Arizona a 4 Form 2021

What is the Arizona A 4 Form

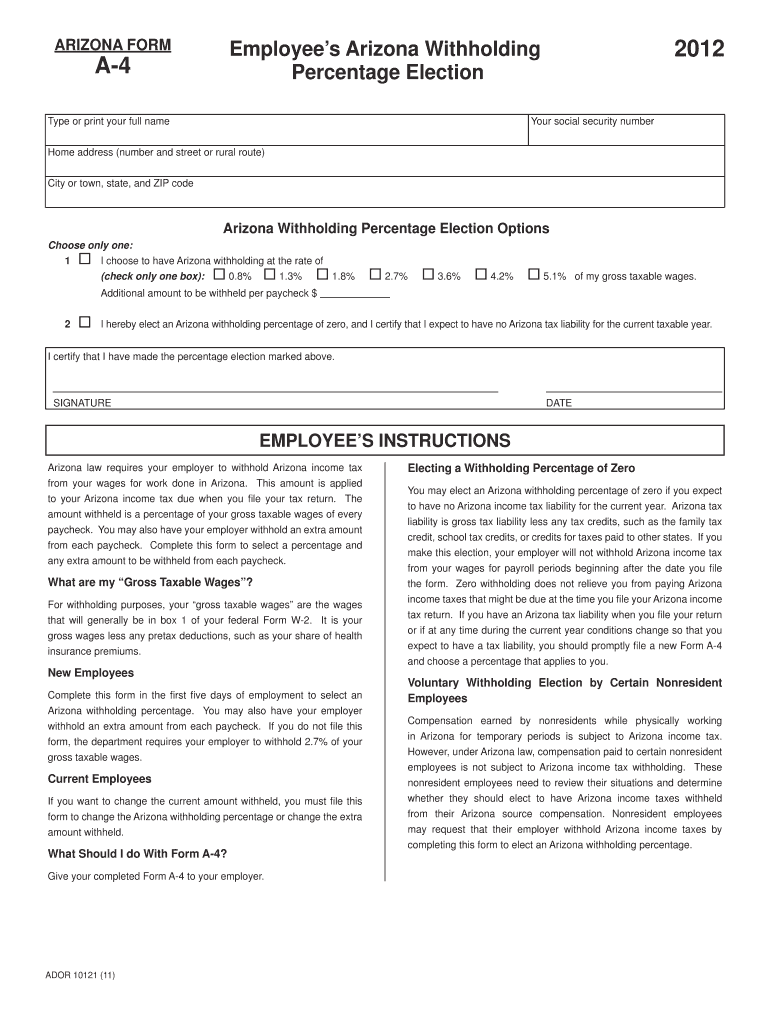

The Arizona A 4 Form is a state-specific document used for employee withholding allowances. This form is essential for employers in Arizona to determine the correct amount of state income tax to withhold from employees' wages. It allows employees to claim personal exemptions and any additional withholding they might prefer, ensuring accurate tax deductions throughout the year. By completing the Arizona A 4 Form, employees can manage their tax liabilities more effectively, aligning their withholdings with their financial situations.

How to obtain the Arizona A 4 Form

The Arizona A 4 Form can be easily obtained through various channels. It is available for download directly from the Arizona Department of Revenue's official website. Additionally, employers may provide copies of the form to their employees upon request. It is important to ensure that you are using the most current version of the form to comply with state regulations. If assistance is needed, local tax offices or accounting professionals can also provide guidance on obtaining and completing the form.

Steps to complete the Arizona A 4 Form

Completing the Arizona A 4 Form involves several straightforward steps:

- Enter your personal information, including your name, address, and Social Security number.

- Indicate your filing status by selecting the appropriate box for single, married, or head of household.

- Claim your allowances by calculating the number based on your personal and dependent exemptions.

- If you wish to have additional amounts withheld, specify that amount in the designated section.

- Sign and date the form to validate your submission.

After completing the form, submit it to your employer for processing. Ensure that you keep a copy for your records.

Legal use of the Arizona A 4 Form

The Arizona A 4 Form is legally recognized as a valid document for establishing state income tax withholding. It must be completed accurately to ensure compliance with Arizona tax laws. Employers are required to maintain these forms on file for their employees, as they serve as a record of withholding allowances claimed. This form is also subject to review by the Arizona Department of Revenue, making it essential to provide truthful and complete information to avoid potential penalties.

Key elements of the Arizona A 4 Form

Several key elements are crucial to the Arizona A 4 Form:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must indicate whether they are single, married, or head of household.

- Allowances: The number of allowances claimed affects the amount withheld from paychecks.

- Additional Withholding: Employees can specify any extra amount they wish to have withheld.

Understanding these elements helps ensure that the form is filled out correctly and meets the necessary requirements.

Form Submission Methods

The Arizona A 4 Form can be submitted through various methods, depending on the employer's preferences. Typically, employees provide the completed form directly to their employer, who will then use the information to adjust payroll withholdings. Some employers may also allow electronic submission of the form through their payroll systems. It is important to confirm with your employer regarding their preferred submission method to ensure compliance and accuracy in tax withholding.

Quick guide on how to complete arizona a 4 2012 form

Prepare Arizona A 4 Form effortlessly on any device

Online document management has grown increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct template and securely store it digitally. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage Arizona A 4 Form across any platform with airSlate SignNow's Android or iOS applications and streamline any documentation process today.

How to edit and electronically sign Arizona A 4 Form with ease

- Find Arizona A 4 Form and click Get Form to commence.

- Use the tools we provide to fill out your form.

- Emphasize the important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Arizona A 4 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona a 4 2012 form

Create this form in 5 minutes!

How to create an eSignature for the arizona a 4 2012 form

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Arizona A 4 Form?

The Arizona A 4 Form is a state-specific tax form used for declaring Arizona withholding. It provides employees and employers with essential information on tax deductions related to income tax. Understanding how to properly fill out the Arizona A 4 Form can help ensure compliance with state requirements.

-

How can airSlate SignNow help with the Arizona A 4 Form?

airSlate SignNow streamlines the process of completing and eSigning the Arizona A 4 Form. With its user-friendly interface, businesses can easily fill out, send, and manage their Arizona A 4 Forms digitally. This enhances efficiency and accuracy in submitting important tax documents.

-

Is there a cost associated with using airSlate SignNow for the Arizona A 4 Form?

Yes, there is a cost to using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans are tailored to meet different needs, offering features that simplify the preparation and submission of documents like the Arizona A 4 Form. You can review pricing options on our website.

-

What features does airSlate SignNow offer for the Arizona A 4 Form?

AirSlate SignNow offers various features for the Arizona A 4 Form, including customizable templates, eSigning, and document tracking. These features ensure that users can manage their documents efficiently and securely. Additionally, the integration capabilities with other applications make it easy to incorporate into existing workflows.

-

Can I integrate airSlate SignNow with other software for handling the Arizona A 4 Form?

Absolutely! airSlate SignNow supports integrations with various software solutions, allowing for seamless handling of the Arizona A 4 Form alongside other business processes. Popular integrations include CRM and accounting software, which can enhance your document management capabilities.

-

How secure is airSlate SignNow when dealing with the Arizona A 4 Form?

Security is a priority at airSlate SignNow. We use advanced encryption methods and security protocols to ensure that your Arizona A 4 Form and other sensitive documents are protected. This means your data is safe while being managed and shared within our platform.

-

What are the benefits of using airSlate SignNow for the Arizona A 4 Form?

Using airSlate SignNow for the Arizona A 4 Form provides numerous benefits, such as increased speed in processing forms and reduced paper usage. Additionally, you can maintain compliance more easily and have a clear audit trail for your documentation. These benefits contribute to improved efficiency in your business operations.

Get more for Arizona A 4 Form

- Fundticker fidelity california short intermediate tax bond form

- Sample warning letter for disclosing confidential information

- Canada child benefits application jkc tax form

- Publication 946 how to depreciate propertyinternal revenue irs tax forms

- Dss 8655sp report of medical examination requested by dss spanish version form

- Buy and sell contract template form

- Buy contract template form

- B2013b registration form 2 strings without boundaries

Find out other Arizona A 4 Form

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online