NC 3X Amended Annual Withholding Reconciliation 2013

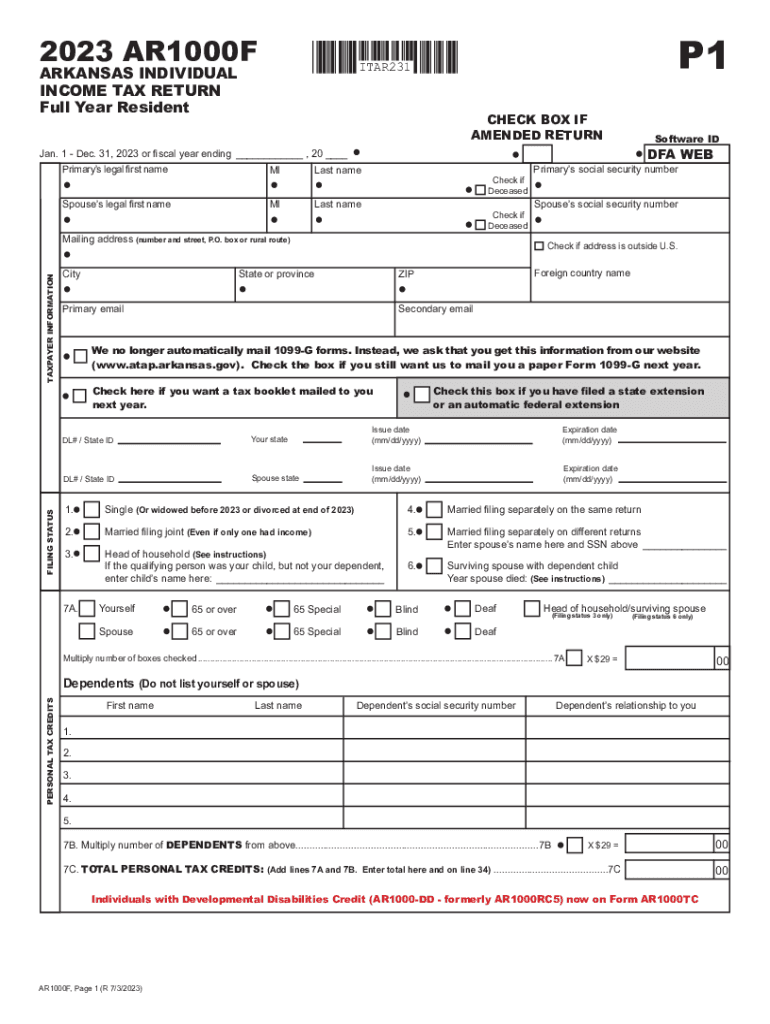

Understanding the Arkansas State Tax Form

The Arkansas state tax form, particularly the AR1000F, is essential for individuals filing their state income taxes. This form is used to report income, calculate tax liability, and claim any applicable credits or deductions. It is crucial for residents to accurately complete this form to ensure compliance with state tax laws and avoid potential penalties.

Steps to Complete the Arkansas State Tax Form AR1000F

Completing the Arkansas state tax form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the form.

- Calculate your deductions and credits to determine your taxable income.

- Compute your tax liability based on the Arkansas tax rates.

- Sign and date the form before submission.

Filing Deadlines for Arkansas State Tax Forms

It is important to be aware of the filing deadlines for the Arkansas state tax form. Typically, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be mindful of any extensions they may need to file.

Form Submission Methods for Arkansas State Tax Forms

Taxpayers have several options for submitting their Arkansas state tax form:

- Online: Many individuals choose to file electronically through authorized e-file providers.

- Mail: Completed forms can be mailed to the Arkansas Department of Finance and Administration.

- In-Person: Taxpayers may also submit their forms in person at designated state offices.

Key Elements of the Arkansas State Tax Form AR1000F

The AR1000F includes several important sections that taxpayers must complete:

- Personal Information: This section captures the taxpayer's identity and contact details.

- Income Reporting: Taxpayers must list all sources of income, including wages, dividends, and interest.

- Deductions and Credits: This section allows taxpayers to claim deductions and credits that reduce their taxable income.

- Signature: A signature is required to validate the form and confirm the accuracy of the information provided.

Penalties for Non-Compliance with Arkansas State Tax Laws

Failure to file the Arkansas state tax form on time or providing inaccurate information can lead to penalties. Common penalties include:

- Late Filing Penalty: Taxpayers may incur a penalty for failing to file by the deadline.

- Accuracy-Related Penalty: Incorrect information may result in additional charges.

- Interest on Unpaid Taxes: Interest accrues on any unpaid tax amounts until they are settled.

Quick guide on how to complete nc 3x amended annual withholding reconciliation

Effortlessly Prepare NC 3X Amended Annual Withholding Reconciliation on Any Device

The management of documents online has gained popularity among both businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to quickly create, modify, and electronically sign your documents without any delays. Manage NC 3X Amended Annual Withholding Reconciliation on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

How to Alter and Electronically Sign NC 3X Amended Annual Withholding Reconciliation with Ease

- Obtain NC 3X Amended Annual Withholding Reconciliation and click Get Form to begin.

- Utilize the provided tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sharing the form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign NC 3X Amended Annual Withholding Reconciliation to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc 3x amended annual withholding reconciliation

Create this form in 5 minutes!

How to create an eSignature for the nc 3x amended annual withholding reconciliation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Arkansas state tax form?

The Arkansas state tax form is used by residents to report their income, calculate taxes owed, and claim any eligible deductions. This form ensures compliance with state tax laws and helps individuals avoid penalties. Utilizing airSlate SignNow, you can easily eSign and submit your Arkansas state tax form securely.

-

How can airSlate SignNow help me with my Arkansas state tax form?

airSlate SignNow provides a straightforward platform where you can prepare, eSign, and manage your Arkansas state tax form efficiently. With features like real-time collaboration and document tracking, you can ensure your tax documents are completed accurately and submitted on time. This makes tax season less stressful and more organized.

-

Is there a cost associated with using airSlate SignNow for Arkansas state tax forms?

Yes, airSlate SignNow offers affordable pricing plans that cater to different needs, whether you're an individual or a business. These plans allow you to eSign multiple documents, including your Arkansas state tax form, without breaking the bank. You can easily find a plan that suits your budget while enjoying all the benefits of our platform.

-

Can I store my Arkansas state tax form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store your Arkansas state tax form and other important documents in the cloud. This ensures that your records are accessible whenever you need them, providing peace of mind and easy retrieval for future reference.

-

What integrations are available with airSlate SignNow for managing Arkansas state tax forms?

airSlate SignNow integrates seamlessly with various applications and services, making it simple to manage your Arkansas state tax form alongside other tools. Whether you need to connect with your accounting software or file through a third-party application, our integrations streamline the process, saving you time and effort.

-

How secure is my information when using airSlate SignNow for Arkansas state tax forms?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and secure cloud services to protect your personal information while processing your Arkansas state tax form. You can trust that your sensitive data remains confidential and safe with us.

-

Can I track the status of my Arkansas state tax form once submitted via airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for your documents, including your Arkansas state tax form. You can see when your form has been eSigned, submitted, and even received by the state, providing complete transparency throughout the process.

Get more for NC 3X Amended Annual Withholding Reconciliation

- Notice not for use for condominium transactions or closings form

- Bill of sale form unimproved property contract templates

- Texas real estate commission residential sales contract form

- Trec no 28 2 environmental assessment addendum form

- Addendum for abstract of title form

- Notice not for use where seller owns fee simple title to land beneath unit form

- Fha or va financed residential condominium contract form

- Trec no 32 4 condominium resale certificate texasgov form

Find out other NC 3X Amended Annual Withholding Reconciliation

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe