Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 2021

Understanding the Virginia Resident Form 760 Individual Income Tax Return

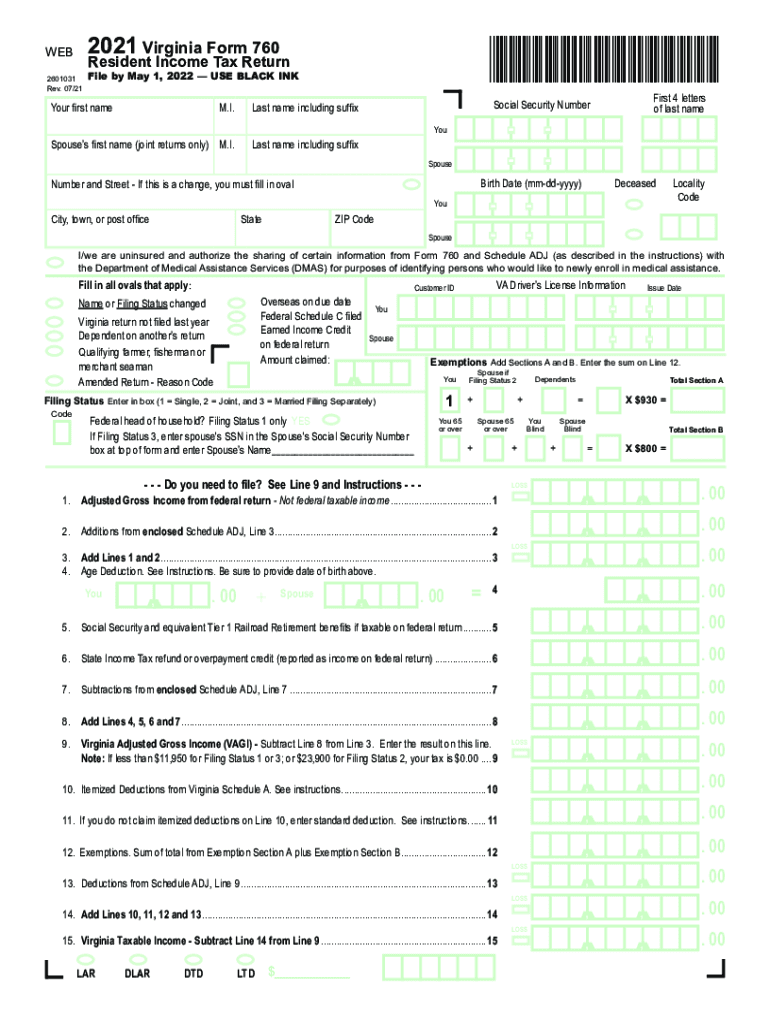

The Virginia Resident Form 760 is the official document required for individuals residing in Virginia to report their income and calculate their state tax liability. This form is essential for residents who earn income from various sources, including wages, self-employment, and investments. By accurately completing the Form 760, taxpayers can ensure compliance with state tax laws and avoid potential penalties.

Steps to Complete the Virginia Resident Form 760

Completing the Virginia Resident Form 760 involves several key steps:

- Gather Required Information: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Input all sources of income in the designated sections, ensuring accuracy to avoid discrepancies.

- Calculate Deductions: Review available deductions and credits to reduce your taxable income, such as standard deductions or itemized deductions.

- Determine Tax Liability: Use the tax tables provided to calculate your total tax owed based on your taxable income.

- Sign and Date the Form: Ensure that you sign and date the form before submission, as an unsigned form may be considered invalid.

How to Obtain the Virginia Resident Form 760

The Virginia Resident Form 760 can be obtained through various methods:

- Online: Download the form directly from the Virginia Department of Taxation's official website.

- Local Tax Offices: Visit local tax offices or libraries where physical copies of the form may be available.

- Tax Preparation Software: Many tax preparation software programs include the Virginia Form 760, allowing for easy completion and submission.

Key Elements of the Virginia Resident Form 760

Understanding the key elements of the Virginia Resident Form 760 is crucial for accurate completion:

- Personal Information: Essential details such as name, address, and Social Security number.

- Income Reporting: Sections to report various types of income, including wages and investment earnings.

- Deductions and Credits: Areas to claim deductions that may lower your taxable income.

- Tax Calculation: A section for calculating the total tax owed based on reported income and applicable rates.

State-Specific Rules for the Virginia Resident Form 760

Virginia has specific rules that govern the use of the Resident Form 760, including:

- Filing Status: Taxpayers must select the appropriate filing status, such as single, married filing jointly, or head of household.

- Income Thresholds: Certain income thresholds may determine eligibility for specific deductions or credits.

- Deadline for Submission: The form must be filed by the state-mandated deadline to avoid penalties.

Legal Use of the Virginia Resident Form 760

The Virginia Resident Form 760 is legally binding when completed and submitted according to state regulations. It serves as a formal declaration of income and tax liability. To ensure its legal standing, taxpayers should:

- Provide Accurate Information: All entries must be truthful and verifiable to avoid legal repercussions.

- Sign the Document: A signature affirms the accuracy of the information provided and the taxpayer's commitment to compliance.

- Maintain Records: Keep copies of submitted forms and supporting documentation for future reference or audits.

Quick guide on how to complete 2021 virginia resident form 760 individual income tax return 2021 virginia resident form 760

Effortlessly Prepare Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as a perfect environmentally-friendly substitute for traditional printed and signed papers, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on any platform using airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The Easiest Method to Edit and eSign Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 Effortlessly

- Obtain Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Revise and eSign Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 virginia resident form 760 individual income tax return 2021 virginia resident form 760

Create this form in 5 minutes!

How to create an eSignature for the 2021 virginia resident form 760 individual income tax return 2021 virginia resident form 760

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Virginia form income tax and who needs to file it?

The Virginia form income tax is a state tax form utilized by residents and non-residents of Virginia to report their income and calculate their tax liability. Anyone earning income within Virginia, including wages, self-employment earnings, and investment income, is required to file this form. Understanding how to fill it out is crucial for meeting state tax obligations.

-

How can airSlate SignNow assist with filing the Virginia form income tax?

With airSlate SignNow, you can easily send and eSign your Virginia form income tax documents securely and efficiently. Our platform allows for smooth collaboration with tax professionals, ensuring all signatures are collected promptly, making your tax filing process hassle-free. This streamlines your experience and helps you stay organized during tax season.

-

What are the costs associated with using airSlate SignNow for Virginia form income tax documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs, making it affordable for anyone needing to manage Virginia form income tax documents. You can choose from several subscription tiers based on your usage and feature requirements. A free trial is also available, allowing you to explore our platform without commitment.

-

What features does airSlate SignNow offer for managing Virginia form income tax?

airSlate SignNow provides numerous features for managing Virginia form income tax, such as customizable templates, secure eSigning, and real-time tracking of document status. Additionally, our user-friendly interface allows you to easily access and manage all your tax-related documents in one place. This ensures your Virginia form income tax paperwork is organized and accessible when needed.

-

Are there any integrations available with airSlate SignNow for tax management?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software, allowing you to synchronize your data effortlessly. By connecting your existing tools, you can streamline the process of preparing and filing your Virginia form income tax, eliminating duplicate entries and potential errors. This enhances productivity and saves valuable time in your tax preparation.

-

Can I store previous Virginia form income tax returns using airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store all your previous Virginia form income tax returns in a digital format. This ensures you have easy access to your historical tax documents whenever you need them, which can be helpful for reference in future filings or audits. Our secure storage system guarantees that your sensitive information is protected.

-

Is airSlate SignNow compliant with Virginia state eSignature laws?

Yes, airSlate SignNow is fully compliant with Virginia state eSignature laws, ensuring that your digitally signed Virginia form income tax documents are legally binding. Our platform meets all necessary regulatory requirements, giving you peace of mind that your transactions are secure and valid. This is essential for maintaining compliance in your tax filing processes.

Get more for Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- Buyers notice of intent to vacate and surrender property to seller under contract for deed arizona form

- General notice of default for contract for deed arizona form

- Arizona seller disclosure statement form

- Seller disclosure residential form

- Arizona seller form

- Arizona notice default form

- Arizona default form

- Assignment of contract for deed by seller arizona form

Find out other Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free