About Form 1041, U S Income Tax Return for Estates and Trusts 2022-2026

What is the About Form 1041, U S Income Tax Return For Estates And Trusts

The Form 1041 is a U.S. income tax return specifically designed for estates and trusts. It is used to report the income, deductions, gains, and losses of an estate or trust. This form ensures that the income generated by the estate or trust is accurately reported to the Internal Revenue Service (IRS). The fiduciary, or the person responsible for managing the estate or trust, must file this form annually if the estate or trust has gross income of $600 or more, or if it has a beneficiary who is a non-resident alien.

Steps to complete the About Form 1041, U S Income Tax Return For Estates And Trusts

Completing Form 1041 involves several key steps:

- Gather necessary information, including the estate's or trust's income, expenses, and deductions.

- Fill out the form accurately, including identifying information such as the name, address, and taxpayer identification number of the estate or trust.

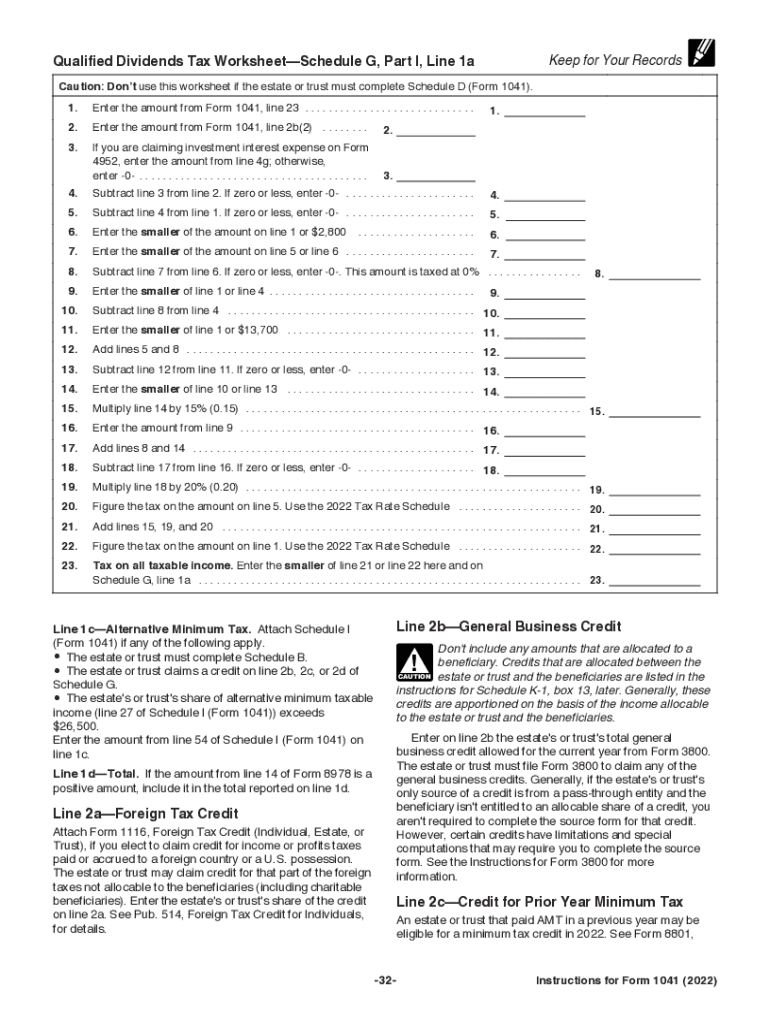

- Report income and deductions on the appropriate lines, ensuring to include all relevant schedules, such as Schedule G for income distribution.

- Calculate the tax liability, if applicable, and determine any payments owed or refunds due.

- Sign and date the form, ensuring that the fiduciary or authorized individual completes this step.

- Submit the completed form to the IRS by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for completing Form 1041, which include instructions on reporting income types, allowable deductions, and tax credits. It is essential to refer to the latest IRS publications and instructions for Form 1041 to ensure compliance with current tax laws. The IRS updates these guidelines regularly, so staying informed about any changes is crucial for accurate reporting.

Filing Deadlines / Important Dates

Form 1041 must be filed by the 15th day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these deadlines to avoid penalties for late filing.

Required Documents

To complete Form 1041, several documents may be required:

- Financial statements for the estate or trust, including income statements and balance sheets.

- Records of all income received, such as interest, dividends, and rental income.

- Documentation of expenses and deductions, such as medical expenses, administrative costs, and charitable contributions.

- Tax identification numbers for the estate or trust and its beneficiaries.

Penalties for Non-Compliance

Failure to file Form 1041 on time or inaccuracies in reporting can result in penalties imposed by the IRS. The penalties may include fines for late filing, interest on unpaid taxes, and potential legal consequences for fraudulent reporting. It is essential to adhere to filing requirements and ensure the accuracy of the information provided to avoid these penalties.

Quick guide on how to complete about form 1041 us income tax return for estates and trusts

Effortlessly Complete About Form 1041, U S Income Tax Return For Estates And Trusts on Any Device

The management of online documents is increasingly favored by both businesses and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage About Form 1041, U S Income Tax Return For Estates And Trusts seamlessly across various platforms with the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Alter and eSign About Form 1041, U S Income Tax Return For Estates And Trusts Without Stress

- Locate About Form 1041, U S Income Tax Return For Estates And Trusts and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow parts of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether via email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate concerns about lost or mislaid files, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign About Form 1041, U S Income Tax Return For Estates And Trusts while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1041 us income tax return for estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the about form 1041 us income tax return for estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 and why is it important?

Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is essential for reporting income, deductions, and tax liability for estates and trusts. Understanding how to properly complete Form 1041 can help ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow assist with completing Form 1041?

airSlate SignNow streamlines the process of completing Form 1041 by enabling users to easily fill out, send, and eSign the document digitally. Our platform allows for collaboration among multiple parties, ensuring that all necessary signatures and approvals are gathered efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 1041?

Yes, airSlate SignNow offers several pricing plans tailored to meet different needs, starting from a budget-friendly option for individuals to more comprehensive packages for businesses and organizations. Each plan provides robust features to assist in managing Form 1041 and other documents.

-

What features does airSlate SignNow offer for managing Form 1041?

airSlate SignNow provides a variety of features specifically designed to simplify the management of Form 1041. These include easy document sharing, customizable templates, and secure electronic signatures, all aimed at enhancing the overall user experience.

-

Can I integrate airSlate SignNow with other software while working on Form 1041?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, including popular accounting software and cloud storage services. This capability ensures that users can access, manage, and submit Form 1041 alongside their existing tools and workflows.

-

What security measures does airSlate SignNow have for handling Form 1041 data?

Security is a top priority for airSlate SignNow. We implement industry-standard encryption and data protection protocols to ensure that all Form 1041 information is securely transmitted and stored, safeguarding sensitive financial data.

-

How does airSlate SignNow improve the efficiency of processing Form 1041?

By utilizing airSlate SignNow, users can signNowly improve the efficiency of processing Form 1041. Features such as real-time updates, tracking of document status, and automated reminders help expedite the signing process, reducing turnaround time.

Get more for About Form 1041, U S Income Tax Return For Estates And Trusts

Find out other About Form 1041, U S Income Tax Return For Estates And Trusts

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online