Enhanced Form it 201 X, Amended Resident Income Tax 2022-2026

Understanding the Form AR1000F 2014

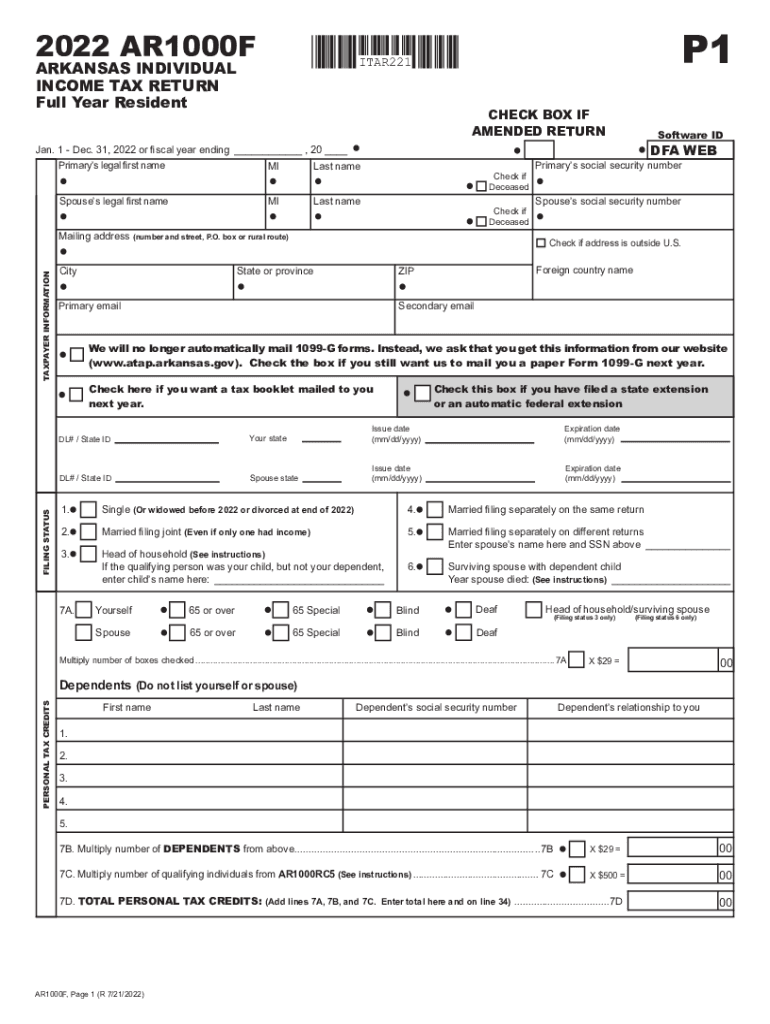

The Form AR1000F 2014 is the Arkansas Individual Income Tax Return form, which is essential for residents of Arkansas to report their income and calculate their state tax obligations. This form is specifically designed for individuals who are filing their state income taxes for the year 2014. It includes various sections that allow taxpayers to detail their income, deductions, and credits, ultimately determining the amount of tax owed or refund due.

Steps to Complete the Form AR1000F 2014

Completing the Form AR1000F 2014 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the form.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Determine if you owe additional taxes or if you are entitled to a refund.

Required Documents for Filing Form AR1000F 2014

To successfully file the Form AR1000F 2014, taxpayers must have several documents ready:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Filing Deadlines for Form AR1000F 2014

It is crucial to be aware of the filing deadlines for the Form AR1000F 2014 to avoid penalties. The deadline for filing individual income tax returns in Arkansas typically aligns with the federal tax deadline, which is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure their forms are submitted on time, whether electronically or via mail.

Legal Use of Form AR1000F 2014

The Form AR1000F 2014 is legally binding when completed and submitted according to Arkansas state tax laws. It is important for taxpayers to ensure that all information provided is accurate and truthful, as providing false information can lead to penalties, including fines or legal action. The form must be signed and dated to validate the submission.

Digital vs. Paper Version of Form AR1000F 2014

Taxpayers have the option to file the Form AR1000F 2014 either digitally or on paper. Filing electronically is often quicker and may result in faster processing times for refunds. Digital submissions can also reduce the risk of errors, as many tax software programs provide built-in checks. However, some individuals may prefer the traditional paper method for various reasons, including personal comfort or lack of access to technology.

Quick guide on how to complete enhanced form it 201 x amended resident income tax

Effortlessly Prepare Enhanced Form IT 201 X, Amended Resident Income Tax on Any Device

The management of online documents has gained popularity among both businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Enhanced Form IT 201 X, Amended Resident Income Tax on any device using the airSlate SignNow applications available for Android or iOS and enhance any document-related process today.

How to Edit and eSign Enhanced Form IT 201 X, Amended Resident Income Tax with Ease

- Locate Enhanced Form IT 201 X, Amended Resident Income Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or redact sensitive data with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Enhanced Form IT 201 X, Amended Resident Income Tax to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct enhanced form it 201 x amended resident income tax

Create this form in 5 minutes!

How to create an eSignature for the enhanced form it 201 x amended resident income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ar1000f 2014 and how is it used?

The form ar1000f 2014 is a specific taxation form used by businesses to report various income and deductions to the IRS. By utilizing airSlate SignNow, you can easily fill out and electronically sign this form, streamlining the submission process while ensuring compliance with tax regulations.

-

How can airSlate SignNow help me with form ar1000f 2014?

airSlate SignNow provides a user-friendly platform for filling, signing, and sending the form ar1000f 2014. With its customizable templates and electronic signature capabilities, you can complete and submit this form quickly and securely, helping to enhance your operational efficiency.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that suits your budget while ensuring you have the necessary tools to efficiently manage documents like the form ar1000f 2014 without compromising on functionality.

-

Are there any features specifically for tax forms like form ar1000f 2014?

Yes, airSlate SignNow includes features designed specifically for handling tax forms, such as the form ar1000f 2014. These features include document templates, secure signatures, and audit trails, ensuring your forms are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for managing form ar1000f 2014?

Absolutely! airSlate SignNow offers seamless integration with various software applications, enabling you to manage the form ar1000f 2014 alongside your existing workflow tools. This integration helps streamline document management, ensuring all your information is centralized and accessible.

-

What benefits does airSlate SignNow provide for small businesses prepared to file form ar1000f 2014?

For small businesses, airSlate SignNow offers cost-effective solutions and ease of use when handling the form ar1000f 2014. With features like electronic signatures and document customization, it minimizes paperwork hassles and speeds up the approval process, which is crucial for small enterprises.

-

Is it secure to use airSlate SignNow for submitting form ar1000f 2014?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your form ar1000f 2014 is handled with the utmost care. The platform utilizes encryption and secure data storage to protect sensitive information, giving you peace of mind while you complete your tax filings.

Get more for Enhanced Form IT 201 X, Amended Resident Income Tax

Find out other Enhanced Form IT 201 X, Amended Resident Income Tax

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy