it 209 2020

What is the IT-209?

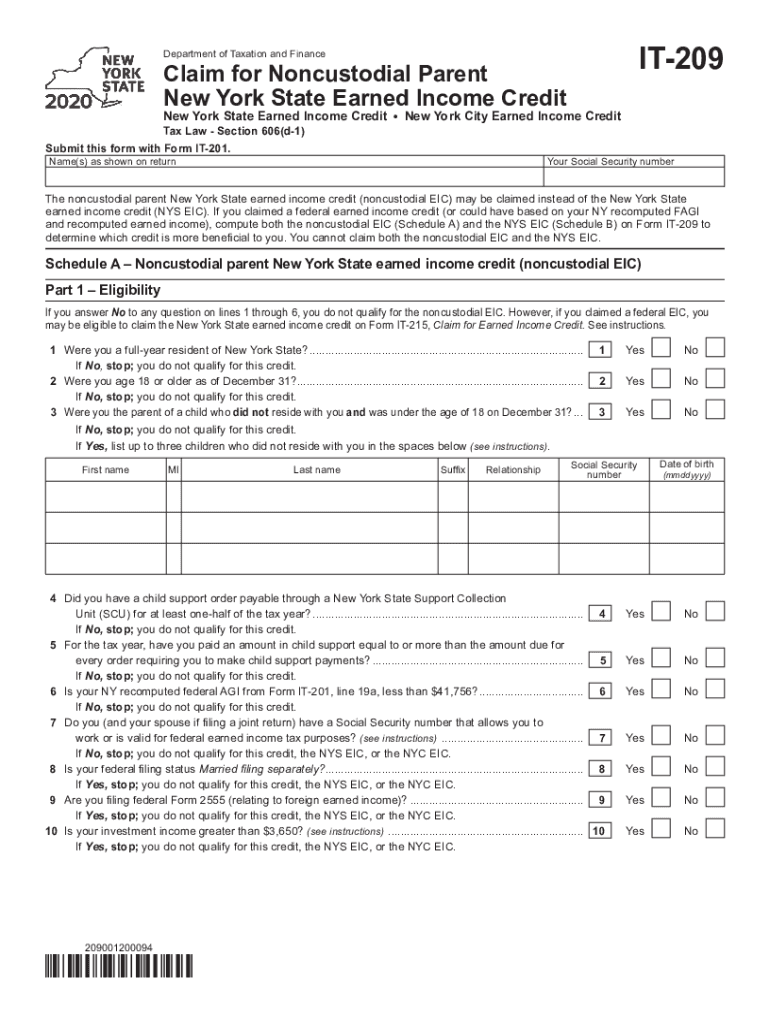

The IT-209 form, also known as the New York State Non-Resident and Part-Year Resident Income Tax Return, is designed for individuals who do not reside in New York for the entire year but have earned income from New York sources. This form allows non-residents and part-year residents to report their income accurately and pay any taxes owed to the state. Understanding the purpose of the IT-209 is crucial for compliance with New York tax laws and ensuring that individuals fulfill their tax obligations correctly.

How to Obtain the IT-209

The IT-209 form can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, tax preparation software often includes the IT-209, making it accessible for those who prefer to complete their taxes digitally. Individuals can also request a paper copy by contacting the Department of Taxation and Finance if they prefer not to use online resources.

Steps to Complete the IT-209

Completing the IT-209 involves several key steps:

- Gather all necessary documents, such as W-2 forms, 1099s, and any other income records.

- Fill out personal information, including your name, address, and Social Security number.

- Report income earned from New York sources accurately, ensuring to include all relevant figures.

- Calculate your tax liability based on the income reported and applicable tax rates.

- Complete any additional schedules or forms as required, depending on your specific tax situation.

- Review the completed form for accuracy before submission.

Legal Use of the IT-209

The IT-209 is legally binding when completed accurately and submitted in accordance with New York tax regulations. It is essential to ensure that all information provided is truthful and complete, as any discrepancies can lead to penalties or legal issues. The form must be filed by the appropriate deadlines to avoid additional fees or interest charges. Utilizing a reliable eSignature solution can help ensure that the form is signed and submitted securely, maintaining compliance with eSignature laws.

Form Submission Methods

The IT-209 can be submitted through various methods, offering flexibility to taxpayers:

- Online: Many individuals choose to file electronically through tax preparation software, which often streamlines the process and reduces the chance of errors.

- By Mail: Completed paper forms can be mailed to the address specified in the instructions, ensuring to use the correct postage and delivery method.

- In-Person: Some taxpayers may opt to visit local tax offices for assistance and submission, although this may require an appointment.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the IT-209 to avoid penalties:

- The standard deadline for filing is typically April fifteenth of each year, aligning with federal tax deadlines.

- Extensions may be available, but it is important to file for an extension before the original deadline to avoid late fees.

- Specific dates may vary, so checking the New York State Department of Taxation and Finance website for updates is advisable.

Quick guide on how to complete it 209 563641539

Effortlessly Prepare It 209 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to locate the right form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hindrances. Manage It 209 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to edit and eSign It 209 with minimal effort

- Obtain It 209 and click on Get Form to initiate the process.

- Utilize the resources we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Verify all details and then click the Done button to save your changes.

- Select your preferred method for sending your form, either via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign It 209 and ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 209 563641539

Create this form in 5 minutes!

How to create an eSignature for the it 209 563641539

The way to make an e-signature for your PDF document in the online mode

The way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a 209 form and how is it used?

The 209 form is a vital document used in various industries, primarily for reporting. It helps businesses maintain compliance and ensures effective communication of important information. By utilizing airSlate SignNow, users can easily eSign and manage their 209 forms electronically, streamlining the process.

-

How much does it cost to use airSlate SignNow for 209 forms?

airSlate SignNow offers competitive pricing plans that accommodate different business needs, including handling 209 forms. Pricing may vary based on the features and number of users, ensuring you get a tailored solution without overspending. Sign up today to discover cost-effective plans suitable for your organization.

-

Can I integrate the 209 form with other applications?

Yes, airSlate SignNow supports integrations with various applications to facilitate seamless document management, including the 209 form. This means you can connect it with your existing workflow tools, helping you efficiently send, eSign, and manage your documents. Explore our integration options to enhance your productivity.

-

What features does airSlate SignNow offer for managing 209 forms?

AirSlate SignNow provides a user-friendly platform equipped with features tailored for managing 209 forms. Key features include customizable templates, advanced eSignature options, and document tracking. These tools ensure that sending and signing your 209 forms is quick and efficient.

-

Is airSlate SignNow secure for handling sensitive 209 forms?

Absolutely! AirSlate SignNow takes the security of your 209 forms seriously, employing advanced encryption and compliance protocols. Your documents are stored securely, protecting sensitive information while allowing easy access for authorized users. Trust airSlate SignNow for secure document management.

-

How can airSlate SignNow benefit my business when using a 209 form?

Using airSlate SignNow to manage your 209 forms can signNowly streamline your processes. It enhances efficiency by providing an easy-to-use platform for sending, signing, and storing documents. This results in faster turnaround times and improved collaboration within your team.

-

Can I track the status of my 209 forms with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your 209 forms in real-time. You will receive notifications when your document is viewed, signed, or completed, giving you peace of mind and keeping you updated throughout the process. This feature enhances accountability and document management.

Get more for It 209

- Lien waiver form

- Virginia special or limited power of attorney for real estate sales transaction by seller form

- Foreclosure 481369205 form

- Purchase real property form

- Nc commercial lease form

- North carolina north carolina prenuptial premarital agreement uniform premarital agreement act with financial statements

- Pennsylvania general durable power of attorney for property and finances or financial effective upon disability form

- Handbook real estate form

Find out other It 209

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free