Ar1000f 2016

What is the AR1000F?

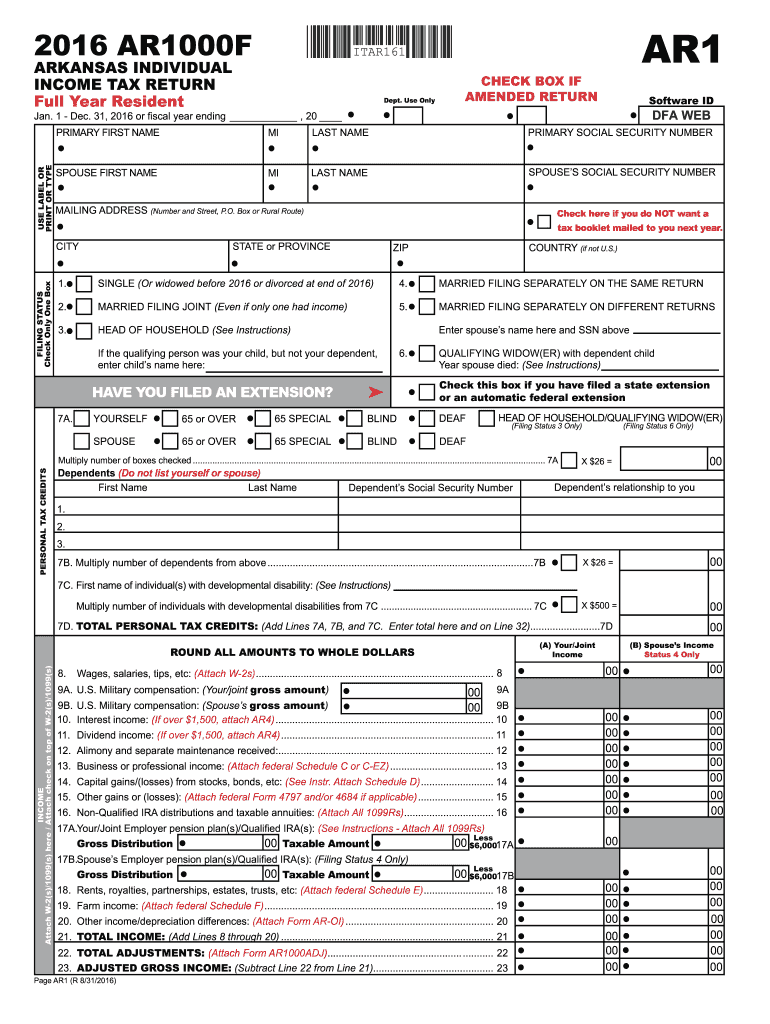

The AR1000F is the official state income tax form used by residents of Arkansas to report their annual income and calculate their tax liability. This form is essential for individuals and families who earn income in the state, as it allows them to fulfill their tax obligations to the Arkansas Department of Finance and Administration (DFA). The AR1000F is designed to capture various types of income, deductions, and credits, ensuring accurate reporting and compliance with state tax laws.

How to Use the AR1000F

Using the AR1000F involves several steps, starting with gathering all necessary financial documents, such as W-2s, 1099s, and records of any deductions or credits you plan to claim. The form requires you to input your total income, calculate your taxable income, and determine the amount of tax owed or refund due. It is important to carefully follow the instructions provided with the form to ensure accurate completion. Additionally, taxpayers may choose to complete the form electronically for convenience and efficiency.

Steps to Complete the AR1000F

Completing the AR1000F requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, self-employment income, and interest.

- Calculate your deductions and credits, ensuring you have the necessary documentation to support your claims.

- Determine your tax liability based on the taxable income calculated.

- Review the completed form for accuracy before submission.

Legal Use of the AR1000F

The AR1000F is legally binding when completed accurately and submitted to the Arkansas DFA. To ensure its legal standing, taxpayers must provide truthful information and maintain compliance with all applicable tax laws. Electronic signatures and submissions are accepted, provided they meet the requirements set forth by the state. It is crucial to retain copies of the submitted form and any supporting documentation for future reference.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the AR1000F to avoid penalties. Typically, the deadline for submitting the form is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Arkansas DFA website for any updates or changes to filing deadlines, especially in light of special circumstances that may affect tax filings.

Form Submission Methods

The AR1000F can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file electronically through approved e-filing services.

- Mail: Completed forms can be mailed to the Arkansas DFA at the address specified in the form instructions.

- In-Person: Taxpayers may also choose to submit their forms in person at designated DFA offices.

Who Issues the Form

The AR1000F is issued by the Arkansas Department of Finance and Administration (DFA). This state agency is responsible for tax administration and compliance in Arkansas. The DFA provides resources, guidelines, and support to help taxpayers understand their obligations and complete their tax forms accurately. For any inquiries or assistance, taxpayers can contact the DFA directly or visit their official website.

Quick guide on how to complete ar1000f 2019

Prepare Ar1000f seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents rapidly without delays. Manage Ar1000f on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

How to alter and eSign Ar1000f with ease

- Obtain Ar1000f and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark essential sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow covers all your needs in document management in just a few clicks from any device you prefer. Change and eSign Ar1000f while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar1000f 2019

Create this form in 5 minutes!

How to create an eSignature for the ar1000f 2019

How to generate an eSignature for the Ar1000f 2019 in the online mode

How to generate an electronic signature for your Ar1000f 2019 in Chrome

How to generate an eSignature for putting it on the Ar1000f 2019 in Gmail

How to make an electronic signature for the Ar1000f 2019 from your smart phone

How to generate an eSignature for the Ar1000f 2019 on iOS

How to generate an electronic signature for the Ar1000f 2019 on Android OS

People also ask

-

What is the Ar1000f and how does it work with airSlate SignNow?

The Ar1000f is a powerful tool designed for businesses to streamline their document signing process. With airSlate SignNow, the Ar1000f allows users to send, receive, and eSign documents efficiently, ensuring a seamless workflow. This integration enhances productivity by facilitating quick and secure electronic signatures.

-

What features does the Ar1000f offer within airSlate SignNow?

The Ar1000f comes packed with features that include customizable templates, bulk sending of documents, and advanced tracking capabilities. These features help businesses manage their eSigning needs more effectively. Additionally, the Ar1000f integrates with other tools within airSlate SignNow, providing a comprehensive solution for document management.

-

Is the Ar1000f cost-effective for small businesses?

Yes, the Ar1000f is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. With flexible pricing plans available through airSlate SignNow, users can choose the best option that fits their budget. This makes it accessible for small businesses looking to enhance their document management processes.

-

How does the Ar1000f improve document security?

The Ar1000f signNowly enhances document security by utilizing advanced encryption and authentication methods. With airSlate SignNow, all eSigned documents are securely stored and easily retrievable, ensuring that sensitive information is protected. Users can also track changes and maintain an audit trail for compliance purposes.

-

Can the Ar1000f integrate with other software applications?

Absolutely! The Ar1000f offers seamless integration with various software applications, enhancing its functionality within airSlate SignNow. Whether it’s CRM systems or project management tools, these integrations ensure that users can leverage the full potential of their existing applications while using the Ar1000f.

-

What are the benefits of using the Ar1000f for eSigning?

Using the Ar1000f for eSigning provides numerous benefits, such as faster turnaround times, reduced paper usage, and improved efficiency. With airSlate SignNow’s user-friendly interface, the Ar1000f simplifies the signing process, allowing users to complete transactions swiftly. This leads to better customer satisfaction and streamlined operations.

-

How can I get started with the Ar1000f on airSlate SignNow?

Getting started with the Ar1000f on airSlate SignNow is simple and straightforward. Users can sign up for an account, select the Ar1000f option, and begin exploring its features immediately. The platform also provides helpful resources and customer support to assist new users in maximizing their experience.

Get more for Ar1000f

- Electrical permit application livingston county building form

- Kcmo codes information bulletin no 110 part a 2013 2019

- Application for gaming funds north dakota 2017 2019 form

- Form lurp 2013 2019

- Owner of record seller form

- Nyc lic33 form 2018 2019

- Mercer county board of elections 101 n main st rm 107 celina form

- Request for statements of city of troutdale form

Find out other Ar1000f

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online