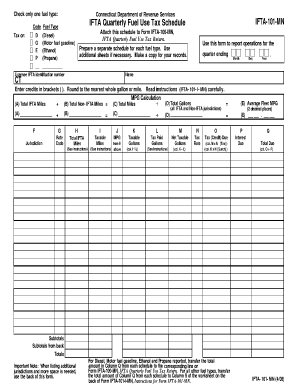

Ct Ifta Quarterly Fuel Use Tax Schedule Form

What is the IFTA Quarterly Fuel Tax Schedule Form?

The IFTA quarterly fuel tax schedule form is a crucial document for businesses operating commercial vehicles across state lines in the United States. This form is used to report and pay fuel taxes owed to member jurisdictions under the International Fuel Tax Agreement (IFTA). The IFTA aims to simplify the reporting of fuel use taxes by allowing carriers to file a single quarterly return instead of separate returns for each state. Understanding this form is essential for compliance and ensuring that all fuel taxes are accurately reported and paid.

How to Use the IFTA Quarterly Fuel Tax Schedule Form

Using the IFTA quarterly fuel tax schedule form involves several steps to ensure accurate reporting. First, gather all necessary information regarding fuel purchases and miles traveled in each jurisdiction. This includes tracking fuel receipts, mileage logs, and any other relevant documentation. Once you have compiled this information, you can begin filling out the form. Make sure to enter the fuel consumption and mileage for each state accurately. After completing the form, review it for any errors before submission to avoid penalties.

Steps to Complete the IFTA Quarterly Fuel Tax Schedule Form

Completing the IFTA quarterly fuel tax schedule form requires careful attention to detail. Follow these steps:

- Collect all fuel purchase receipts and mileage records for the reporting period.

- Fill in the total gallons of fuel purchased in each state.

- Record the total miles driven in each jurisdiction.

- Calculate the taxable gallons and the tax owed for each state based on their respective tax rates.

- Complete any additional sections required by your home jurisdiction.

- Review the completed form for accuracy.

- Submit the form by the deadline specified by your jurisdiction.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA quarterly fuel tax schedule form are typically set on a quarterly basis. The due dates are usually the last day of the month following the end of each quarter. For example:

- First quarter (January to March) - Due April 30

- Second quarter (April to June) - Due July 31

- Third quarter (July to September) - Due October 31

- Fourth quarter (October to December) - Due January 31

It is crucial to adhere to these deadlines to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to comply with the IFTA quarterly fuel tax schedule requirements can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, which may increase the overall amount owed.

- Potential audits from state authorities, leading to further scrutiny of records.

- Suspension of IFTA privileges, which can impact your ability to operate across state lines.

Staying compliant is essential to avoid these consequences and maintain smooth operations.

Legal Use of the IFTA Quarterly Fuel Tax Schedule Form

The IFTA quarterly fuel tax schedule form is legally binding when completed and submitted according to the regulations set forth by the IFTA. To ensure its legal use, it is important to:

- Provide accurate and truthful information on the form.

- Maintain records that support the data reported, such as fuel receipts and mileage logs.

- Sign and date the form as required, which may involve electronic signatures if submitted digitally.

Compliance with these requirements ensures that the form is recognized as valid by tax authorities.

Quick guide on how to complete ct ifta quarterly fuel use tax schedule form

Prepare Ct Ifta Quarterly Fuel Use Tax Schedule Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Ct Ifta Quarterly Fuel Use Tax Schedule Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ct Ifta Quarterly Fuel Use Tax Schedule Form with ease

- Locate Ct Ifta Quarterly Fuel Use Tax Schedule Form and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your preference. Alter and eSign Ct Ifta Quarterly Fuel Use Tax Schedule Form and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the IFTA quarterly fuel tax schedule?

The IFTA quarterly fuel tax schedule refers to the specific periods during which Interstate Fuel Tax Agreement (IFTA) licensees must file their fuel tax reports. Typically, these reports are due every quarter, and understanding this schedule is crucial for compliance. By adhering to the IFTA quarterly fuel tax schedule, businesses can avoid penalties and ensure accurate tax payments.

-

How does airSlate SignNow help with IFTA quarterly fuel tax schedule filings?

airSlate SignNow simplifies the process of filing your IFTA quarterly fuel tax schedule by providing an easy-to-use platform for document management. You can electronically sign and send all necessary documents seamlessly. This streamlining helps reduce errors and ensures timely submissions, ultimately saving you valuable time and effort.

-

What features does airSlate SignNow offer for IFTA reports?

airSlate SignNow offers features tailored for IFTA reports, including customizable templates, secure e-signatures, and real-time tracking. These tools help you prepare and submit your IFTA quarterly fuel tax schedule more efficiently. Additionally, automated reminders ensure that you never miss a filing deadline.

-

Is airSlate SignNow cost-effective for managing fuel tax filings?

Yes, airSlate SignNow is a cost-effective solution aimed at businesses of all sizes. With various pricing plans, you can choose one that fits your needs while ensuring that managing your IFTA quarterly fuel tax schedule remains budget-friendly. Investing in this platform can ultimately lead to savings by reducing your administrative workload.

-

Can airSlate SignNow integrate with other accounting software for fuel tax management?

Absolutely. airSlate SignNow offers integrations with popular accounting software, making it easy to manage your IFTA quarterly fuel tax schedule alongside your financial data. This integration ensures that all necessary documents are connected, allowing for streamlined data entry and reducing the chances of mistakes.

-

How can I ensure compliance with the IFTA quarterly fuel tax schedule using airSlate SignNow?

With airSlate SignNow, you can ensure compliance with the IFTA quarterly fuel tax schedule by utilizing automated reminders and tracking tools. The platform assists you in organizing your documentation, and e-signature features streamline the approval process. This organized approach helps maintain compliance and minimizes the risk of audits.

-

What benefits does airSlate SignNow offer for fleet managers regarding fuel tax?

Fleet managers can benefit signNowly from airSlate SignNow when managing the IFTA quarterly fuel tax schedule. The platform allows for quick document access and secure electronic signatures, facilitating faster approval processes. This efficiency enables fleet managers to focus on operational aspects rather than administrative burdens.

Get more for Ct Ifta Quarterly Fuel Use Tax Schedule Form

- Welcome to medcorps asthma and pulmonary specialists form

- Specialty medical services initial appointment acuity form

- Committed to providing you with the highest quality care form

- Our practice is form

- Disclaimer privacy and terms of useobstetrics and form

- Delaware county employee handbook form

- Tualatin clinic form

- Oregon occupational medicine occupational medicine clinic form

Find out other Ct Ifta Quarterly Fuel Use Tax Schedule Form

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter