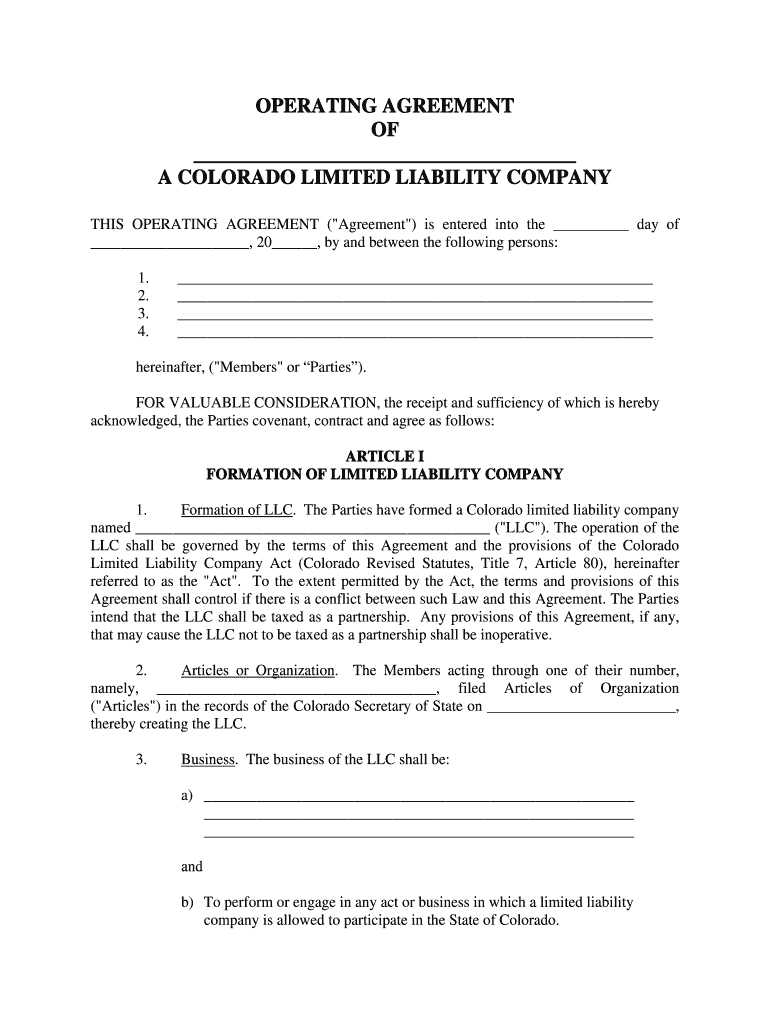

Operating Agreement Template Form

What is the Operating Agreement Template

The operating agreement template for an S corporation is a vital document that outlines the management structure, operational procedures, and ownership details of the business. This template serves as a foundational agreement among shareholders, detailing their rights, responsibilities, and the distribution of profits and losses. It is essential for defining how the corporation will operate and how decisions will be made, ensuring clarity and reducing conflicts among stakeholders.

Key Elements of the Operating Agreement Template

Several key elements should be included in an S corporation operating agreement template to ensure it is comprehensive and effective:

- Business Information: This includes the name of the corporation, its principal office location, and the purpose of the business.

- Ownership Structure: Details regarding the shareholders, including their ownership percentages and any restrictions on transferring shares.

- Management Structure: This outlines whether the corporation will be managed by shareholders or a designated board of directors.

- Voting Rights: Specifies how votes will be conducted, including the requirements for a quorum and the voting power of each shareholder.

- Profit Distribution: Describes how profits and losses will be allocated among shareholders.

- Amendment Procedures: Establishes the process for making changes to the operating agreement in the future.

Steps to Complete the Operating Agreement Template

Completing the operating agreement template involves several important steps to ensure accuracy and compliance:

- Gather Information: Collect all necessary details about the corporation, including shareholder information and management structure.

- Fill Out the Template: Carefully input the gathered information into the template, ensuring all sections are completed.

- Review for Accuracy: Double-check all entries for correctness and completeness to avoid potential disputes later.

- Obtain Signatures: Ensure that all shareholders sign the agreement to validate it legally.

- Store Safely: Keep a copy of the signed agreement in a secure location, as it may be needed for future reference or legal purposes.

Legal Use of the Operating Agreement Template

The operating agreement template must comply with state laws to be legally binding. Each state has specific requirements regarding the contents and execution of such agreements. It is crucial to ensure that the template adheres to these regulations to avoid complications. Additionally, the agreement should be signed by all shareholders to establish its validity and enforceability in a court of law.

How to Obtain the Operating Agreement Template

The operating agreement template can be obtained through various sources. Many legal websites offer customizable templates that can be tailored to meet specific business needs. Additionally, consulting with a legal professional can provide access to templates that comply with state-specific regulations. It is important to choose a reliable source to ensure the template is comprehensive and legally sound.

Examples of Using the Operating Agreement Template

Utilizing the operating agreement template can vary based on the business structure and goals. For instance, a startup may use the template to outline initial ownership percentages and management roles, while an existing S corporation might revise its agreement to reflect changes in ownership or management. These examples illustrate the flexibility of the template in adapting to the evolving needs of the business.

Quick guide on how to complete blank llc operating agreement form

Complete Operating Agreement Template effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Operating Agreement Template on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The simplest way to modify and eSign Operating Agreement Template with ease

- Locate Operating Agreement Template and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Operating Agreement Template and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get help to modify an operating agreement for a newly formed LLC without hiring a lawyer?

Legally, you can't. A person cannot cannot offer legal services without an active law license, and such issues are far too complex for unintelligent forms based sites (not run by actual attorneys, just legally classified "form assistants") like Legal Zoom, etc; they can only act as a "filing service" to file base docs, and that is only q% of the overall process, if that; it does not suffice, and they mislead people.The other parts of legal entities are very complex and subtle and become exponentially more so with more members. The exception is a CPA, who can do very limited company formation work, but who generally don't really know what they're doing with formation, other than the tax specific aspects, and are never used for ongoing matters or as the lead people for company exit stages. The best option is always a corporate attorney (senior if possible) with a strong enjoyment of the tax law area of the work, or a combo team (e.g corporate lawyer and tax lawyer in the same firm, or a bit quite as common but still good, a corporate attorney and a CPA (some firms actually offer this in house).Normally however you get what you pay for, and if you invest in a good business attorney up front you will never have to even ask such a question because all contingencies would have been handled during setup. If you did that yourself, it's likely things weren't done correctly at the corporate governance level and half the decisions are null and void anyway, falling back to state law defaults (which are intended for large and/or public companies), leaving many unintended consequences. You may need a commercial litigation attorney/firn at this stage depending on size.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

How does an LLC adopt a new operating agreement?

Good question as an administrative task like this can have drastic effects if it’s not completed properly. Operating agreements often include language addressing how the LLC may alter or revoke the agreement. If not, the rule for adopting a new operating agreement is governed by the default rule in your state. The default rule for the State of Washington is approval by all members, which is easy for your single member LLC.I agree with Dana and and Stephen that you should clearly note in your new operating agreement that this one replaces the former. I also agree with the Anonymous post that recommends seeking counsel on the tax implications that your amendment may have.We’ve helped countless startups with making changes like this at LawTrades. Our platform connects bootstrapping entrepreneurs to a vast network of experienced and affordable startups attorneys. Also, feel free to message me if you have any other questions regarding your operating agreement!

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

Create this form in 5 minutes!

How to create an eSignature for the blank llc operating agreement form

How to make an electronic signature for your Blank Llc Operating Agreement Form in the online mode

How to generate an eSignature for your Blank Llc Operating Agreement Form in Chrome

How to create an electronic signature for signing the Blank Llc Operating Agreement Form in Gmail

How to make an electronic signature for the Blank Llc Operating Agreement Form straight from your mobile device

How to create an electronic signature for the Blank Llc Operating Agreement Form on iOS

How to make an eSignature for the Blank Llc Operating Agreement Form on Android OS

People also ask

-

What is an Operating Agreement Template and why do I need one?

An Operating Agreement Template is a legal document that outlines the management structure and operating procedures of a business entity, particularly LLCs. It is essential for establishing clear roles and responsibilities among owners, helping prevent disputes and ensuring compliance with state laws. Utilizing an Operating Agreement Template can streamline the process of setting up your business and provide a solid foundation for its operations.

-

How can I customize my Operating Agreement Template using airSlate SignNow?

With airSlate SignNow, you can easily customize your Operating Agreement Template to suit your specific business needs. Our platform allows you to edit text, add clauses, and include your company's branding. This flexibility ensures that your Operating Agreement Template reflects your unique operations and governance.

-

Is airSlate SignNow's Operating Agreement Template compliant with state laws?

Yes, airSlate SignNow's Operating Agreement Template is designed to comply with the legal requirements of various states. We keep our templates updated to reflect the latest regulations, helping you ensure that your document meets all necessary legal standards. However, it's always advisable to consult a legal professional for specific compliance questions.

-

What features does the airSlate SignNow platform offer for managing an Operating Agreement Template?

airSlate SignNow provides a range of features to effectively manage your Operating Agreement Template, including eSignature capabilities, document storage, and collaboration tools. You can send your template for signatures, track the signing process, and securely store the finalized document in the cloud. These features enhance efficiency and ensure that your agreements are easily accessible.

-

Can I use the Operating Agreement Template for multiple businesses?

Yes, you can use the Operating Agreement Template for multiple businesses, provided you customize each template to reflect the specific details and requirements of each entity. airSlate SignNow makes it easy to duplicate and modify your templates, ensuring you can efficiently manage agreements for various business ventures.

-

What is the pricing structure for using airSlate SignNow's Operating Agreement Template?

airSlate SignNow offers flexible pricing plans that include access to the Operating Agreement Template. You can choose from various subscription options based on your business needs, with features that cater to both small businesses and larger enterprises. Visit our pricing page for detailed information on the plans available.

-

Does airSlate SignNow integrate with other business software for managing documents?

Yes, airSlate SignNow seamlessly integrates with various business software applications, enhancing your ability to manage documents like the Operating Agreement Template. You can connect with tools such as Google Workspace, Microsoft Office, and more, allowing for streamlined workflows and better document management across your business.

Get more for Operating Agreement Template

Find out other Operating Agreement Template

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free