T5013 Fillable 2011

What is the T5013 Fillable

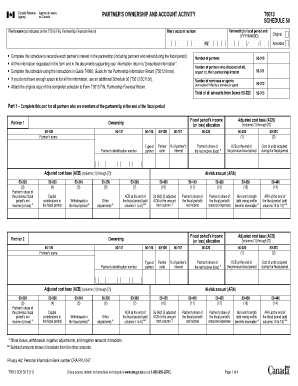

The T5013 fillable form is a tax document used in the United States for reporting income from partnerships, limited liability companies, and certain other business entities. This form is essential for partners or members of these entities to report their share of income, deductions, and credits on their individual tax returns. The T5013 form provides a structured way to ensure that all necessary financial information is accurately reported to the Internal Revenue Service (IRS).

How to use the T5013 Fillable

Using the T5013 fillable form involves several steps. First, access the form through a reliable source, ensuring it is the most current version. Fill out the required fields, including details about the partnership or entity, and your share of income and deductions. It is crucial to provide accurate information to avoid discrepancies during tax filing. Once completed, review the form for accuracy before submission.

Steps to complete the T5013 Fillable

Completing the T5013 fillable form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the T5013 form.

- Enter the name and address of the partnership or entity.

- Fill in your identifying information, including your Social Security number or Employer Identification Number.

- Report your share of income, deductions, and credits as specified in the form.

- Review all entries for accuracy and completeness.

- Save the completed form for your records.

Legal use of the T5013 Fillable

The T5013 fillable form is legally binding when completed accurately and submitted in compliance with IRS regulations. It serves as a formal declaration of income and deductions, which can be audited by the IRS if necessary. To ensure legal validity, it is essential to follow all instructions carefully and maintain copies of the submitted forms for your records.

Filing Deadlines / Important Dates

Filing deadlines for the T5013 fillable form are crucial for compliance with tax regulations. Typically, the form must be submitted by the due date of the partnership's tax return. For most partnerships, this date falls on the fifteenth day of the third month after the end of their fiscal year. It is important to stay informed about any changes to these deadlines to avoid penalties.

Who Issues the Form

The T5013 fillable form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. The IRS provides guidelines on how to fill out the form and the requirements for submission, ensuring that taxpayers have the necessary resources to comply with tax obligations.

Quick guide on how to complete t5013 fillable

Complete T5013 Fillable seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage T5013 Fillable on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign T5013 Fillable effortlessly

- Locate T5013 Fillable and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Select signNow sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign T5013 Fillable and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t5013 fillable

Create this form in 5 minutes!

How to create an eSignature for the t5013 fillable

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is Schedule 50 in the context of airSlate SignNow?

Schedule 50 refers to a federal pricing schedule that airSlate SignNow adheres to, making it a cost-effective choice for government agencies and organizations. By leveraging Schedule 50, users can obtain signNow discounts while accessing robust eSigning and document management features tailored for their needs.

-

How does airSlate SignNow support Schedule 50 pricing?

AirSlate SignNow is proud to offer solutions under Schedule 50, which simplifies the procurement process for government entities. This means eligible organizations can enjoy budget-friendly pricing options without compromising on functionality or ease of use.

-

What features does airSlate SignNow provide under Schedule 50?

Under Schedule 50, airSlate SignNow offers features such as document eSigning, templates, real-time tracking, and secure cloud storage. These features are designed to meet the needs of various sectors, ensuring compliance and efficiency in document management.

-

Are there any additional benefits to using airSlate SignNow with Schedule 50?

Yes, using airSlate SignNow under Schedule 50 gives you access to dedicated customer support and advanced integration options. This makes it easier for your organization to implement eSignature solutions while focusing on compliance and enhancing operational productivity.

-

Is airSlate SignNow easy to integrate with other software using Schedule 50?

Absolutely! airSlate SignNow is designed for seamless integration with popular business applications and systems, ensuring that teams can utilize their existing tools efficiently. This compatibility facilitates a smooth transition while maintaining adherence to Schedule 50 pricing.

-

How do I get started with airSlate SignNow under Schedule 50?

To get started with airSlate SignNow under Schedule 50, simply visit our website and fill out the request form specific to government contracts. Our team will signNow out to guide you through the setup process and discuss your organization's specific needs.

-

What type of customer support does airSlate SignNow provide for Schedule 50 users?

Customers using airSlate SignNow under Schedule 50 receive priority support from our experienced team. Whether you need help with setup, troubleshooting, or feature utilization, we are committed to ensuring a smooth experience for all government clients.

Get more for T5013 Fillable

- Employment application pdf missouri form

- University of louisville transcripts 448042292 form

- Style guide university of north carolina form

- Outdoor facility application form ucsc arboretum

- Eop income verification form 516708441

- Health insurance waiver form for tufts universitys boston amp grafton campuses 2019 2020

- Forensic and insurance claim submission formc

- Community health nursing mn quarterly progressplanning form

Find out other T5013 Fillable

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer