Arkansas Tax Amendment Instructions and Forms Prepare 2019

What are the Arkansas tax amendment instructions and forms?

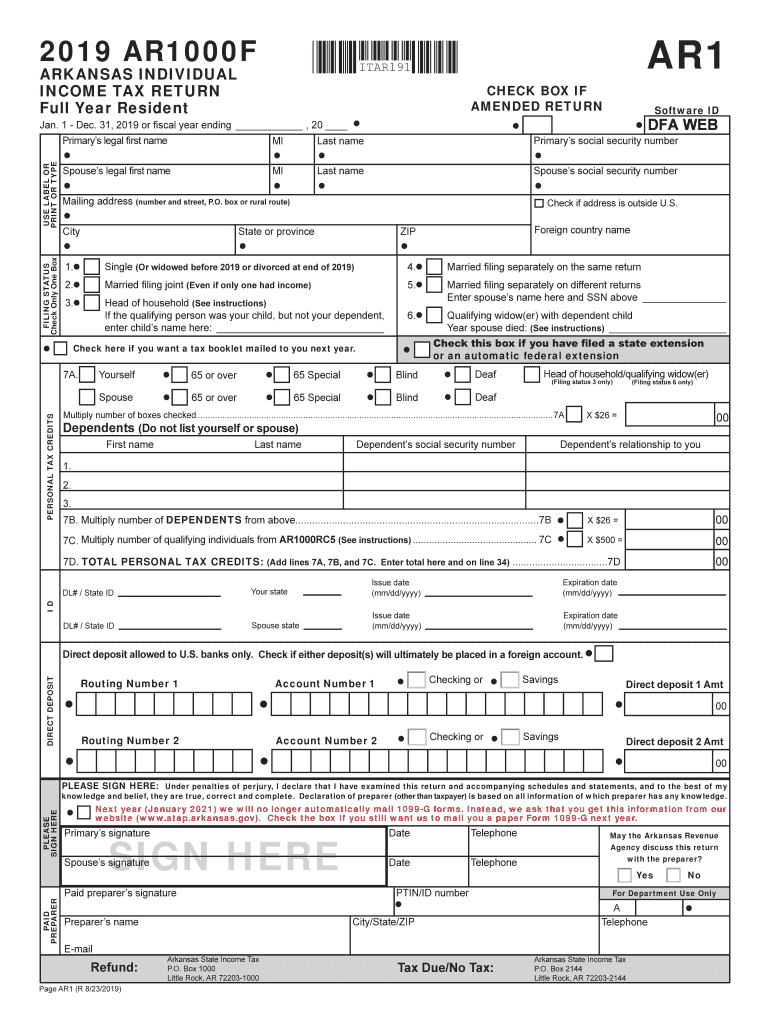

The Arkansas tax amendment instructions and forms are essential documents for individuals and businesses wishing to amend their previously filed Arkansas state tax returns. These forms allow taxpayers to correct errors, claim additional deductions, or report changes in income. The primary form used for this purpose is the AR1000F, which is specifically designed for amending individual income tax returns. Understanding the specific instructions associated with these forms is crucial to ensure compliance and avoid penalties.

How to use the Arkansas tax amendment instructions and forms

To use the Arkansas tax amendment instructions and forms effectively, follow these steps:

- Obtain the correct version of the AR1000F form for the tax year you are amending.

- Carefully read the instructions provided with the form to understand the requirements for amendments.

- Fill out the form accurately, ensuring all necessary changes are clearly indicated.

- Attach any supporting documentation that may be required to substantiate your amendments.

- Submit the completed form according to the guidelines outlined in the instructions, whether online or via mail.

Steps to complete the Arkansas tax amendment instructions and forms

Completing the Arkansas tax amendment forms involves several key steps:

- Gather all relevant tax documents, including your original tax return and any new information that necessitates the amendment.

- Download or request the AR1000F form and its accompanying instructions from the Arkansas Department of Finance and Administration.

- Fill out the form, indicating the specific changes you wish to make. Be sure to provide clear explanations for each amendment.

- Review your completed form for accuracy and completeness before submission.

- Submit the form by the specified deadline to avoid any penalties or interest charges.

Filing deadlines and important dates

Filing deadlines for Arkansas tax amendments typically align with the state’s tax return deadlines. Generally, taxpayers have three years from the original due date of the return to file an amendment. It is important to stay informed about specific deadlines for each tax year, as these can vary. Mark your calendar and ensure your amendments are submitted on time to prevent potential penalties.

Required documents for Arkansas tax amendments

When filing an Arkansas tax amendment, certain documents may be required to support your changes. These can include:

- Your original tax return.

- Any new W-2 or 1099 forms that reflect changes in income.

- Documentation for any additional deductions or credits you are claiming.

- Any correspondence from the Arkansas Department of Finance and Administration regarding your original return.

Who issues the Arkansas tax amendment forms?

The Arkansas tax amendment forms, including the AR1000F, are issued by the Arkansas Department of Finance and Administration (DFA). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It is advisable to refer to the DFA's official resources for the most current forms and instructions.

Quick guide on how to complete arkansas tax amendment instructions and forms prepare

Effortlessly Prepare Arkansas Tax Amendment Instructions And Forms Prepare on Any Device

The management of online documents has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle Arkansas Tax Amendment Instructions And Forms Prepare on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric workflow today.

How to Edit and Electronically Sign Arkansas Tax Amendment Instructions And Forms Prepare with Ease

- Obtain Arkansas Tax Amendment Instructions And Forms Prepare and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Arkansas Tax Amendment Instructions And Forms Prepare to ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas tax amendment instructions and forms prepare

Create this form in 5 minutes!

How to create an eSignature for the arkansas tax amendment instructions and forms prepare

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What are Arkansas state tax forms 2013?

Arkansas state tax forms 2013 include all the necessary documents for filing your state taxes for that year. This includes individual income tax forms, schedules, and relevant instructions. It is crucial to use the correct forms to ensure compliance with state regulations.

-

How can I access Arkansas state tax forms 2013?

You can access Arkansas state tax forms 2013 through the official Arkansas Department of Finance and Administration website. Additionally, airSlate SignNow can help simplify the process of filling out and submitting these forms electronically, ensuring a smooth experience.

-

Does airSlate SignNow support Arkansas state tax forms 2013?

Yes, airSlate SignNow supports the completion and e-signing of Arkansas state tax forms 2013. Our platform allows users to easily fill out the forms and securely send them for signatures, making tax season much more efficient.

-

What are the pricing options for using airSlate SignNow for Arkansas state tax forms 2013?

airSlate SignNow offers various pricing plans to fit different needs, starting from a basic tier ideal for individuals to more advanced solutions suitable for businesses. Regardless of the plan, users can efficiently manage their Arkansas state tax forms 2013, enhancing their overall productivity.

-

What features does airSlate SignNow provide for Arkansas state tax forms 2013?

airSlate SignNow provides several features tailored for Arkansas state tax forms 2013, including customizable templates, cloud storage, reminders for deadlines, and the ability to track document status. These features ensure an organized approach to managing your tax documents.

-

How does e-signing work for Arkansas state tax forms 2013 with airSlate SignNow?

E-signing with airSlate SignNow for Arkansas state tax forms 2013 is straightforward. After completing the forms, you can easily send them to others to e-sign using a secure link, which helps to speed up the approval and submission process.

-

Can I integrate airSlate SignNow with other tools for completing Arkansas state tax forms 2013?

Absolutely! airSlate SignNow offers numerous integrations with popular applications such as Google Drive, Dropbox, and Salesforce, which makes managing your Arkansas state tax forms 2013 even easier. These integrations streamline the workflow, reducing manual entry and enhancing efficiency.

Get more for Arkansas Tax Amendment Instructions And Forms Prepare

Find out other Arkansas Tax Amendment Instructions And Forms Prepare

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF