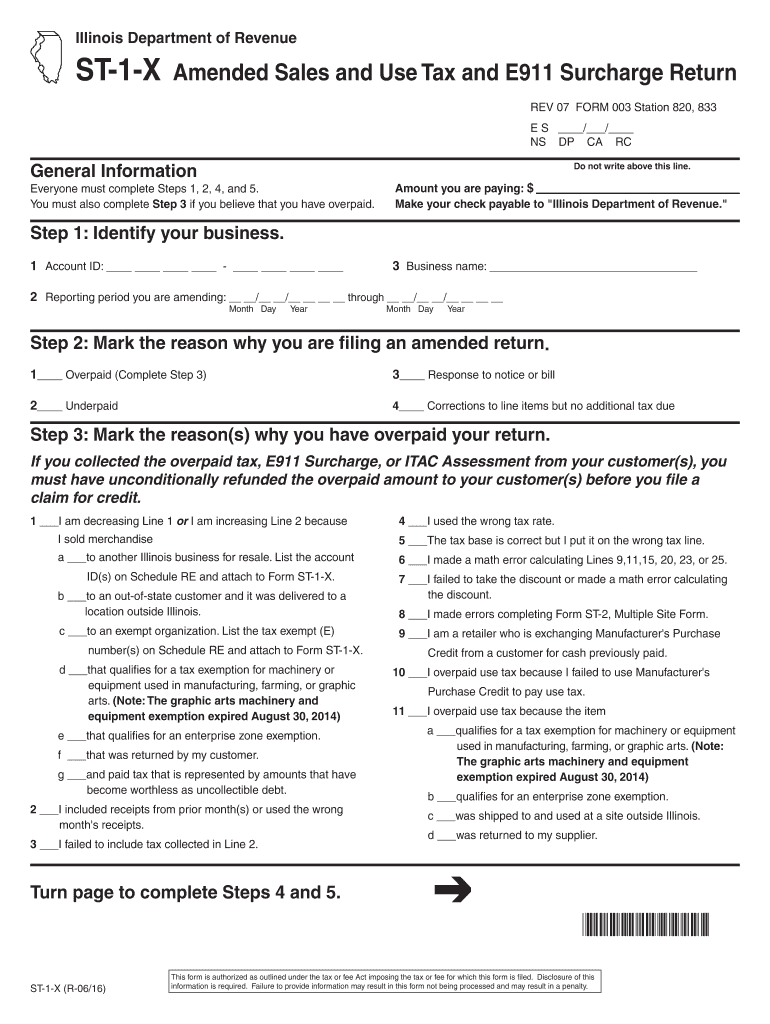

Print Out St1 Form for Illinois 2019

Understanding the Illinois Sales Tax Form ST-1

The Illinois Sales Tax Form ST-1 is a crucial document for businesses operating within the state. It is used to report and remit sales tax collected from customers. This form is essential for compliance with state tax regulations, ensuring that businesses fulfill their tax obligations. The ST-1 form must be accurately completed and submitted to the Illinois Department of Revenue to avoid penalties and interest on unpaid taxes.

Steps to Complete the Illinois Sales Tax Form ST-1

Completing the ST-1 form involves several key steps:

- Gather necessary information, including your business name, address, and sales tax identification number.

- Calculate the total sales made during the reporting period, including taxable and non-taxable sales.

- Determine the total sales tax collected from customers during this period.

- Fill out the ST-1 form accurately, ensuring all figures are correct and reflect your sales accurately.

- Review the completed form for any errors before submission.

Legal Use of the Illinois Sales Tax Form ST-1

The ST-1 form serves as a legal document that verifies the amount of sales tax collected by a business. It is essential for maintaining compliance with Illinois tax laws. Proper use of this form can protect businesses from audits and potential legal issues related to tax evasion. Businesses must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties.

Filing Deadlines for the Illinois Sales Tax Form ST-1

Filing deadlines for the ST-1 form vary depending on the frequency of your sales tax reporting. Businesses may be required to file monthly, quarterly, or annually. It is important to stay informed about these deadlines to avoid late fees and interest charges. Generally, forms must be submitted by the 20th of the month following the end of the reporting period.

Form Submission Methods for the Illinois Sales Tax ST-1

The ST-1 form can be submitted through various methods:

- Online submission via the Illinois Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices.

Choosing the right submission method can streamline the process and ensure timely filing.

Key Elements of the Illinois Sales Tax Form ST-1

When completing the ST-1 form, certain key elements must be included:

- Taxpayer information, including name and address.

- Sales tax identification number.

- Total gross sales and taxable sales amounts.

- Total sales tax collected.

- Signature of the authorized person verifying the information.

Ensuring all key elements are accurately filled out is vital for compliance and successful processing of the form.

Examples of Using the Illinois Sales Tax Form ST-1

Businesses in various sectors utilize the ST-1 form, including retail, e-commerce, and service industries. For example, a retail store collects sales tax on each transaction and reports the total on the ST-1 form. Similarly, an online business selling products to Illinois customers must also report sales tax collected. Understanding how different business models apply the ST-1 form can help ensure compliance across various industries.

Quick guide on how to complete print out st1 form for illinois 2011

Complete Print Out St1 Form For Illinois seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers since you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents rapidly without delays. Manage Print Out St1 Form For Illinois on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Print Out St1 Form For Illinois effortlessly

- Obtain Print Out St1 Form For Illinois and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize necessary sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Print Out St1 Form For Illinois and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct print out st1 form for illinois 2011

Create this form in 5 minutes!

How to create an eSignature for the print out st1 form for illinois 2011

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the Illinois sales tax rate?

The Illinois sales tax rate is currently set at 6.25% for general merchandise. However, local jurisdictions can impose additional taxes, leading to a combined rate that varies by location. It's essential to verify the specific rate in your area to ensure compliance with all Illinois sales tax obligations.

-

How can airSlate SignNow help with Illinois sales tax documentation?

airSlate SignNow streamlines the process of signing and managing documents related to Illinois sales tax. By using our eSignature solution, businesses can easily create, send, and store essential documents securely. This efficiency helps ensures that all tax records are promptly signed and readily accessible for audits.

-

Does airSlate SignNow integrate with accounting software for sales tax calculations?

Yes, airSlate SignNow offers seamless integrations with popular accounting software that can assist with Illinois sales tax calculations. These integrations enable businesses to automate their tax processes, ensuring accuracy and compliance. By linking your eSignature solution with your accounting tools, you can simplify the overall management of your tax liabilities.

-

What benefits does eSigning offer for Illinois sales tax forms?

eSigning documents related to Illinois sales tax offers numerous benefits, including speed and convenience. With airSlate SignNow, you can get documents signed instantly without the hassle of printing or physical delivery. This not only saves time but also ensures that your sales tax documents are processed efficiently and filed on time.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides a free trial for new users to explore its features, including those pertinent to Illinois sales tax. This allows you to test the platform's ease of use and effectiveness in handling tax documents before committing to a subscription. During the trial, you can evaluate how our tools can streamline your tax processes.

-

Can I customize templates for Illinois sales tax forms in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize templates tailored to Illinois sales tax forms. This flexibility lets you create documents that include specific compliance language, making sure that your forms meet all state requirements while saving time on repetitive tasks.

-

How does airSlate SignNow ensure security for documents related to Illinois sales tax?

Security is a top priority for airSlate SignNow, especially concerning sensitive documents like those related to Illinois sales tax. We use encryption, secure storage, and access controls to protect your data. Our platform complies with industry standards, ensuring your tax documents are safe from unauthorized access.

Get more for Print Out St1 Form For Illinois

- August september new century planners form

- Form stex a1 application for sales tax certificate of exemption

- Instructions for form 5329 internal revenue service

- About form 8275 disclosure statementinternal revenue

- Application for enrollment to practice before form

- Premarital intake form

- Car hire contract template form

- Military judge verification of record of trial form

Find out other Print Out St1 Form For Illinois

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later