Wg 002 2016

What is the Wg 002?

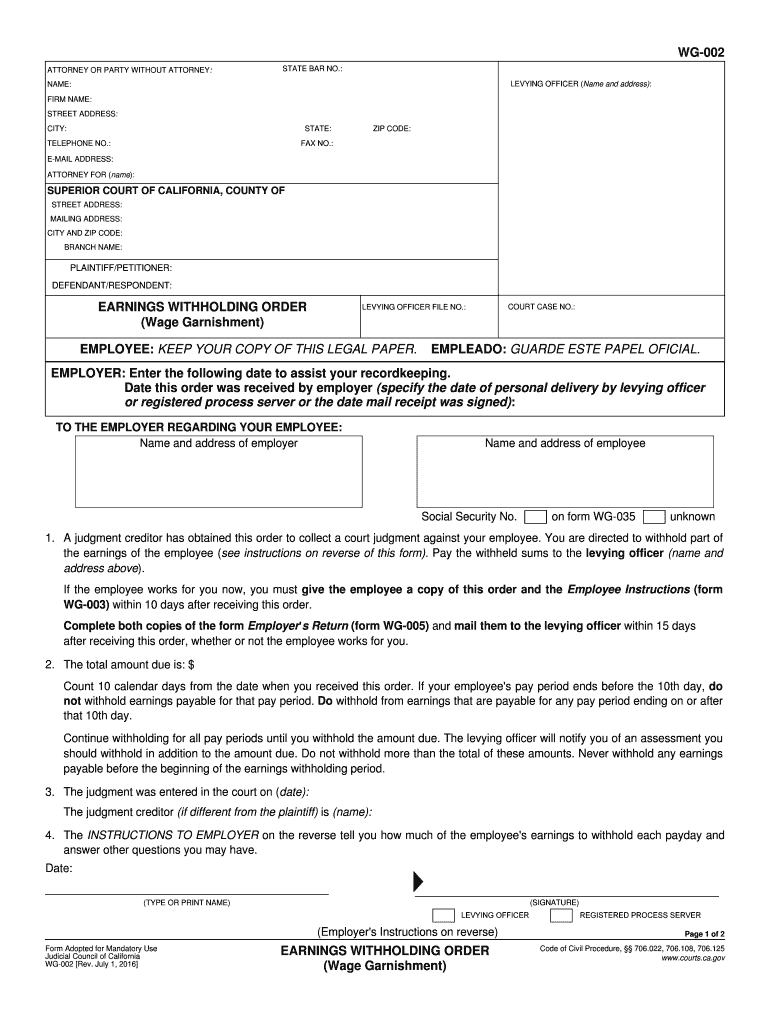

The Wg 002, commonly referred to as the earnings withhold form, is a legal document used in the United States to facilitate wage garnishment. This form allows creditors to collect debts directly from a debtor's earnings, ensuring that a portion of their income is withheld to satisfy outstanding obligations. The Wg 002 is essential for both employers and employees, as it outlines the necessary details regarding the garnishment process and the amounts to be withheld.

How to use the Wg 002

Using the Wg 002 involves several steps to ensure proper completion and compliance with legal requirements. First, the creditor must obtain a court order for wage garnishment, which will specify the amount to be withheld. Once the order is secured, the employer must fill out the Wg 002, detailing the employee's information and the specific terms of the garnishment. It is crucial for employers to review the form carefully to ensure accuracy and compliance with state laws regarding garnishment limits.

Steps to complete the Wg 002

Completing the Wg 002 requires attention to detail to ensure that all necessary information is accurately provided. Follow these steps:

- Obtain the court order that authorizes the wage garnishment.

- Fill in the employee's name, address, and Social Security number on the form.

- Specify the amount to be withheld from the employee's earnings.

- Include the creditor's information and any relevant case numbers.

- Sign and date the form, ensuring that it is submitted to the appropriate payroll department.

Legal use of the Wg 002

The Wg 002 must be used in accordance with federal and state laws governing wage garnishment. These laws dictate how much of an employee's wages can be withheld and under what circumstances. Employers are responsible for ensuring compliance with these regulations to avoid legal repercussions. The form serves as a formal record of the garnishment order and must be retained for documentation purposes.

State-specific rules for the Wg 002

Each state in the U.S. has its own regulations regarding wage garnishment, which can affect how the Wg 002 is utilized. Some states may impose stricter limits on the amount that can be garnished from an employee's wages, while others may have specific requirements for the form itself. It is important for both creditors and employers to be familiar with their state's laws to ensure compliance and avoid potential penalties.

Examples of using the Wg 002

Examples of situations where the Wg 002 may be used include:

- A creditor seeking to collect unpaid credit card debts through wage garnishment.

- A child support agency requiring a portion of an employee's wages to be withheld for child support payments.

- A court order for the repayment of student loans that mandates garnishment of wages.

Penalties for Non-Compliance

Failure to comply with the requirements of the Wg 002 can result in serious consequences for employers. Non-compliance may lead to legal action from creditors, fines, or penalties imposed by state authorities. Employers may also face lawsuits from employees if garnishments are not handled correctly. Understanding the legal obligations associated with the Wg 002 is essential to avoid these risks.

Quick guide on how to complete wg 002

Effortlessly prepare Wg 002 on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Manage Wg 002 on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Wg 002 with no hassle

- Find Wg 002 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Wg 002 and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wg 002

Create this form in 5 minutes!

How to create an eSignature for the wg 002

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What are California earnings and how does airSlate SignNow help manage them?

California earnings refer to the income generated by individuals or businesses within the state of California. airSlate SignNow offers a streamlined solution for managing the paperwork involved in reporting and documenting these earnings, ensuring compliance with local regulations effortlessly.

-

How does airSlate SignNow's pricing structure cater to businesses dealing with California earnings?

airSlate SignNow features a flexible pricing structure designed to accommodate businesses of all sizes handling California earnings. With various plans available, companies can choose a package that aligns with their document-signing needs and budget without sacrificing functionality.

-

What features does airSlate SignNow offer to enhance the management of California earnings?

airSlate SignNow provides several features that simplify the document management process for California earnings, including customizable templates, automated workflows, and secure eSignature capabilities. These tools allow businesses to efficiently handle their earnings documentation while saving time.

-

How does airSlate SignNow ensure secure handling of documents related to California earnings?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like California earnings. The platform uses advanced encryption technologies and complies with industry standards to protect your documents from unauthorized access.

-

Can airSlate SignNow integrate with other financial tools to track California earnings?

Yes, airSlate SignNow seamlessly integrates with various financial tools, ensuring that tracking California earnings is comprehensive and efficient. This integration allows businesses to connect their document signing to accounting software and other applications for real-time updates.

-

What are the benefits of using airSlate SignNow for handling California earnings documentation?

Using airSlate SignNow for California earnings documentation provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced accuracy. Businesses can accelerate their processes and ensure compliance without the traditional hassles associated with document management.

-

Is airSlate SignNow suitable for freelancers managing their California earnings?

Absolutely! airSlate SignNow is an excellent choice for freelancers managing their California earnings. Its user-friendly interface and affordability make it accessible for individual users who need to send, sign, and store documents related to their income.

Get more for Wg 002

Find out other Wg 002

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement