Arkansas State Tax Forms 2021

What are Arkansas State Tax Forms?

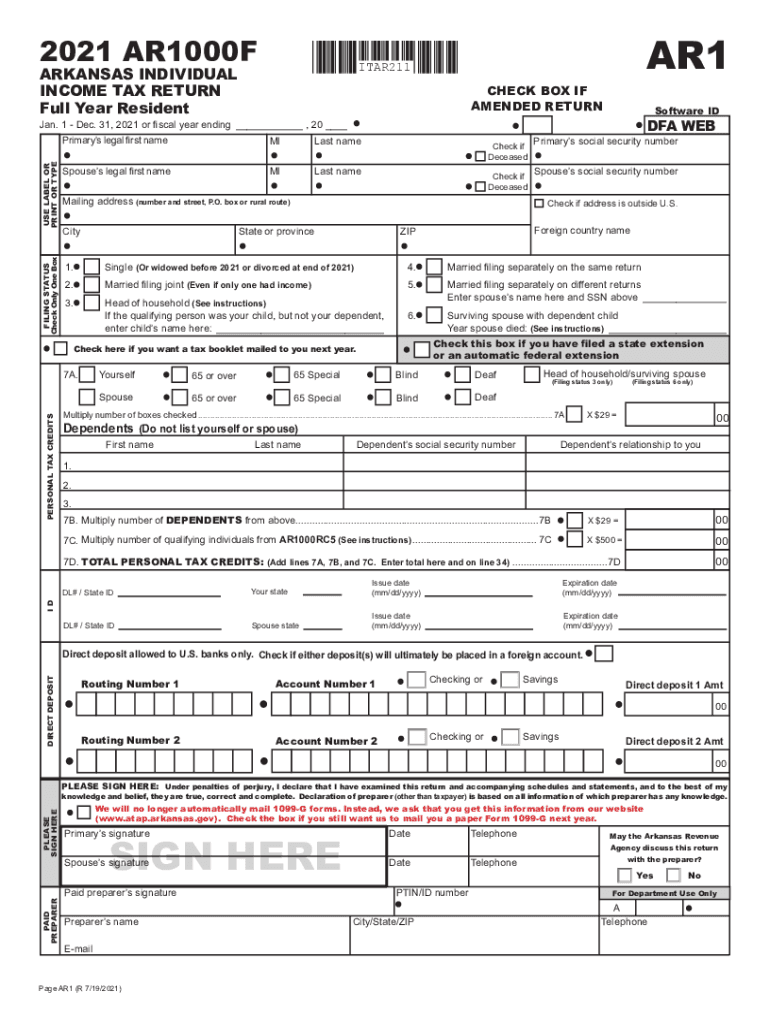

Arkansas state tax forms are official documents required for filing income taxes in the state of Arkansas. These forms enable residents and businesses to report their income, deductions, and tax liabilities to the Arkansas Department of Finance and Administration. The most commonly used form is the Form AR1000F, which is specifically designed for individual income tax filers. Other forms may include variations for businesses, property tax assessments, and specific situations such as self-employment or retirement income.

How to Obtain Arkansas State Tax Forms

To obtain Arkansas state tax forms, individuals can visit the Arkansas Department of Finance and Administration's official website, where they can access and download the necessary forms. Many forms are available in a fillable PDF format, allowing users to complete them digitally before printing. Additionally, physical copies of the forms can often be found at local libraries, post offices, and tax preparation offices throughout the state.

Steps to Complete the Arkansas State Tax Forms

Completing Arkansas state tax forms involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any relevant receipts for deductions.

- Choose the appropriate form based on your filing status and income type.

- Fill out the form accurately, ensuring all personal information and financial details are correct.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

Legal Use of Arkansas State Tax Forms

Arkansas state tax forms must be completed and submitted in accordance with state laws to be considered legally valid. This includes ensuring that all information provided is accurate and truthful. The forms can be signed electronically, provided that the eSignature complies with the ESIGN Act and UETA. Using a reliable eSignature solution can help ensure that the submission is legally binding and secure.

Filing Deadlines / Important Dates

Filing deadlines for Arkansas state tax forms typically align with federal tax deadlines. For individual income tax returns, the deadline is usually April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to stay informed about any changes to deadlines or extensions that may be announced by the Arkansas Department of Finance and Administration.

Form Submission Methods

Arkansas state tax forms can be submitted through several methods:

- Online: Many forms can be filed electronically through the Arkansas Department of Finance and Administration's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also submit their forms in person at designated state offices.

Quick guide on how to complete arkansas state tax forms

Complete Arkansas State Tax Forms effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Arkansas State Tax Forms on any device with airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

The easiest way to modify and eSign Arkansas State Tax Forms smoothly

- Locate Arkansas State Tax Forms and select Get Form to begin.

- Employ the tools we provide to fill out your document.

- Highlight important sections of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and hit the Done button to finalize your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Arkansas State Tax Forms and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas state tax forms

Create this form in 5 minutes!

People also ask

-

What are Arkansas state tax forms?

Arkansas state tax forms are official documents required for filing taxes in the state of Arkansas. These forms include various calculations and details about your income, deductions, and credits. Using airSlate SignNow, you can easily access, complete, and eSign your Arkansas state tax forms securely online.

-

How can airSlate SignNow help with Arkansas state tax forms?

airSlate SignNow simplifies the process of managing Arkansas state tax forms by allowing you to upload, edit, and electronically sign documents. Moreover, it ensures that your forms remain compliant and are submitted promptly. This user-friendly platform streamlines tax filing, saving valuable time and effort.

-

Is there a cost associated with using airSlate SignNow for Arkansas state tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs for handling Arkansas state tax forms. Each plan provides access to essential features for document management and e-signature services. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for Arkansas state tax forms?

AirSlate SignNow provides several features for Arkansas state tax forms, including document templates, cloud storage, and electronic signatures. Additionally, its user-friendly interface allows for easy navigation and completion of tax forms. This ensures a smooth and efficient process for filing your taxes.

-

Can I integrate airSlate SignNow with other applications for my Arkansas state tax forms?

Absolutely! AirSlate SignNow offers integrations with various third-party applications that can enhance your experience with Arkansas state tax forms. This includes accounting software and cloud storage solutions, allowing for easy access and management of your tax documentation.

-

How secure is my information when using airSlate SignNow for Arkansas state tax forms?

Security is a top priority for airSlate SignNow. When you use the platform for Arkansas state tax forms, your personal and financial information is protected with advanced encryption methods. Additionally, the platform complies with industry standards to ensure the safety of your data.

-

Can airSlate SignNow help me keep track of my Arkansas state tax forms?

Yes, airSlate SignNow offers features for tracking your Arkansas state tax forms, including document status updates and reminders. This ensures that you are always aware of where your documents are in the signing and filing process. Staying organized will help you meet all necessary deadlines easily.

Get more for Arkansas State Tax Forms

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat delaware form

- Delaware 7 day form

- Delaware notice form

- Assignment of mortgage by individual mortgage holder delaware form

- Delaware pay rent form

- Delaware lease form

- Assignment of mortgage by corporate mortgage holder delaware form

- Consent order guardian of the person delaware form

Find out other Arkansas State Tax Forms

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online