AR1000F Full Year Resident Individual Income Tax Return 2020

What is the AR1000F Full Year Resident Individual Income Tax Return

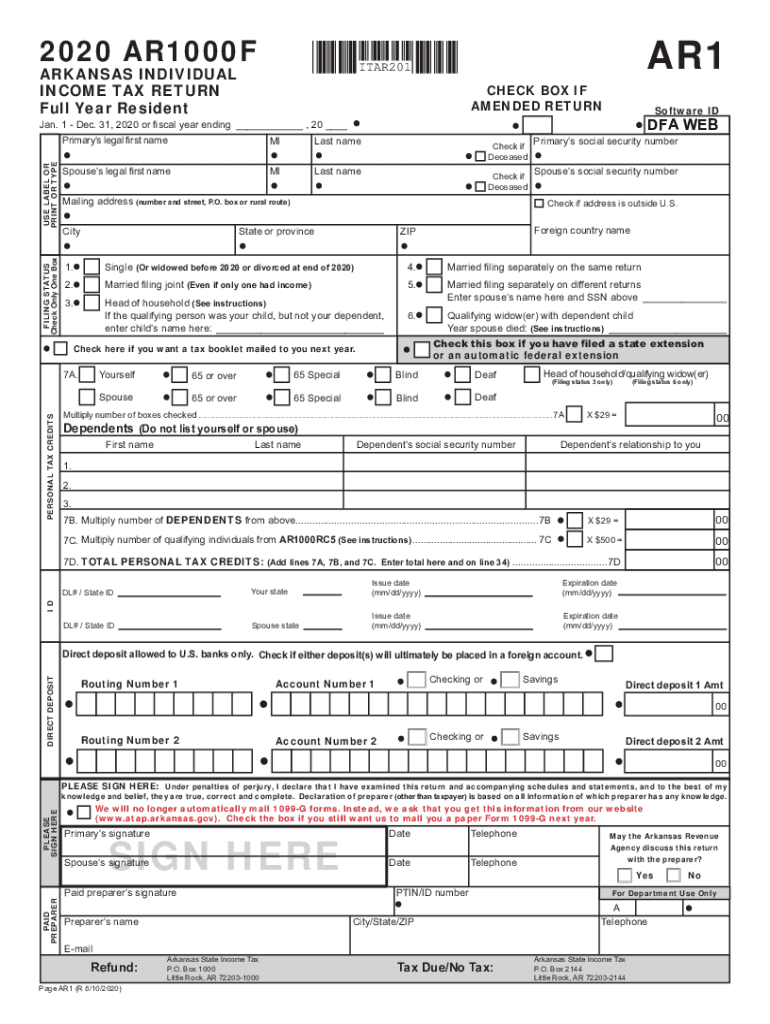

The AR1000F is the official form used by residents of Arkansas to report their individual income tax for the entire year. This form is essential for calculating the amount of tax owed to the state based on the individual's income, deductions, and credits. It is specifically designed for full-year residents, meaning those who have maintained their residency in Arkansas for the entire tax year.

Completing the AR1000F accurately is crucial as it determines your tax liability and eligibility for any potential refunds. The form includes sections for reporting various types of income, such as wages, salaries, interest, and dividends, as well as adjustments and deductions that can reduce taxable income.

Steps to complete the AR1000F Full Year Resident Individual Income Tax Return

Filling out the AR1000F involves several key steps to ensure accuracy and compliance with Arkansas tax laws. Here is a general outline of the process:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering personal information, such as your name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring to include all relevant figures.

- Apply any deductions or credits you qualify for, which can help lower your taxable income.

- Calculate your total tax liability using the provided tax tables or formulas.

- Review the completed form for accuracy before signing and dating it.

Following these steps carefully can help streamline the filing process and reduce the risk of errors that could lead to penalties or delays in processing.

How to obtain the AR1000F Full Year Resident Individual Income Tax Return

The AR1000F form can be obtained through several convenient methods. Residents can access the form online through the Arkansas Department of Finance and Administration's website, where it is available for download in PDF format. Alternatively, physical copies of the form can be requested by contacting local tax offices or visiting them in person.

Additionally, many tax preparation software programs include the AR1000F form as part of their offerings, allowing users to fill it out digitally. This can simplify the process, especially for those who prefer electronic filing.

Legal use of the AR1000F Full Year Resident Individual Income Tax Return

The AR1000F is legally binding when completed and submitted according to Arkansas state tax laws. To ensure its validity, the form must be signed by the taxpayer or an authorized representative. Electronic signatures are acceptable if they meet the requirements set forth by relevant eSignature laws.

It is important to retain copies of the filed form and any supporting documents for your records, as they may be needed for future reference or in the event of an audit. Compliance with all filing requirements and deadlines is essential to avoid penalties.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the AR1000F to avoid late fees and penalties. Typically, the deadline for submitting the AR1000F is April 15 of the following year, aligning with federal tax filing dates. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day.

It is advisable to check for any updates or changes to deadlines each tax year, as state regulations may evolve. Additionally, taxpayers should consider any extensions available if they need more time to file.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the AR1000F form, providing flexibility for taxpayers. The form can be filed electronically through approved tax preparation software, which often includes direct submission options to the state. This method can expedite processing and refunds.

For those who prefer traditional methods, the completed AR1000F can be mailed to the appropriate state tax office. Ensure that the form is sent to the correct address and that sufficient postage is applied. Additionally, taxpayers can submit the form in person at designated state tax offices, which may provide immediate confirmation of receipt.

Quick guide on how to complete ar1000f full year resident individual income tax return

Effortlessly Prepare AR1000F Full Year Resident Individual Income Tax Return on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and eSign your documents promptly without delays. Manage AR1000F Full Year Resident Individual Income Tax Return across any platform with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The Easiest Way to Modify and eSign AR1000F Full Year Resident Individual Income Tax Return with Ease

- Find AR1000F Full Year Resident Individual Income Tax Return and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact confidential information using the specific tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors necessitating new document prints. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign AR1000F Full Year Resident Individual Income Tax Return and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar1000f full year resident individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the ar1000f full year resident individual income tax return

The best way to generate an e-signature for a PDF in the online mode

The best way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is the Arkansas state income tax form, and why is it important?

The Arkansas state income tax form is a document that residents of Arkansas must complete to report their income and calculate how much state tax they owe. It is important because filing this form accurately ensures compliance with state tax laws and helps avoid penalties.

-

How can airSlate SignNow help me with my Arkansas state income tax form?

airSlate SignNow makes it easy to eSign your Arkansas state income tax form, allowing you to securely sign documents online without the hassle of printing and scanning. This streamlined process saves time and helps ensure that your form is submitted quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for my Arkansas state income tax form?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. You can choose a plan based on how frequently you need to use the service, ensuring an affordable solution for managing your Arkansas state income tax form and other documents.

-

What features does airSlate SignNow offer for managing the Arkansas state income tax form?

airSlate SignNow provides features such as document templates, customizable signing workflows, and secure cloud storage for your Arkansas state income tax form. These tools enhance efficiency and allow you to track the status of your document in real-time.

-

Can I integrate airSlate SignNow with other software for my Arkansas state income tax form?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to incorporate your Arkansas state income tax form into your existing workflow. This compatibility ensures that you can manage your tax documents alongside other business tools efficiently.

-

How secure is airSlate SignNow when handling my Arkansas state income tax form?

airSlate SignNow prioritizes your data security, employing advanced encryption and security protocols to protect your Arkansas state income tax form. You can be confident that your sensitive information is safe while using our platform.

-

What benefits does airSlate SignNow provide for filing the Arkansas state income tax form?

Using airSlate SignNow to file your Arkansas state income tax form offers benefits like reduced filing time, enhanced accuracy through automated features, and easy access to documents anytime, anywhere. This leads to a more efficient tax filing process overall.

Get more for AR1000F Full Year Resident Individual Income Tax Return

- Warranty deed to separate property of one spouse to both as joint tenants or as community property with right of survivorship form

- Warranty deed for fiduciary alaska form

- Warranty deed from limited partnership or llc is the grantor or grantee alaska form

- Alaska deed trust form

- Legal last will and testament form for single person with no children alaska

- Legal last will and testament form for a single person with minor children alaska

- Legal last will and testament form for single person with adult and minor children alaska

- Legal last will and testament form for single person with adult children alaska

Find out other AR1000F Full Year Resident Individual Income Tax Return

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy