Instructions for Schedule D Form 1041 Internal Revenue 2014

What is the Instructions For Schedule D Form 1041 Internal Revenue

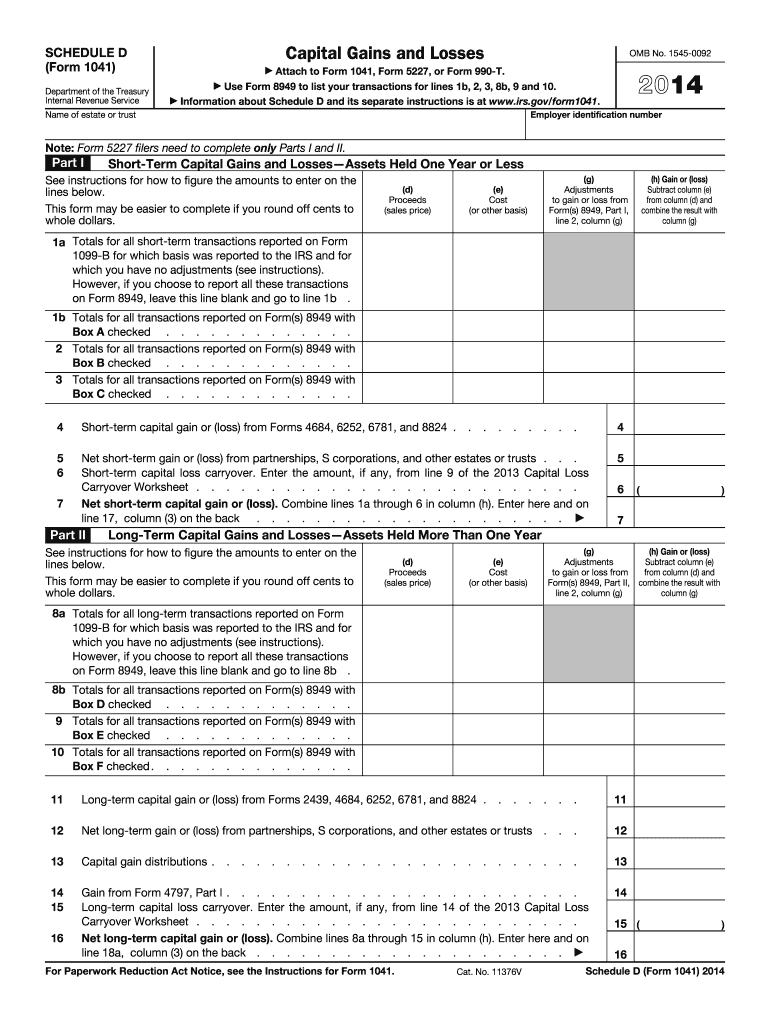

The Instructions for Schedule D Form 1041 provide guidance on how to report capital gains and losses for estates and trusts. This form is essential for fiduciaries who need to accurately calculate the tax implications of asset sales or exchanges. It is part of the U.S. federal tax system and is used to ensure compliance with Internal Revenue Service (IRS) regulations. Understanding these instructions is crucial for proper tax reporting and to avoid potential penalties.

Steps to complete the Instructions For Schedule D Form 1041 Internal Revenue

Completing the Instructions for Schedule D Form 1041 involves several key steps. First, gather all necessary documentation related to capital gains and losses. This includes records of asset purchases and sales, as well as any related expenses. Next, follow the detailed instructions provided in the form to enter information accurately. Be sure to report both short-term and long-term capital gains separately, as they are taxed at different rates. Finally, review the completed form for accuracy before submission to ensure compliance with IRS requirements.

Legal use of the Instructions For Schedule D Form 1041 Internal Revenue

The legal use of the Instructions for Schedule D Form 1041 is vital for ensuring that all capital gains and losses are reported correctly. This form must be completed in accordance with IRS guidelines to maintain its legal validity. Using the form properly helps avoid issues such as audits or penalties. Additionally, electronic submission through a compliant eSignature platform can enhance the legal standing of the document, provided that all necessary signature requirements are met.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for Schedule D Form 1041 are crucial for compliance. Generally, the form must be submitted by the due date of the estate's or trust's income tax return, which is typically April fifteenth for calendar year filers. If the fiduciary applies for an extension, the deadline may be extended, but it is essential to check the specific guidelines for the current tax year. Timely filing helps avoid late fees and penalties imposed by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Instructions for Schedule D Form 1041 can be submitted through various methods. For electronic filing, many tax preparation software programs support the submission of this form. Alternatively, the form can be mailed directly to the IRS, using the address specified in the instructions. In-person submission options may also be available at local IRS offices, though this is less common. Choosing the right submission method can streamline the process and ensure timely delivery.

Key elements of the Instructions For Schedule D Form 1041 Internal Revenue

Key elements of the Instructions for Schedule D Form 1041 include detailed guidance on reporting capital gains and losses, definitions of short-term and long-term assets, and specific calculations required for each. The instructions also outline the importance of accurate record-keeping and provide examples to clarify complex scenarios. Understanding these elements is crucial for fiduciaries to ensure compliance and accurate reporting on their tax returns.

Quick guide on how to complete instructions for schedule d form 1041 2018internal revenue

Complete Instructions For Schedule D Form 1041 Internal Revenue effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Instructions For Schedule D Form 1041 Internal Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Instructions For Schedule D Form 1041 Internal Revenue without any hassle

- Locate Instructions For Schedule D Form 1041 Internal Revenue and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes needing reprints of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Schedule D Form 1041 Internal Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule d form 1041 2018internal revenue

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule d form 1041 2018internal revenue

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the purpose of the Instructions For Schedule D Form 1041 Internal Revenue?

The Instructions For Schedule D Form 1041 Internal Revenue provide guidance on reporting capital gains and losses for estates and trusts. This form is essential for accurate tax reporting, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with completing the Instructions For Schedule D Form 1041 Internal Revenue?

With airSlate SignNow, users can easily create, edit, and eSign documents related to the Instructions For Schedule D Form 1041 Internal Revenue. The platform streamlines the process, providing templates and guidance for accurate completion.

-

Are there cost-effective solutions for accessing the Instructions For Schedule D Form 1041 Internal Revenue with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to fit different budgets, ensuring that businesses of all sizes can access the necessary tools for the Instructions For Schedule D Form 1041 Internal Revenue process. This cost-effective solution helps users manage their document workflows efficiently.

-

What features does airSlate SignNow offer for managing documents related to the Instructions For Schedule D Form 1041 Internal Revenue?

AirSlate SignNow includes features such as templates for the Instructions For Schedule D Form 1041 Internal Revenue, real-time collaboration, and automated workflows. These features help users complete their tax documents efficiently while maintaining compliance.

-

Can airSlate SignNow integrate with other accounting software to simplify the Instructions For Schedule D Form 1041 Internal Revenue process?

Absolutely! AirSlate SignNow integrates seamlessly with leading accounting and tax software, allowing users to easily manage their financial documents related to the Instructions For Schedule D Form 1041 Internal Revenue. This integration enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the Instructions For Schedule D Form 1041 Internal Revenue?

Using airSlate SignNow for the Instructions For Schedule D Form 1041 Internal Revenue streamlines the preparation and submission process. The platform ensures secure eSigning, provides templates, and facilitates collaboration, making it easier for businesses to comply with tax regulations.

-

Is technical support available for users navigating the Instructions For Schedule D Form 1041 Internal Revenue with airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist users in navigating the Instructions For Schedule D Form 1041 Internal Revenue. Whether through chat, email, or phone, our support team is ready to help users get the most out of their experience.

Get more for Instructions For Schedule D Form 1041 Internal Revenue

- Contract for deed package delaware form

- Power of attorney forms package delaware

- Delaware uniform act

- Employment hiring process package delaware form

- Delaware next kin form

- Statutory uniform anatomical gift act donation by a living minor delaware

- Revocation of uniform anatomical gift donation declaration delaware

- Employment or job termination package delaware form

Find out other Instructions For Schedule D Form 1041 Internal Revenue

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile