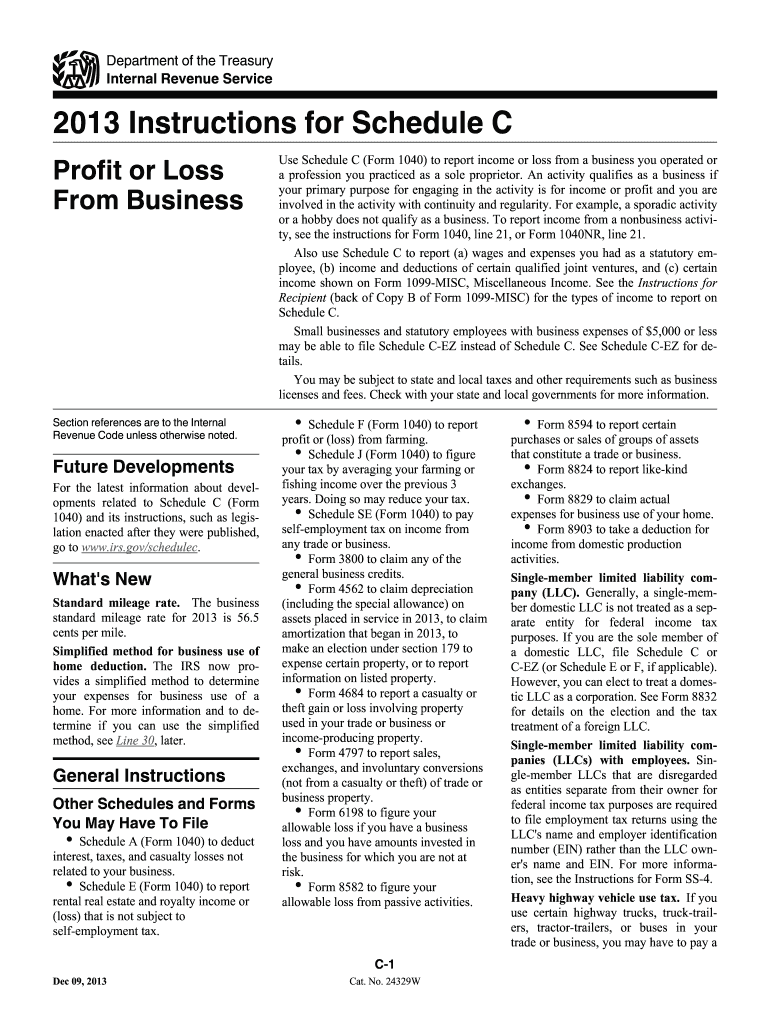

Irs Form

What is the IRS?

The Internal Revenue Service (IRS) is the federal agency responsible for administering and enforcing the United States tax laws. Established in 1862, the IRS oversees the collection of taxes, the issuance of tax refunds, and the enforcement of tax regulations. It plays a critical role in ensuring compliance with tax obligations, providing guidance to taxpayers, and facilitating the tax filing process.

How to Use the IRS

Using the IRS effectively involves understanding its resources and services. Taxpayers can access a wealth of information on the IRS website, including tax forms, instructions, and guidelines. The IRS also provides tools for checking the status of refunds, making payments, and filing taxes electronically. Familiarity with these resources can streamline the tax process and ensure compliance with federal regulations.

Steps to Complete the IRS Form

Completing an IRS form involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Choose the appropriate IRS form based on your tax situation, such as the 1040 for individual income tax returns.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail before the deadline.

Legal Use of the IRS

The legal use of IRS forms and guidelines is essential for compliance with U.S. tax laws. Taxpayers must ensure that they use the correct forms and follow the prescribed procedures to avoid penalties. Understanding the legal implications of filing taxes accurately can prevent issues with the IRS, such as audits or fines.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for taxpayers. The primary deadline for individual tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, certain forms, such as extensions, have their own deadlines. Keeping track of these dates helps ensure timely compliance with tax obligations.

Required Documents

When filing taxes with the IRS, certain documents are essential. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can simplify the filing process and ensure accuracy.

Penalties for Non-Compliance

Failure to comply with IRS regulations can result in significant penalties. Common penalties include fines for late filing, underpayment of taxes, and inaccuracies in tax returns. Understanding these potential consequences emphasizes the importance of timely and accurate tax submissions, helping taxpayers avoid unnecessary financial burdens.

Quick guide on how to complete irs 100651359

Effortlessly prepare [SKS] on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Steps to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Irs

Create this form in 5 minutes!

How to create an eSignature for the irs 100651359

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to the IRS?

airSlate SignNow is an easy-to-use eSignature solution that empowers businesses to send and sign documents electronically. For those dealing with IRS documents, SignNow provides a reliable platform to ensure your forms are signed securely and efficiently, helping you manage tax-related paperwork with confidence.

-

How can I use airSlate SignNow for IRS-related documents?

You can use airSlate SignNow to electronically sign and send various IRS-related documents, like tax forms and declarations. The platform simplifies the process of getting necessary signatures and allows for the secure storage of important IRS documents, ensuring compliance and organization.

-

What features does airSlate SignNow offer for IRS document processing?

airSlate SignNow includes features like customizable templates, secure storage, and an intuitive drag-and-drop interface. These tools are particularly beneficial for managing IRS documents, making it easy to create, send, and track your tax-related workflows without hassle.

-

Is airSlate SignNow cost-effective for managing IRS documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage their IRS documents efficiently. With its competitive pricing plans, it offers great value for those who need a reliable eSignature solution to streamline their tax-related tasks.

-

What are the benefits of using airSlate SignNow for business tax needs with the IRS?

Utilizing airSlate SignNow offers numerous benefits for handling your IRS documents, including faster turnaround times and reduced paperwork hassles. With secure electronic signatures and easy integration with other tools, businesses can focus more on their strategic tasks while ensuring IRS compliance.

-

Does airSlate SignNow integrate with IRS software solutions?

Yes, airSlate SignNow offers integrations with various tax software solutions that can help manage your IRS-related tasks. These integrations streamline the process of preparing and submitting your IRS documents, enhancing productivity and reducing errors.

-

How secure is airSlate SignNow for sending IRS documents?

airSlate SignNow prioritizes security, employing industry-standard encryption and secure storage for all documents, including IRS-related materials. You can trust that your sensitive tax information is protected while using the platform, ensuring compliance and data integrity.

Get more for Irs

- Katrina emergency tax relief act govinfo form

- 2022 instructions for form 1120 s

- Form 14039 sp rev 12 2022

- 2022 shareholders instructions for schedule k 1 form 1120 s

- Abl 20 sc department of revenue form

- About form 1041 us income tax return for estates and trusts

- What is a schedule k 1 form 1041 estates and trusts

- Sc 1120s sc department of revenue form

Find out other Irs

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe