Ct 3 S Form 2020

What is the Ct 3 S Form

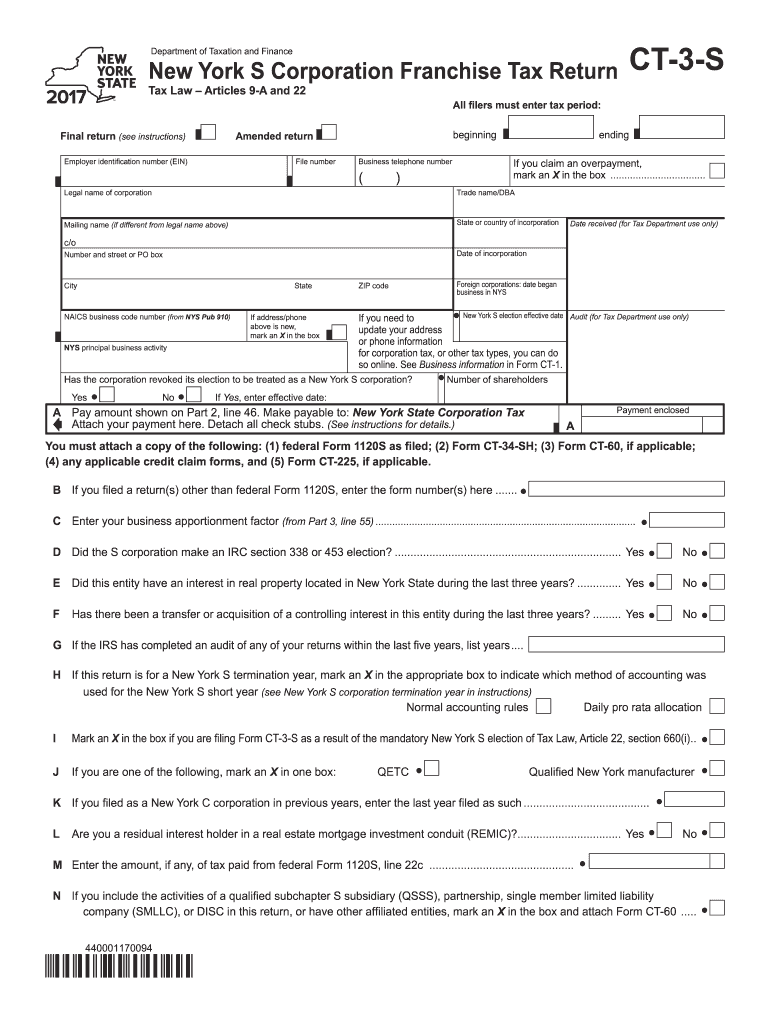

The Ct 3 S Form is a tax document used by certain business entities in the United States to report income and calculate tax liabilities. This form is specifically designed for S corporations, which are pass-through entities that allow income to be taxed at the shareholder level rather than at the corporate level. The Ct 3 S Form provides essential information about the corporation's financial activities, including income, deductions, and credits. Understanding this form is crucial for compliance with federal and state tax regulations.

How to use the Ct 3 S Form

Using the Ct 3 S Form involves a series of steps to ensure accurate reporting of your business’s financial information. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise figures, ensuring that all calculations are correct. It is important to review the instructions provided with the form to comply with all requirements. After completing the form, it can be submitted electronically or via mail, depending on the specific guidelines provided by the state tax authority.

Steps to complete the Ct 3 S Form

Completing the Ct 3 S Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather financial records, including revenue, expenses, and previous tax returns.

- Access the Ct 3 S Form from the appropriate state tax authority website.

- Fill in the required information, ensuring all numbers are accurate and correspond to your financial records.

- Review the form for any errors or omissions.

- Submit the completed form according to the guidelines, either electronically or by mail.

Legal use of the Ct 3 S Form

The legal use of the Ct 3 S Form is governed by federal and state tax laws. To ensure compliance, it is essential to complete the form accurately and submit it by the designated deadlines. Failure to do so may result in penalties or audits. The form must be signed by an authorized individual within the corporation, affirming that the information provided is true and complete. Adhering to legal requirements helps maintain the corporation's good standing and avoids potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 S Form can vary based on the corporation's tax year and state regulations. Typically, S corporations must file their tax returns by the fifteenth day of the third month following the end of their fiscal year. For corporations operating on a calendar year, this usually means a deadline of March 15. It is important to stay informed about any changes to deadlines or requirements to avoid late filing penalties.

Required Documents

When completing the Ct 3 S Form, certain documents are necessary to support the information reported. Required documents may include:

- Financial statements, such as profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for any deductions claimed, including receipts and invoices.

- Previous tax returns for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The Ct 3 S Form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state tax authority's e-filing system, which is often the fastest and most efficient method.

- Mailing a paper copy of the completed form to the appropriate tax office, ensuring that it is postmarked by the filing deadline.

- In-person submission at designated tax offices, which may be available in some states for those who prefer direct interaction.

Quick guide on how to complete ct 3 s form 2017

Complete Ct 3 S Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Ct 3 S Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Ct 3 S Form seamlessly

- Locate Ct 3 S Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to conserve your modifications.

- Choose how you would like to deliver your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of missing or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Edit and eSign Ct 3 S Form to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 s form 2017

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s form 2017

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is a Ct 3 S Form and why is it important?

The Ct 3 S Form is a simplified tax return used by small businesses in Connecticut. It allows eligible entities to report their income and calculate their tax liability efficiently. By utilizing the Ct 3 S Form, businesses can streamline their filing process and ensure compliance with state tax regulations.

-

How does airSlate SignNow assist with the Ct 3 S Form signing process?

airSlate SignNow provides a user-friendly platform to eSign and manage your Ct 3 S Form digitally. Our solution allows you to send, track, and obtain signatures securely, thereby speeding up the completion of your tax documents. This minimizes delays and enhances the overall efficiency of your filing process.

-

Is there a cost associated with using airSlate SignNow for the Ct 3 S Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that facilitate the signing and management of documents like the Ct 3 S Form. You can choose a plan that best fits your budget and requirements for optimal document handling.

-

What features does airSlate SignNow offer for managing the Ct 3 S Form?

Our platform includes features such as document templates, customizable workflows, and real-time tracking for the Ct 3 S Form. Additionally, you can set reminders for signers to ensure timely completion. These features ensure that your document management is as efficient and organized as possible.

-

Can I integrate airSlate SignNow with other software to manage the Ct 3 S Form?

Absolutely! airSlate SignNow offers seamless integrations with popular software tools such as Google Drive, Dropbox, and CRM systems. This compatibility makes it easier to access and manage your Ct 3 S Form alongside other business documents, enhancing productivity and collaboration.

-

Is my data safe when using airSlate SignNow for the Ct 3 S Form?

Yes, airSlate SignNow prioritizes your data security. Our platform uses advanced encryption methods to protect sensitive information related to the Ct 3 S Form. You can trust that your documents and personal data are safe while using our services.

-

How can I get started with airSlate SignNow for my Ct 3 S Form needs?

Getting started with airSlate SignNow is quick and easy! Simply sign up for an account, select a suitable pricing plan, and start uploading your Ct 3 S Form. Our intuitive interface guides you through the signing and management process seamlessly.

Get more for Ct 3 S Form

- Order form 272844815

- Education ky govedprepcertteacher certification and renewal kentucky department of form

- Forum gibson comtopic36248 golf tournamentgolf tournament the gibson lounge gibson brands forums form

- Travel state govcontenttraveldna relationship testing procedures travel form

- Application for enrollment mille lacs mlbo dev form

- Standard handyman contract template form

- Standard loan contract template form

- Standard for service contract template form

Find out other Ct 3 S Form

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer