Joint Tenancy With Right Of Survivorship in Georgia. These integrations streamline your workflow and improve efficiency.

Get more for Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

Find out other Warranty Deed Joint Tenancy With Right Of Survivorship Georgia

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form