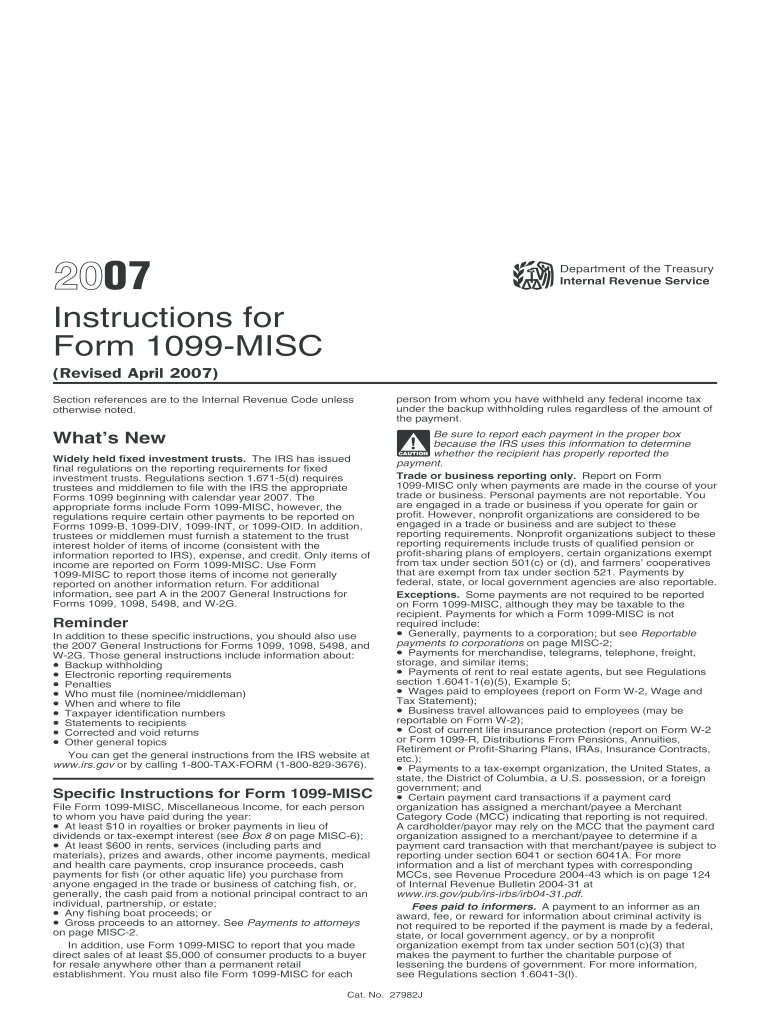

Form 1099 Misc 2007

What is the Form 1099 Misc

The Form 1099 Misc is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses and individuals to report payments made to independent contractors, freelancers, and other non-employees. It is essential for tax reporting purposes, ensuring that the Internal Revenue Service (IRS) receives accurate information about income received by individuals and entities. The 1099 Misc form includes details such as the total amount paid, the recipient's taxpayer identification number (TIN), and the reason for the payment.

How to use the Form 1099 Misc

Using the Form 1099 Misc involves several steps to ensure accurate reporting of income. First, businesses must gather the necessary information about the recipient, including their name, address, and TIN. Next, they need to complete the form by entering the appropriate amounts in the designated boxes, depending on the type of payment made. After filling out the form, the payer must provide a copy to the recipient by January thirty-first of the following year. Additionally, a copy must be submitted to the IRS, typically by the end of February if filing by mail or by March thirty-first if filing electronically.

Steps to complete the Form 1099 Misc

Completing the Form 1099 Misc requires careful attention to detail. Follow these steps:

- Gather the recipient's information, including their name, address, and TIN.

- Identify the type of payment made and the corresponding box on the form.

- Enter the total amount paid in the appropriate box.

- Provide your business information, including your name, address, and TIN.

- Review the completed form for accuracy before submitting it.

Legal use of the Form 1099 Misc

The legal use of the Form 1099 Misc is crucial for compliance with IRS regulations. This form must be used to report payments made to individuals or entities that meet specific criteria, such as independent contractors earning at least six hundred dollars in a calendar year. Failure to issue a 1099 Misc when required may result in penalties for the payer. It is important to ensure that the information provided on the form is accurate and complete to avoid issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 Misc are critical for compliance. The form must be provided to recipients by January thirty-first of the year following the tax year. For submissions to the IRS, the deadline is February twenty-eighth if filing by mail and March thirty-first if filing electronically. It is essential to adhere to these deadlines to avoid potential penalties and ensure timely reporting of income.

Penalties for Non-Compliance

Non-compliance with the Form 1099 Misc filing requirements can lead to significant penalties. If a payer fails to file the form or provides incorrect information, the IRS may impose fines. The penalties vary based on how late the form is filed, with higher fines for late submissions. Additionally, failure to provide a copy to the recipient can also result in penalties. Therefore, it is vital for businesses to understand their obligations regarding this form and ensure timely and accurate submissions.

Quick guide on how to complete 2007 form 1099 misc

Effortlessly Prepare Form 1099 Misc on Any Device

Digital document administration has gained traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form 1099 Misc on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and eSign Form 1099 Misc with Ease

- Locate Form 1099 Misc and click on Get Form to initiate the process.

- Employ the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information, then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1099 Misc to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 form 1099 misc

Create this form in 5 minutes!

How to create an eSignature for the 2007 form 1099 misc

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is Form 1099 Misc and how is it used?

Form 1099 Misc is a tax form used to report payments made to non-employees, such as contractors or freelancers. Businesses utilize this form to ensure compliance with IRS regulations regarding payments over a certain threshold. airSlate SignNow streamlines the process of sending and signing Form 1099 Misc electronically, making it easier for businesses to stay organized and compliant.

-

How does airSlate SignNow simplify the eSigning of Form 1099 Misc?

airSlate SignNow provides an intuitive platform that allows users to easily upload, send, and electronically sign Form 1099 Misc documents. With our user-friendly interface, you can get the necessary signatures promptly, eliminating the hassle of paper forms. This efficiency helps businesses save time and reduce errors in tax reporting.

-

Is there a cost associated with using airSlate SignNow for Form 1099 Misc?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. We provide a cost-effective solution that allows you to manage eSigning for Form 1099 Misc and other documents all in one place. By exploring our plans, you can choose the one that best fits your budget and requirements.

-

Can I track the status of my Form 1099 Misc once sent through airSlate SignNow?

Absolutely! airSlate SignNow includes tracking features so you can monitor the status of your sent Form 1099 Misc. You will receive notifications once the document has been viewed and signed by the recipient, providing full accountability. This helps ensure that your tax documents are completed on time.

-

What integrations does airSlate SignNow offer for managing Form 1099 Misc?

airSlate SignNow integrates with popular applications like Google Drive, Dropbox, and CRM tools to facilitate seamless document management. These integrations enable you to easily access and manage your Form 1099 Misc along with other related documents. This connectivity enhances workflow efficiency and helps ensure no documents are misplaced.

-

How secure is the transmission of Form 1099 Misc with airSlate SignNow?

The security of your documents is a priority at airSlate SignNow. We employ top-notch encryption and comply with industry-standard security protocols to protect your Form 1099 Misc during transmission. You can rest assured that your sensitive information is safeguarded throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for Form 1099 Misc management?

Using airSlate SignNow for Form 1099 Misc management streamlines the entire process, from creation to signatures. Our platform allows for better organization, quicker turnaround times, and enhanced compliance with tax regulations. This ultimately saves you time and reduces stress during busy tax seasons.

Get more for Form 1099 Misc

- Notice of appeal idaho form

- Appeal order form

- 3 day notice to pay rent or lease terminated for residential property idaho form

- Idaho termination form

- Idaho 3 day form

- Assignment of deed of trust by individual mortgage holder idaho form

- Idaho corporate form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property idaho form

Find out other Form 1099 Misc

- Invite eSignature PDF Safe

- Invite eSignature Presentation Online

- Invite eSignature Presentation Free

- How To Invite eSignature Presentation

- How Do I Invite eSignature Presentation

- Invite eSignature Presentation Android

- Invite eSignature Presentation iOS

- How Can I Invite eSignature Presentation

- Invite eSignature Presentation iPad

- Complete eSignature Form Simple

- Request eSignature Word Easy

- Request eSignature Document Myself

- Add eSignature PDF Online

- How To Add eSignature PDF

- How To Add eSignature Word

- Add eSignature Word Easy

- Add eSignature Word Mac

- Add eSignature Form Online

- How To Add eSignature Form

- Add eSignature Form Mac