Form CT 300 Tax Ny 2021

What is the Form CT 300 Tax Ny

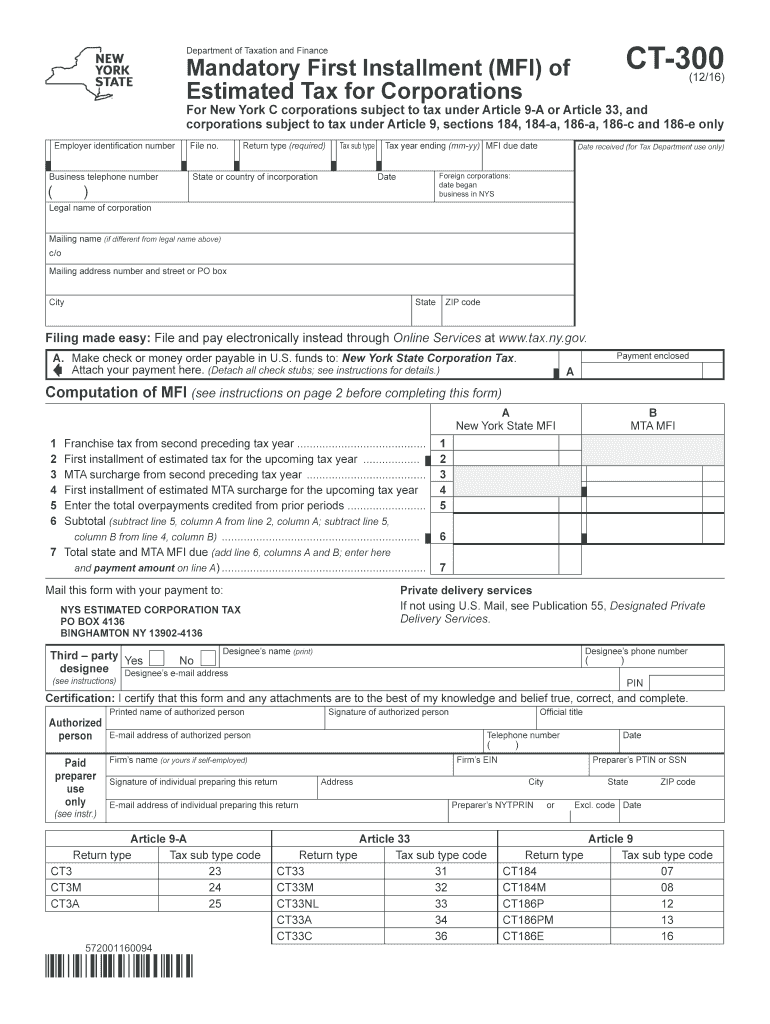

The Form CT 300 Tax Ny is a tax form used by corporations in New York State to report their estimated tax payments. This form is essential for businesses that expect to owe tax of $500 or more for the current tax year. It allows corporations to calculate and remit their estimated tax obligations in a timely manner, ensuring compliance with state tax regulations.

How to use the Form CT 300 Tax Ny

To effectively use the Form CT 300 Tax Ny, businesses must first determine their estimated taxable income for the year. This involves analyzing financial records and projecting future earnings. Once the estimated income is calculated, businesses can use the form to compute their estimated tax liability. It is crucial to submit the form by the specified deadlines to avoid penalties.

Steps to complete the Form CT 300 Tax Ny

Completing the Form CT 300 Tax Ny involves several key steps:

- Gather financial information, including income statements and prior tax returns.

- Calculate the estimated taxable income for the current year.

- Determine the applicable tax rate based on the corporation's income bracket.

- Fill out the form with the calculated estimates and any necessary supporting information.

- Review the form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Legal use of the Form CT 300 Tax Ny

The legal use of the Form CT 300 Tax Ny is governed by New York State tax laws. To be considered valid, the form must be filled out accurately and submitted by the due date. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for corporations to maintain records of their submissions for legal and auditing purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 300 Tax Ny are critical for compliance. Corporations must submit estimated tax payments on or before the due dates, which typically align with quarterly tax periods. The deadlines are usually set for April 15, June 15, September 15, and December 15 of each year. It is important for businesses to mark these dates on their calendars to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 300 Tax Ny can be submitted through various methods, providing flexibility for businesses. Corporations can file the form online through the New York State Department of Taxation and Finance website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so businesses should choose the one that best suits their needs.

Quick guide on how to complete form ct 300 tax ny

Complete Form CT 300 Tax Ny seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form CT 300 Tax Ny on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form CT 300 Tax Ny effortlessly

- Locate Form CT 300 Tax Ny and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form CT 300 Tax Ny and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 300 tax ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 300 tax ny

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form CT 300 Tax Ny?

Form CT 300 Tax Ny is a tax form required for certain business entities in New York to file and report their franchise tax liability. It is essential for ensuring compliance with state tax regulations. Understanding how to fill out this form correctly can save you time and prevent costly mistakes.

-

How does airSlate SignNow help with Form CT 300 Tax Ny?

airSlate SignNow provides a user-friendly platform to create, send, and eSign Form CT 300 Tax Ny and other essential documents. Our easy-to-use solution streamlines the process, allowing you to focus on your business rather than paperwork. With automated workflows, you can ensure timely submissions and compliance.

-

Is the pricing for airSlate SignNow competitive?

Yes, airSlate SignNow offers competitive pricing for its eSignature services, ensuring businesses of all sizes can access essential solutions like Form CT 300 Tax Ny. We provide multiple pricing plans, including a free trial, so you can choose the right option that fits your budget. Transparent rates mean no hidden fees.

-

What features does airSlate SignNow offer for managing Form CT 300 Tax Ny?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and real-time tracking for Form CT 300 Tax Ny. Our platform allows you to remind recipients and track the status of your documents seamlessly. This ensures your tax paperwork is completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for Form CT 300 Tax Ny?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easy to manage Form CT 300 Tax Ny and other documents. Whether you're using accounting software or customer relationship management (CRM) tools, our seamless integrations enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for Form CT 300 Tax Ny?

Using airSlate SignNow for Form CT 300 Tax Ny offers numerous benefits, such as reducing turnaround times, enhancing accuracy, and increasing document security. Our platform minimizes paper usage and promotes a more efficient signing process, allowing you to focus on your core business activities. Compliance is simpler with a reliable eSignature solution.

-

How secure is airSlate SignNow for handling Form CT 300 Tax Ny?

airSlate SignNow prioritizes your data security, ensuring that all documents, including Form CT 300 Tax Ny, are protected with industry-standard encryption and secure storage. Our platform complies with various regulatory requirements, safeguarding your sensitive information. You can trust us to keep your tax documents secure.

Get more for Form CT 300 Tax Ny

Find out other Form CT 300 Tax Ny

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement