Shareholder's Instructions for Schedule K 1 Form 1120 S 2022

Understanding the Shareholder's Instructions For Schedule K-1 Form 1120-S

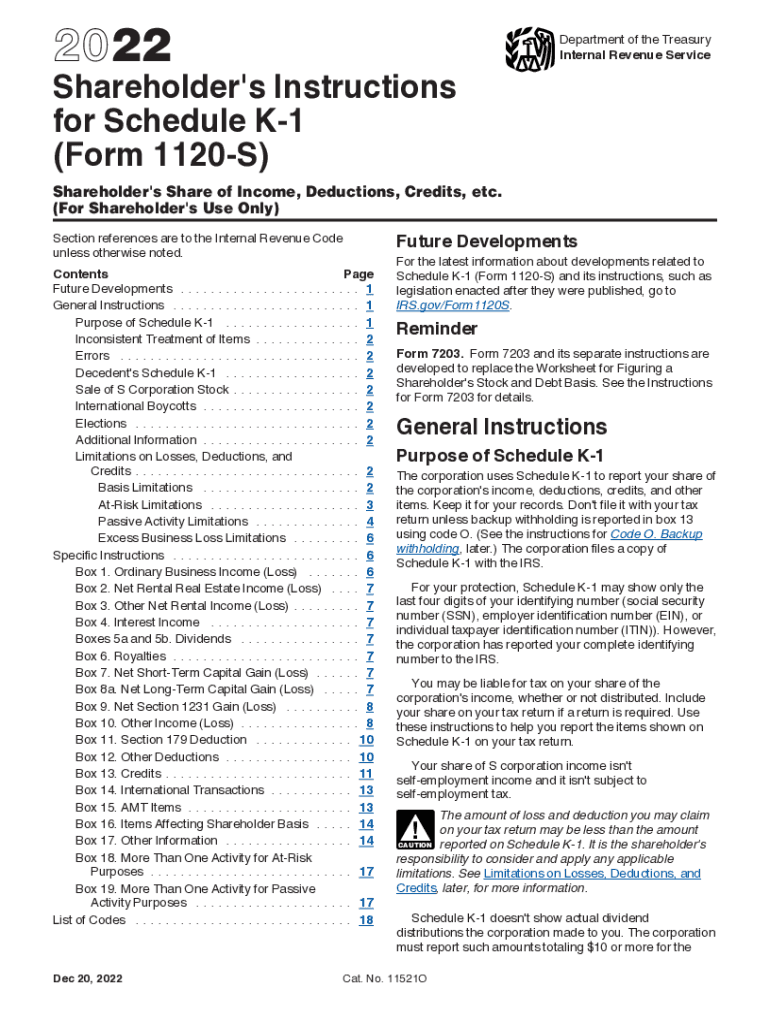

The Shareholder's Instructions for Schedule K-1 Form 1120-S provide essential guidance for shareholders of S corporations in reporting their income, deductions, and credits on their personal tax returns. This form is crucial for ensuring compliance with IRS regulations and accurately reflecting a shareholder's share of the corporation's income. The instructions detail how to interpret each box on the K-1, including income types, deductions, and tax credits available to shareholders.

Steps to Complete the Shareholder's Instructions For Schedule K-1 Form 1120-S

Completing the Shareholder's Instructions for Schedule K-1 Form 1120-S involves several key steps:

- Gather necessary financial documents, including the corporation's financial statements and previous K-1 forms.

- Review the instructions to understand the specific information required for each box on the K-1.

- Fill in personal information, including the shareholder's name, address, and taxpayer identification number.

- Report the income, deductions, and credits as indicated in the corporation's records.

- Ensure all entries are accurate and complete to avoid issues with the IRS.

Legal Use of the Shareholder's Instructions For Schedule K-1 Form 1120-S

The legal use of the Shareholder's Instructions for Schedule K-1 Form 1120-S is fundamental for compliance with federal tax laws. This form must be accurately completed and filed to report the shareholder's share of the S corporation's income, losses, and other tax attributes. Failure to comply with these instructions can lead to penalties and interest on unpaid taxes. It is essential for shareholders to understand their responsibilities and the legal implications of the information reported on the K-1.

IRS Guidelines for Shareholder's Instructions For Schedule K-1 Form 1120-S

The IRS provides specific guidelines for completing the Shareholder's Instructions for Schedule K-1 Form 1120-S. These guidelines outline the requirements for reporting income, deductions, and credits accurately. Shareholders should familiarize themselves with the IRS regulations to ensure compliance and avoid potential audits. The guidelines also emphasize the importance of maintaining proper records to support the information reported on the K-1.

Filing Deadlines for Shareholder's Instructions For Schedule K-1 Form 1120-S

Filing deadlines for the Shareholder's Instructions for Schedule K-1 Form 1120-S are critical for shareholders to meet. Typically, the S corporation must provide the K-1 to shareholders by March 15 of the following tax year. Shareholders must then report this information on their personal tax returns, usually due by April 15. Understanding these deadlines is essential to avoid late filing penalties and ensure timely compliance with tax obligations.

Required Documents for Shareholder's Instructions For Schedule K-1 Form 1120-S

To accurately complete the Shareholder's Instructions for Schedule K-1 Form 1120-S, shareholders need several key documents:

- The corporation's Form 1120-S, which reports the overall income and deductions.

- Previous K-1 forms for reference and consistency in reporting.

- Personal tax documents, including prior year tax returns and any supporting financial statements.

Quick guide on how to complete 2022 shareholders instructions for schedule k 1 form 1120 s

Complete Shareholder's Instructions For Schedule K 1 Form 1120 S effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your papers swiftly without delays. Manage Shareholder's Instructions For Schedule K 1 Form 1120 S on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and electronically sign Shareholder's Instructions For Schedule K 1 Form 1120 S with ease

- Locate Shareholder's Instructions For Schedule K 1 Form 1120 S and then click Get Form to begin.

- Make use of the tools we offer to finalize your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to apply your changes.

- Select how you wish to share your form, via email, text message (SMS), or a link invitation, or download it to your computer.

Stop worrying about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Shareholder's Instructions For Schedule K 1 Form 1120 S to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 shareholders instructions for schedule k 1 form 1120 s

Create this form in 5 minutes!

How to create an eSignature for the 2022 shareholders instructions for schedule k 1 form 1120 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 2011 shareholder credits and how do they work?

2011 shareholder credits refer to specific entitlements or benefits granted to shareholders in that fiscal year. These credits can provide financial advantages or special voting rights, depending on the company’s policy. Understanding how to utilize these credits effectively can enhance your overall shareholder experience.

-

How can airSlate SignNow facilitate the management of 2011 shareholder credits?

airSlate SignNow allows businesses to easily manage documents related to 2011 shareholder credits through a seamless eSigning solution. With our platform, you can store, send, and sign critical documents efficiently, ensuring that shareholder entitlements are tracked and processed without hassle. Streamlining these procedures can improve compliance and overall management.

-

Is there a cost associated with managing 2011 shareholder credits on airSlate SignNow?

Using airSlate SignNow for managing 2011 shareholder credits is cost-effective compared to traditional methods. Our pricing plans are designed to fit various business sizes, and many features are included in our basic package. By adopting our services, you can save costs associated with printing and mailing documents.

-

What features does airSlate SignNow offer for handling shareholder credits?

airSlate SignNow provides several features that are essential for managing 2011 shareholder credits, including easy document sharing, automated reminders, and secure eSignature capabilities. These features work together to ensure that you can manage shareholder credits efficiently while maintaining compliance with legal standards. Additionally, our platform offers tracking options to easily monitor document status.

-

What are the benefits of using airSlate SignNow for 2011 shareholder credits?

By using airSlate SignNow, companies can signNowly reduce the time spent on managing 2011 shareholder credits through automation. This leads to enhanced accuracy and faster processing times for document-related tasks. Ultimately, our solution empowers businesses to enhance shareholder satisfaction through streamlined management.

-

Can airSlate SignNow integrate with existing systems to manage 2011 shareholder credits?

Yes, airSlate SignNow integrates seamlessly with various business systems, allowing for efficient management of 2011 shareholder credits. This can include CRM solutions, accounting software, and other platforms used in your organization. Our integration capabilities ensure that your workflows remain uninterrupted and consistent.

-

Is electronic signing for 2011 shareholder credits legally recognized?

Absolutely! Electronic signing for 2011 shareholder credits through airSlate SignNow is legally recognized and compliant with e-signature laws. By utilizing our secure platform, you can ensure the validity of your signed documents while enjoying the benefits of a modern, efficient approach to document management.

Get more for Shareholder's Instructions For Schedule K 1 Form 1120 S

- Voms form

- Doc scientia grade 10 physics answers pdf form

- Texas level 2 security license test answers form

- Ncpc application form

- Photc form

- Solo parent city government of muntinlupa us legal forms

- Employment use the sa102 supplementary pages to record your employment details when filing a tax return for the tax year ended 782153692 form

- Ls 119 e labor standards complaint form

Find out other Shareholder's Instructions For Schedule K 1 Form 1120 S

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer