Partner's Ownership and Account Activity 2017-2026

What is the Partner's Ownership And Account Activity

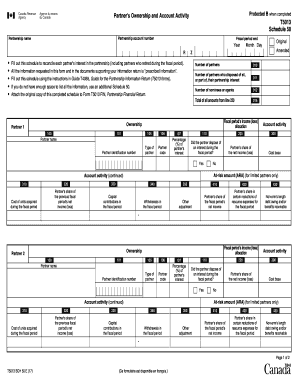

The Partner's Ownership and Account Activity form, commonly referred to as the T5013 schedule 50, is a key document used in the context of partnerships in the United States. This form is essential for reporting the income, deductions, and credits of a partnership to the Internal Revenue Service (IRS). It provides a detailed account of each partner's share of the partnership's financial activities, ensuring transparency and compliance with tax regulations. Understanding this form is crucial for partners to accurately report their income and fulfill their tax obligations.

How to Use the Partner's Ownership And Account Activity

Using the Partner's Ownership and Account Activity form involves several steps that ensure accurate reporting. First, partners must gather all relevant financial information from the partnership, including income, expenses, and distributions. Once this data is compiled, partners can fill out the T5013 schedule 50, detailing their individual shares. It is important to ensure that all figures are correct and that the form is signed by the appropriate parties. After completion, the form must be submitted to the IRS along with the partnership's tax return.

Steps to Complete the Partner's Ownership And Account Activity

Completing the Partner's Ownership and Account Activity form involves a systematic approach:

- Collect all necessary financial documents related to the partnership.

- Determine each partner's share of income, deductions, and credits.

- Fill out the T5013 schedule 50 accurately, ensuring all figures match the partnership's records.

- Review the form for any errors or omissions.

- Obtain signatures from all required partners.

- Submit the completed form to the IRS with the partnership's tax return.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Partner's Ownership and Account Activity form. These guidelines include instructions on how to report various types of income, deductions, and credits. It is important for partners to familiarize themselves with these guidelines to ensure compliance. Partners should also be aware of any changes in tax laws that may affect how the T5013 schedule 50 is completed. Regularly checking the IRS website for updates can help partners stay informed.

Filing Deadlines / Important Dates

Filing deadlines for the Partner's Ownership and Account Activity form are critical for compliance. Typically, the form must be submitted by the due date of the partnership's tax return, which is usually March 15 for calendar year partnerships. If the partnership is on a fiscal year, the deadline will vary accordingly. Partners should also be aware of any extensions that may be available and ensure that they file on time to avoid penalties.

Penalties for Non-Compliance

Failure to properly complete and submit the Partner's Ownership and Account Activity form can result in significant penalties. The IRS may impose fines for late filing, inaccurate reporting, or failure to file altogether. These penalties can add up quickly, making it essential for partners to understand their responsibilities and adhere to all filing requirements. Ensuring accurate and timely submission can help avoid these costly consequences.

Quick guide on how to complete partners ownership and account activity

Complete Partner's Ownership And Account Activity effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Partner's Ownership And Account Activity on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Partner's Ownership And Account Activity with ease

- Locate Partner's Ownership And Account Activity and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Partner's Ownership And Account Activity and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partners ownership and account activity

Create this form in 5 minutes!

How to create an eSignature for the partners ownership and account activity

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a t5013 form and how does it relate to airSlate SignNow?

The t5013 form is a tax document used in Canada for reporting income from partnerships. With airSlate SignNow, businesses can easily manage, send, and eSign t5013 forms, streamlining the process and ensuring compliance. Our solution simplifies the signing workflow, making it accessible for accountants and business owners alike.

-

How can airSlate SignNow help me manage my t5013 forms effectively?

airSlate SignNow provides a user-friendly platform to create, send, and sign t5013 forms electronically. You can track the status of your documents and ensure all parties have signed, reducing the chances of lost paperwork. This efficiency can save your business time and improve overall productivity.

-

What are the pricing options for airSlate SignNow when processing t5013 forms?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes, including options that provide access to features specifically for managing t5013 forms. Our competitive pricing ensures you receive value without compromising on the necessary tools for document management. You can choose a plan that fits your budget and requirements.

-

Are there any specific features in airSlate SignNow for handling t5013 forms?

Yes, airSlate SignNow includes features tailored to managing t5013 forms, such as customizable templates, automated reminders, and signature tracking. These features allow you to streamline your workflow and ensure compliance with tax regulations. Simplifying the management of t5013 forms is just one of the many benefits of using our platform.

-

Can I integrate airSlate SignNow with other software for processing t5013 forms?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions that you might already use for accounting and tax purposes. This integration allows you to easily import and export t5013 forms, ensuring a smooth workflow between your document management and financial systems.

-

What benefits does eSigning t5013 forms with airSlate SignNow offer?

eSigning t5013 forms with airSlate SignNow provides several benefits, including enhanced security, faster turnaround times, and improved document accuracy. By going digital, you reduce paper usage and the risk of errors, making the entire process more efficient. This convenience ensures that your t5013 forms are completed on time and without hassle.

-

Is airSlate SignNow compliant with regulations for processing t5013 forms?

Yes, airSlate SignNow is designed to comply with industry regulations, including those related to tax documents like the t5013 form. By prioritizing compliance, we ensure that your documents are secure and legally binding. You can confidently manage your t5013 forms knowing that you're adhering to the necessary standards.

Get more for Partner's Ownership And Account Activity

- Required items for new students form

- Promotion dossier checklist and submission form

- Expense form for non us residents american college of

- Donor advised funds ampamp scholarships first midwest bank form

- Stockton university fraternity sorority new member drop intraweb stockton form

- This non disclosure agreement hereinafter agreement is effective as of the date of signature of the form

- In order to appeal the denial of financial aid due to failure to maintain satisfactory academic progress form

- Pastoral form pics

Find out other Partner's Ownership And Account Activity

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile