This Application Should Be Filed Only by Charitable, Educational or Religious Institutions; Disregarded, Resident, Single Member 2017-2026

Understanding the Kentucky Exemption Sales Use Tax

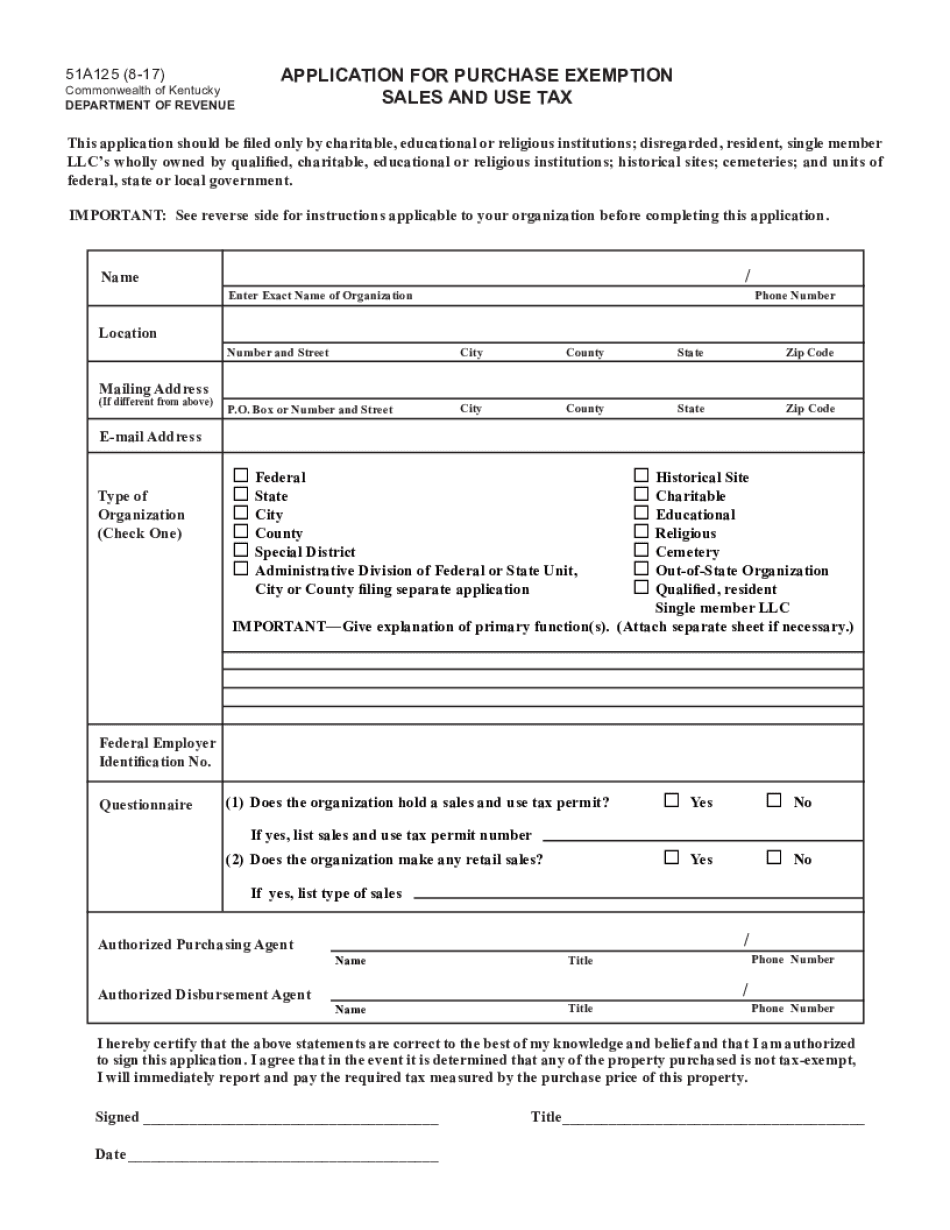

The Kentucky exemption sales use tax is a specific tax relief available to certain entities, primarily charitable, educational, or religious institutions. This exemption allows qualified organizations to purchase goods and services without paying the standard sales tax, thereby reducing their operational costs. To qualify, the organization must be recognized as exempt under Kentucky law, and the purchases must be directly related to their exempt purposes. Understanding the criteria for eligibility is essential for organizations seeking to benefit from this exemption.

Eligibility Criteria for the Kentucky Exemption Sales Use Tax

To qualify for the Kentucky exemption sales use tax, organizations must meet specific eligibility criteria. These include:

- Being a recognized charitable, educational, or religious institution.

- Having a valid Kentucky tax exemption certificate.

- Ensuring that purchases are directly related to the organization's exempt purpose.

Organizations must maintain documentation to support their exempt status and purchases. This documentation may include the Kentucky tax exempt form and any relevant IRS documentation.

Steps to Complete the Kentucky Tax Exempt Form

Filling out the Kentucky tax exempt form involves several key steps:

- Gather necessary documentation, including proof of the organization's exempt status.

- Complete the Kentucky exemption sales use tax form accurately, ensuring all fields are filled out.

- Provide details about the purchases that will be exempt from sales tax.

- Submit the completed form to the appropriate vendor or service provider.

It is important to ensure that all information is accurate to avoid delays or issues with tax exemption claims.

Legal Use of the Kentucky Exemption Sales Use Tax

The legal use of the Kentucky exemption sales use tax is strictly regulated. Only qualified organizations may utilize this exemption, and misuse can result in penalties. Organizations must ensure that they are compliant with both state and federal regulations regarding tax exemptions. This includes keeping accurate records and only claiming exemptions for eligible purchases.

Form Submission Methods for the Kentucky Tax Exempt Form

The Kentucky tax exempt form can typically be submitted through various methods, including:

- Online submission through designated state portals.

- Mailing the completed form to the relevant tax authority.

- In-person submission at local tax offices.

Choosing the appropriate submission method can streamline the process and ensure timely processing of the exemption claim.

Required Documents for the Kentucky Exemption Sales Use Tax

When applying for the Kentucky exemption sales use tax, organizations must prepare several required documents, including:

- A completed Kentucky tax exempt form.

- Proof of the organization's exempt status, such as IRS determination letters.

- Documentation of purchases intended for exemption.

Having these documents ready can facilitate a smoother application process and help avoid potential issues.

Quick guide on how to complete this application should be filed only by charitable educational or religious institutions disregarded resident single member

Easily Prepare This Application Should Be Filed Only By Charitable, Educational Or Religious Institutions; Disregarded, Resident, Single Member on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Handle This Application Should Be Filed Only By Charitable, Educational Or Religious Institutions; Disregarded, Resident, Single Member on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign This Application Should Be Filed Only By Charitable, Educational Or Religious Institutions; Disregarded, Resident, Single Member

- Locate This Application Should Be Filed Only By Charitable, Educational Or Religious Institutions; Disregarded, Resident, Single Member and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of your documents or redact sensitive data using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign This Application Should Be Filed Only By Charitable, Educational Or Religious Institutions; Disregarded, Resident, Single Member to guarantee effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct this application should be filed only by charitable educational or religious institutions disregarded resident single member

Create this form in 5 minutes!

How to create an eSignature for the this application should be filed only by charitable educational or religious institutions disregarded resident single member

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the kentucky exemption sales use tax, and how does it work?

The kentucky exemption sales use tax allows certain organizations or individuals to purchase specific goods and services without the obligation to pay sales tax. Generally, this exemption applies to nonprofit entities, governmental agencies, and specific types of purchases. Understanding the nuances of kentucky exemption sales use tax is crucial for ensuring compliance and maximizing savings.

-

How can airSlate SignNow help with kentucky exemption sales use tax documentation?

With airSlate SignNow, businesses can easily prepare and sign documents required for kentucky exemption sales use tax. The platform streamlines the process of obtaining necessary approvals, ensuring that all transactions are well-documented and compliant with Kentucky tax regulations. Our solution simplifies the paperwork associated with these tax exemptions.

-

Are there any fees associated with using airSlate SignNow to manage kentucky exemption sales use tax forms?

airSlate SignNow offers a variety of pricing plans, allowing you to choose one that best fits your business needs when managing kentucky exemption sales use tax forms. Our plans are designed to provide an economical solution for eSigning and document management without hidden costs, enabling businesses to remain budget-efficient.

-

What features does airSlate SignNow offer for handling kentucky exemption sales use tax?

airSlate SignNow offers a comprehensive set of features, including customizable templates for kentucky exemption sales use tax forms, real-time collaboration, and secure eSigning. The platform also includes workflows that facilitate the easy transfer of these documents for necessary approval, helping to streamline your tax exemption process.

-

Can airSlate SignNow integrate with other systems to manage kentucky exemption sales use tax?

Yes, airSlate SignNow can integrate with various CRM, accounting, and project management software. This capability allows you to easily track and manage kentucky exemption sales use tax forms alongside other business documentation, enhancing overall efficiency and organization within your company.

-

What are the benefits of using airSlate SignNow for kentucky exemption sales use tax compliance?

Using airSlate SignNow for kentucky exemption sales use tax compliance offers numerous benefits, including improved accuracy, faster processing times, and reduced administrative overhead. The platform ensures that all necessary documents are securely stored and accessible, allowing businesses to maintain thorough records and simplify audits.

-

How does airSlate SignNow ensure the security of documents related to kentucky exemption sales use tax?

airSlate SignNow prioritizes document security, employing advanced encryption and compliance with industry standards to protect your information related to kentucky exemption sales use tax. Each document is stored securely, and we implement strict access controls, giving you confidence that your sensitive tax-related data is safe.

Get more for This Application Should Be Filed Only By Charitable, Educational Or Religious Institutions; Disregarded, Resident, Single Member

- Hvac contract for contractor west virginia form

- Landscape contract for contractor west virginia form

- Commercial contract for contractor west virginia form

- Excavator contract for contractor west virginia form

- Renovation contract for contractor west virginia form

- Concrete mason contract for contractor west virginia form

- Demolition contract for contractor west virginia form

- Framing contract for contractor west virginia form

Find out other This Application Should Be Filed Only By Charitable, Educational Or Religious Institutions; Disregarded, Resident, Single Member

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure