Printable T1135 Form 2019

What is the Printable T1135 Form

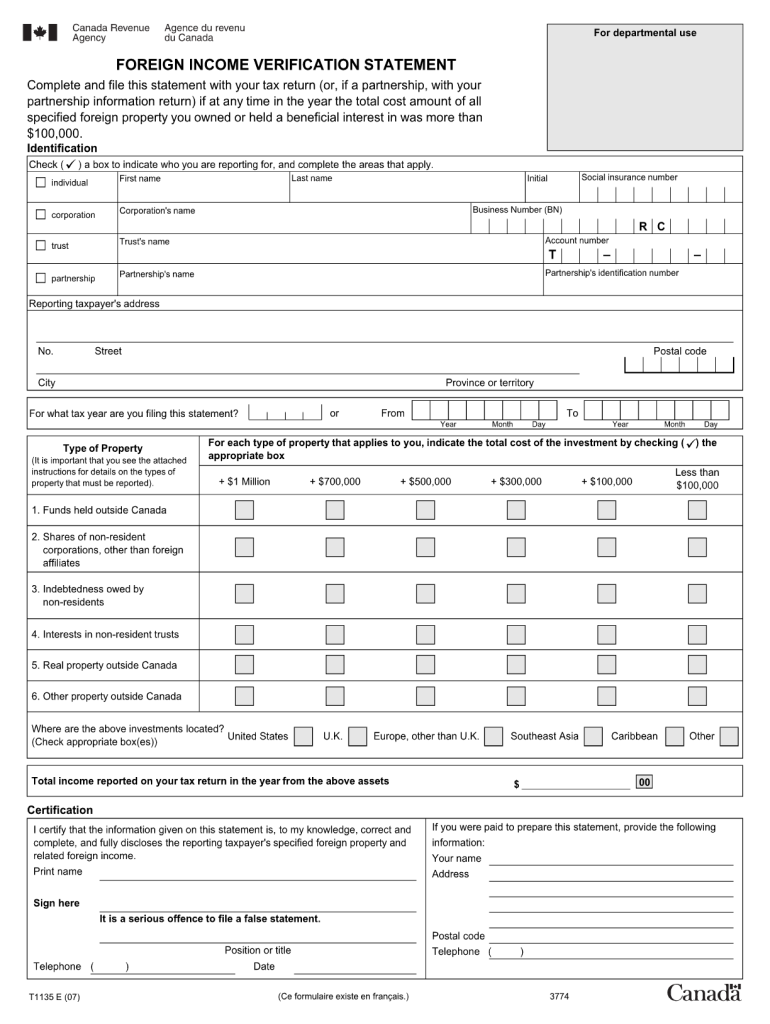

The Printable T1135 Form is a tax form used by U.S. taxpayers to report specified foreign property. This form is particularly relevant for individuals and businesses that hold foreign assets exceeding a certain threshold. The T1135 is essential for maintaining compliance with tax regulations and ensuring accurate reporting of international investments. By filling out this form, taxpayers provide the IRS with detailed information about their foreign holdings, which helps in assessing tax obligations related to those assets.

How to use the Printable T1135 Form

Using the Printable T1135 Form involves several steps to ensure accurate and complete reporting of foreign assets. Start by downloading the form from a reliable source. Next, gather all necessary information about your foreign properties, including their value and type. Carefully fill out each section of the form, ensuring all details are correct. After completing the form, review it for accuracy before submission. This form can be submitted electronically or via traditional mail, depending on your preference and the IRS guidelines.

Steps to complete the Printable T1135 Form

Completing the Printable T1135 Form requires a systematic approach:

- Download the form from an official source.

- Collect information about your foreign assets, including their locations and values.

- Fill out the form, paying close attention to each section.

- Double-check all entries for accuracy and completeness.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Printable T1135 Form

The Printable T1135 Form serves a legal purpose in the context of U.S. tax compliance. It is mandated by the IRS for reporting foreign assets, and failure to file it can result in penalties. The legal framework surrounding this form ensures that taxpayers disclose their foreign holdings, which is crucial for preventing tax evasion. Understanding the legal implications of this form can help taxpayers avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Printable T1135 Form are critical for compliance. Typically, the form must be submitted by a specific date each year, often coinciding with the tax filing deadline. It is important to stay informed about these dates to avoid late filing penalties. Mark your calendar with the due date and ensure that all necessary information is ready well in advance to facilitate timely submission.

Penalties for Non-Compliance

Failing to file the Printable T1135 Form can lead to significant penalties. The IRS imposes fines for late submissions, inaccuracies, or failure to report foreign assets altogether. Understanding these penalties underscores the importance of timely and accurate filing. Taxpayers should be aware of the potential financial consequences and take proactive steps to ensure compliance with reporting requirements.

Quick guide on how to complete printable t1135 2007 form

Complete Printable T1135 Form effortlessly on any device

Digital document management has gained increased popularity among companies and individuals alike. It presents an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly and efficiently. Handle Printable T1135 Form on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to adjust and eSign Printable T1135 Form with ease

- Obtain Printable T1135 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form – via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your preference. Adjust and eSign Printable T1135 Form and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable t1135 2007 form

Create this form in 5 minutes!

How to create an eSignature for the printable t1135 2007 form

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is a Printable T1135 Form?

The Printable T1135 Form is a document required by the Canada Revenue Agency (CRA) that individuals and entities must file to report specified foreign property. Understanding this form is crucial for compliance with tax regulations in Canada. By using airSlate SignNow, you can easily create, sign, and print this form without hassle.

-

How do I complete the Printable T1135 Form using airSlate SignNow?

Completing the Printable T1135 Form with airSlate SignNow is straightforward. You can upload your document, fill out the necessary fields, and save your changes. Our platform also allows you to add e-signatures, making the completion process seamless and compliant.

-

Is there a cost associated with using the Printable T1135 Form feature?

While airSlate SignNow offers various pricing plans, accessing the Printable T1135 Form can be included in some of these plans. For accurate pricing, it's best to visit our pricing page, where you can find the plan that suits your business needs while effectively managing the Printable T1135 Form.

-

Can I integrate airSlate SignNow to manage the Printable T1135 Form with other tools?

Yes, airSlate SignNow offers integrations with popular business tools and software, enabling you to manage the Printable T1135 Form alongside your existing systems. This integration simplifies your workflow and ensures that all your documents are efficiently handled in one place.

-

What are the benefits of using airSlate SignNow for the Printable T1135 Form?

Using airSlate SignNow for the Printable T1135 Form provides several benefits, such as ease of use, quick document turnaround, and enhanced security through e-signatures. Our platform also streamlines the process, allowing you to focus on your core business activities instead of paperwork.

-

Can I save my Printable T1135 Form as a template for future use?

Absolutely! With airSlate SignNow, you can save your Printable T1135 Form as a template, making it easy to reuse the document in the future. This feature helps you save time and ensures that all necessary fields are consistently filled out.

-

How secure is the Printable T1135 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling the Printable T1135 Form, your data is protected through encryption and secure data storage. This ensures that sensitive information remains safe during the entire signing and storage process.

Get more for Printable T1135 Form

- Record of visitors at premises form

- Ds 703 form

- Community service form 10 09 doc

- Child care provider form

- Aiac8 tmp this form is applicable for the first no cost extension request academics triton

- Tax file number declaration mtaa super form

- It05 form jamaica 686683701

- Application instruction sheet bachelors degree as form

Find out other Printable T1135 Form

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney