1040 Ss Form 2010

What is the 1040 SS Form

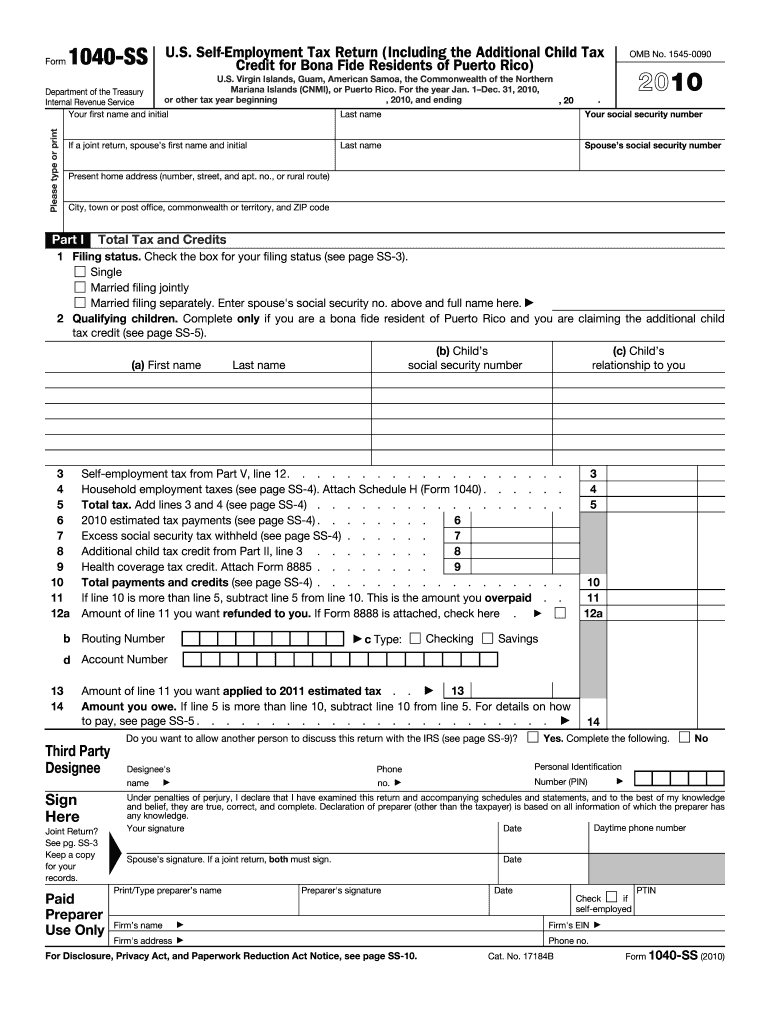

The 1040 SS Form, also known as the U.S. Self-Employment Tax Return, is a tax document specifically designed for self-employed individuals and certain business owners in the United States. This form is essential for reporting income earned from self-employment and calculating the self-employment tax owed. It is primarily used by individuals who work for themselves rather than being employed by a company. The 1040 SS Form is a crucial component of the annual tax filing process, ensuring that self-employed individuals meet their tax obligations accurately.

How to use the 1040 SS Form

Using the 1040 SS Form involves several key steps. First, gather all necessary financial documents, including income statements, expense receipts, and any other relevant records. Next, accurately fill out the form by reporting your total income, deducting allowable business expenses, and calculating your self-employment tax. It is important to ensure that all information is correct to avoid penalties. After completing the form, you can file it electronically or by mail, depending on your preference. Familiarizing yourself with the form's sections will streamline the process and help you ensure compliance with IRS regulations.

Steps to complete the 1040 SS Form

Completing the 1040 SS Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income and expense records.

- Begin filling out the form by entering your personal information, including your name and Social Security number.

- Report your total income from self-employment on the designated line.

- Deduct any allowable business expenses to arrive at your net profit.

- Calculate your self-employment tax based on your net profit, using the appropriate tax rate.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail to the IRS.

Legal use of the 1040 SS Form

The 1040 SS Form is legally binding when filled out correctly and submitted to the IRS. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be filed by the appropriate deadline to avoid late fees. Compliance with IRS regulations is crucial for maintaining good standing with tax authorities. Understanding the legal implications of the 1040 SS Form helps self-employed individuals fulfill their tax obligations responsibly.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 SS Form are critical for self-employed individuals. Generally, the form must be submitted by April fifteenth of the following tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Additionally, self-employed individuals may qualify for an extension, allowing them to file by October fifteenth. However, it is important to note that an extension to file does not extend the time to pay any taxes owed. Keeping track of these important dates ensures compliance and helps avoid unnecessary penalties.

Required Documents

To complete the 1040 SS Form accurately, certain documents are required. These include:

- Income statements, such as 1099 forms or records of cash payments.

- Receipts for business expenses, including supplies, travel, and home office deductions.

- Records of any estimated tax payments made throughout the year.

- Previous year’s tax return for reference.

Having these documents organized and readily available will facilitate a smoother filing process.

Quick guide on how to complete 2010 1040 ss form

Facilitate 1040 Ss Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 1040 Ss Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and electronically sign 1040 Ss Form with ease

- Find 1040 Ss Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the information and then click the Done button to record your modifications.

- Select how you want to send your form, either via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 1040 Ss Form and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 1040 ss form

Create this form in 5 minutes!

How to create an eSignature for the 2010 1040 ss form

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the 1040 Ss Form?

The 1040 Ss Form is a specific tax form used by self-employed individuals and certain taxpayers for their federal income tax return. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations. By using airSlate SignNow, you can seamlessly eSign and send your 1040 Ss Form for secure submission.

-

How can I fill out the 1040 Ss Form using airSlate SignNow?

Filling out the 1040 Ss Form with airSlate SignNow is simple and user-friendly. You can upload the form, fill in the necessary information electronically, and eSign it. This process not only saves time but also ensures that your form is correctly completed and submitted.

-

Is airSlate SignNow suitable for businesses that frequently handle 1040 Ss Forms?

Yes, airSlate SignNow is an ideal solution for businesses that need to handle 1040 Ss Forms frequently. Its cost-effective features allow for seamless document management, storage, and eSigning. You can easily track the status of your forms, ensuring nothing is overlooked or delayed.

-

What pricing options does airSlate SignNow offer for eSigning 1040 Ss Forms?

airSlate SignNow offers various pricing plans to cater to different business needs for eSigning 1040 Ss Forms. Plans are affordable and provide a range of features, including unlimited signing, document templates, and integrations. Choose a plan that aligns with your requirements for the best value.

-

Are there integrations available for the 1040 Ss Form in airSlate SignNow?

Yes, airSlate SignNow provides integrations with various applications that facilitate the completion of the 1040 Ss Form. You can connect your favorite tools such as Google Drive, Dropbox, and more to streamline document management. These integrations enhance the efficiency of your workflow signNowly.

-

What security measures does airSlate SignNow implement for the 1040 Ss Form?

Security is a top priority for airSlate SignNow when handling sensitive documents like the 1040 Ss Form. The platform uses advanced encryption and authentication processes to protect your data. This ensures that your documents are secure and compliant with privacy regulations.

-

Can I track the status of my 1040 Ss Form once eSigned?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your 1040 Ss Form after it has been eSigned. You will receive notifications and updates, so you always know where your documents stand in the process.

Get more for 1040 Ss Form

- Hunting forms package idaho

- Identity theft recovery package idaho form

- Idaho attorney form

- Revocation of statutory living will and durable power of attorney for health care idaho form

- Aging parent package idaho form

- Sale of a business package idaho form

- Idaho legal documents form

- New state resident id form

Find out other 1040 Ss Form

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template