Including IRAs and Other TaxFavored Accounts Irs 2008

What is the Including IRAs And Other TaxFavored Accounts Irs

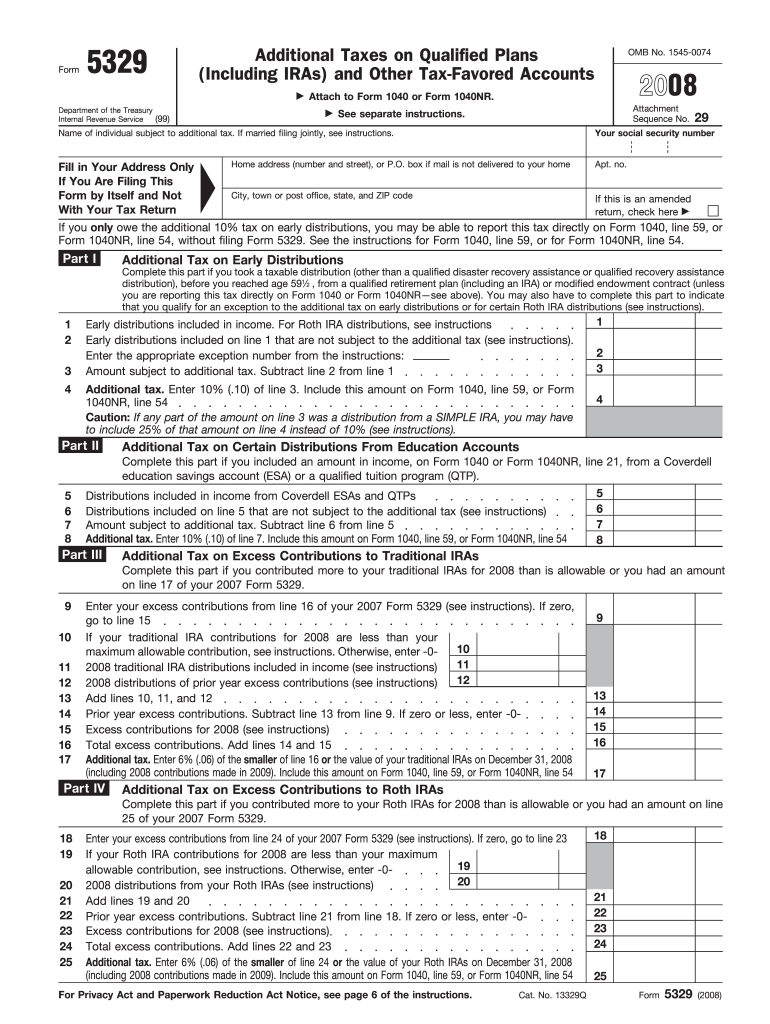

The Including IRAs And Other TaxFavored Accounts IRS form is a critical document used to report contributions and distributions from individual retirement accounts (IRAs) and other tax-favored accounts. This form helps taxpayers understand their tax obligations and ensures compliance with IRS regulations. It is essential for individuals who wish to maximize their retirement savings while adhering to federal tax laws. Understanding this form is vital for effective financial planning and avoiding potential penalties.

Steps to complete the Including IRAs And Other TaxFavored Accounts Irs

Completing the Including IRAs And Other TaxFavored Accounts IRS form involves several important steps:

- Gather necessary documents, such as previous tax returns, account statements, and any relevant financial records.

- Carefully read the instructions provided with the form to understand all requirements.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or by mail, depending on your preference and the IRS guidelines.

Legal use of the Including IRAs And Other TaxFavored Accounts Irs

The legal use of the Including IRAs And Other TaxFavored Accounts IRS form is crucial for ensuring compliance with tax laws. This form must be filled out correctly to avoid legal issues. The IRS requires accurate reporting of all contributions and distributions to maintain transparency and accountability. Failure to comply with these regulations can result in penalties and additional taxes. Therefore, understanding the legal implications of this form is essential for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Including IRAs And Other TaxFavored Accounts IRS form are typically aligned with the annual tax filing deadline. It is important to be aware of these dates to ensure timely submission. Missing the deadline can lead to penalties and interest on any unpaid taxes. Generally, the deadline for filing individual tax returns is April 15, unless it falls on a weekend or holiday, in which case it may be extended to the next business day. Keeping track of these important dates helps in maintaining compliance.

Eligibility Criteria

Eligibility criteria for the Including IRAs And Other TaxFavored Accounts IRS form depend on various factors, including income level, age, and type of retirement account. Generally, individuals must be of legal age and have earned income to contribute to an IRA. There are specific limits on contributions based on income and filing status. Understanding these criteria is essential for taxpayers to ensure they qualify for the benefits associated with tax-favored accounts.

Examples of using the Including IRAs And Other TaxFavored Accounts Irs

Examples of using the Including IRAs And Other TaxFavored Accounts IRS form can help clarify its application. For instance, a self-employed individual may use this form to report contributions to a SEP IRA. Similarly, a retiree may need to report distributions from a traditional IRA. Each scenario requires accurate reporting to ensure compliance with tax regulations. These examples illustrate the form's relevance across different taxpayer situations.

Quick guide on how to complete including iras and other taxfavored accounts irs

Effortlessly Prepare Including IRAs And Other TaxFavored Accounts Irs on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to access the necessary template and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Including IRAs And Other TaxFavored Accounts Irs on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related task today.

Edit and Electronically Sign Including IRAs And Other TaxFavored Accounts Irs with Ease

- Find Including IRAs And Other TaxFavored Accounts Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Decide how you would like to send your form: via email, text message (SMS), or shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Including IRAs And Other TaxFavored Accounts Irs to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct including iras and other taxfavored accounts irs

Create this form in 5 minutes!

How to create an eSignature for the including iras and other taxfavored accounts irs

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What features does airSlate SignNow offer for Including IRAs And Other TaxFavored Accounts Irs?

airSlate SignNow provides a user-friendly platform designed to support document signing and eSigning for Including IRAs And Other TaxFavored Accounts Irs. Key features include secure signing, document templates, and integration with various tools, ensuring a streamlined process for managing tax-favored accounts.

-

How does airSlate SignNow ensure security for documents related to Including IRAs And Other TaxFavored Accounts Irs?

The security of your documents is a top priority at airSlate SignNow. We utilize advanced encryption methods and compliance with relevant regulations to protect data when handling documents related to Including IRAs And Other TaxFavored Accounts Irs, ensuring peace of mind for our users.

-

What are the pricing options available for airSlate SignNow users handling Including IRAs And Other TaxFavored Accounts Irs?

airSlate SignNow offers flexible pricing plans to cater to different business needs, including options for organizations managing Including IRAs And Other TaxFavored Accounts Irs. Each plan provides a range of features to enhance your document signing experience, delivering excellent value for users.

-

Can I integrate airSlate SignNow with other platforms for Including IRAs And Other TaxFavored Accounts Irs?

Yes, airSlate SignNow offers seamless integrations with popular platforms and applications, which is essential for handling Including IRAs And Other TaxFavored Accounts Irs. These integrations simplify workflows and enhance collaboration by connecting with tools you already use.

-

Is airSlate SignNow suitable for small businesses handling Including IRAs And Other TaxFavored Accounts Irs?

Absolutely! airSlate SignNow is specifically designed to cater to businesses of all sizes, including small enterprises managing Including IRAs And Other TaxFavored Accounts Irs. Our cost-effective solution enhances efficiency without compromising on quality or security.

-

How does airSlate SignNow simplify the eSigning process for Including IRAs And Other TaxFavored Accounts Irs?

airSlate SignNow streamlines the eSigning process through intuitive features that guide users step-by-step. By simplifying workflow and enabling quick access to documents concerning Including IRAs And Other TaxFavored Accounts Irs, we help organizations save time and reduce administrative burdens.

-

What are the benefits of using airSlate SignNow for Including IRAs And Other TaxFavored Accounts Irs?

Using airSlate SignNow for Including IRAs And Other TaxFavored Accounts Irs provides numerous benefits such as improved turnaround times, reduced paper usage, and enhanced collaboration. Our platform empowers teams to manage signing processes efficiently, making it easier to handle critical financial documents.

Get more for Including IRAs And Other TaxFavored Accounts Irs

- Living trust property record idaho form

- Financial account transfer to living trust idaho form

- Assignment to living trust idaho form

- Notice of assignment to living trust idaho form

- Idaho trust form

- Letter to lienholder to notify of trust idaho form

- Idaho timber sale contract idaho form

- Idaho forest products timber sale contract idaho form

Find out other Including IRAs And Other TaxFavored Accounts Irs

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT