Tax Form Ar 2015

What is the Tax Form Ar

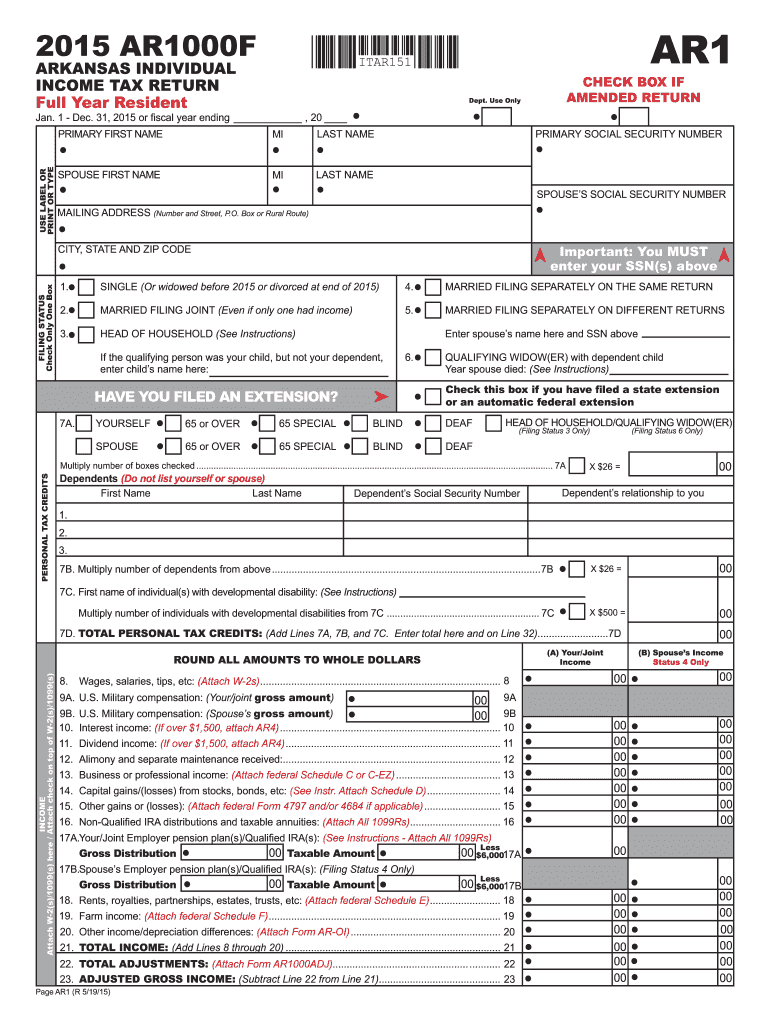

The Tax Form Ar is a specific document used for various tax-related purposes within the United States. It is essential for individuals and businesses to report income, claim deductions, and fulfill their tax obligations accurately. This form is part of the broader tax framework established by the Internal Revenue Service (IRS) and is used to ensure compliance with federal tax laws.

How to use the Tax Form Ar

Using the Tax Form Ar involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submitting it to the appropriate tax authority. Utilizing digital platforms can simplify this process, allowing for easy editing and secure submission.

Steps to complete the Tax Form Ar

Completing the Tax Form Ar requires a systematic approach:

- Gather all relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Access the form through the IRS website or a trusted digital platform.

- Fill in personal information, including name, address, and Social Security number.

- Report all income sources accurately, ensuring to include any taxable income.

- Claim eligible deductions and credits by following the instructions provided with the form.

- Review the completed form for accuracy, checking for any missing information.

- Submit the form electronically or via mail, depending on your preference and the requirements.

Legal use of the Tax Form Ar

The Tax Form Ar is legally binding when completed and submitted correctly. To ensure its legal standing, it must comply with IRS regulations and guidelines. This includes accurate reporting of income and deductions, as well as timely submission. Utilizing a reliable eSignature solution can further enhance the legal validity of the form, ensuring that electronic signatures are compliant with federal laws such as the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form Ar are crucial for compliance with IRS regulations. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates, as late submissions can result in penalties and interest on unpaid taxes.

Required Documents

To complete the Tax Form Ar, several documents are typically required:

- W-2 forms from employers, detailing annual wages and tax withholdings.

- 1099 forms for any freelance or contract work, showing income received.

- Receipts for deductible expenses, such as business expenses or charitable contributions.

- Previous year’s tax return for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The Tax Form Ar can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers choose to file electronically through IRS-approved software, which can streamline the process.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring it is sent with sufficient time to meet deadlines.

- In-Person: Some individuals may opt to file in person at designated IRS offices or through authorized tax professionals.

Quick guide on how to complete tax form ar 2015

Complete Tax Form Ar effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, amend, and electronically sign your documents swiftly without complications. Handle Tax Form Ar on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Tax Form Ar with ease

- Find Tax Form Ar and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for such tasks.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Tax Form Ar and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form ar 2015

Create this form in 5 minutes!

How to create an eSignature for the tax form ar 2015

How to generate an eSignature for the Tax Form Ar 2015 online

How to make an electronic signature for the Tax Form Ar 2015 in Chrome

How to create an eSignature for putting it on the Tax Form Ar 2015 in Gmail

How to create an electronic signature for the Tax Form Ar 2015 right from your smart phone

How to create an eSignature for the Tax Form Ar 2015 on iOS devices

How to generate an eSignature for the Tax Form Ar 2015 on Android devices

People also ask

-

What is a Tax Form Ar and why is it important?

A Tax Form Ar is a specific document used for tax reporting purposes, including income and deductions. Understanding and utilizing Tax Form Ar correctly is essential for accurate tax filings and compliance, which can help avoid potential penalties.

-

How does airSlate SignNow streamline the completion of Tax Form Ar?

airSlate SignNow simplifies the process of completing a Tax Form Ar by providing an intuitive eSigning platform. Users can easily fill out, send, and eSign their Tax Form Ar, saving time and ensuring accuracy in documentation.

-

What features does airSlate SignNow offer for managing Tax Form Ar?

airSlate SignNow offers features such as template creation, document tracking, and customizable workflows for managing Tax Form Ar. These tools help users efficiently oversee the preparation and submission of their tax forms, maximizing productivity.

-

Is airSlate SignNow cost-effective for managing Tax Form Ar?

Yes, airSlate SignNow provides a cost-effective solution for managing Tax Form Ar with flexible pricing plans. This ensures businesses of all sizes can affordably access the tools they need for efficient tax form management without sacrificing quality.

-

Can I integrate airSlate SignNow with other software for Tax Form Ar?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as CRM systems and accounting software, enhancing its functionality for managing Tax Form Ar. This integration allows for easier data transfer and improved overall workflow.

-

What benefits do businesses gain from using airSlate SignNow for Tax Form Ar?

Businesses benefit from increased efficiency, enhanced compliance, and reduced processing time when using airSlate SignNow for Tax Form Ar. The ease of eSigning and document management helps organizations minimize errors and streamline their tax preparation process.

-

Is airSlate SignNow secure for handling sensitive Tax Form Ar data?

Yes, airSlate SignNow employs industry-leading security measures to protect users' sensitive Tax Form Ar data. Features like SSL encryption and secure cloud storage ensure that all documents are safely managed and stored.

Get more for Tax Form Ar

Find out other Tax Form Ar

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast