Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 2022

Understanding the Virginia Resident Form 760

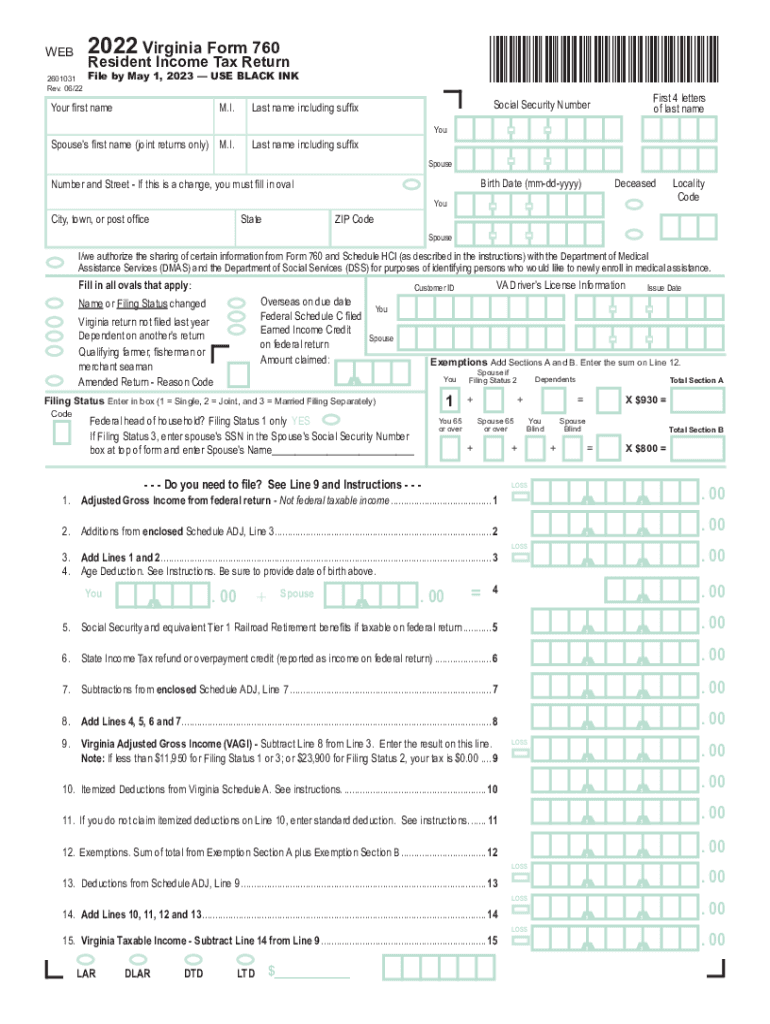

The Virginia Resident Form 760 is the primary document used for filing individual income tax returns for residents of Virginia. This form allows individuals to report their income, calculate their tax liability, and claim any applicable deductions and credits. It is essential for ensuring compliance with state tax laws and for accurately assessing tax obligations. The form is specifically designed for residents, meaning it takes into account various state-specific tax regulations and benefits that may not apply to non-residents.

Steps to Complete the Virginia Resident Form 760

Completing the Virginia Resident Form 760 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any relevant receipts for deductions. Next, fill out the form by entering personal information, income details, and applicable deductions. It is important to follow the instructions provided with the form carefully, as they outline how to report income and claim deductions specific to Virginia tax law. After completing the form, review it for any errors before submitting it.

Legal Use of the Virginia Resident Form 760

The Virginia Resident Form 760 is legally binding when completed correctly and submitted on time. To ensure its legal validity, it must be signed by the taxpayer or an authorized representative. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Maintaining accurate records of submission and any correspondence with the Virginia Department of Taxation is crucial for legal compliance and future reference.

Filing Deadlines and Important Dates

Filing deadlines for the Virginia Resident Form 760 typically align with federal tax deadlines. For most taxpayers, the due date is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to be aware of these dates to avoid penalties and interest on unpaid taxes. Additionally, taxpayers may request an extension if needed, but they must still pay any estimated taxes owed by the original deadline to avoid penalties.

Required Documents for Filing

When preparing to file the Virginia Resident Form 760, several documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Documentation for tax credits

- Previous year's tax return for reference

Having these documents ready will streamline the filing process and help ensure that all income and deductions are reported accurately.

Form Submission Methods

The Virginia Resident Form 760 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file electronically using approved e-filing software, which often simplifies the process and allows for quicker processing times. Alternatively, the form can be printed and mailed to the Virginia Department of Taxation. In-person submission is also an option at designated tax offices. Each method has its advantages, and taxpayers should select the one that best fits their needs.

Key Elements of the Virginia Resident Form 760

The Virginia Resident Form 760 includes several critical components that taxpayers must complete. Key elements include:

- Personal information: Name, address, and Social Security number

- Income section: Reporting wages, interest, dividends, and other income sources

- Deductions: Claiming standard or itemized deductions

- Tax credits: Applying for any eligible credits to reduce tax liability

- Signature: Certifying the accuracy of the information provided

Each section is vital for calculating the correct tax amount owed or refund due, making careful completion essential.

Quick guide on how to complete draft 2022 virginia resident form 760 individual income tax return 2022 virginia resident form 760

Effortlessly prepare Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on any device

Online document management has increased in popularity among businesses and individuals alike. It offers an excellent eco-friendly option to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 seamlessly

- Locate Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of your documents or redact sensitive details with the tools that airSlate SignNow offers specifically for such purposes.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct draft 2022 virginia resident form 760 individual income tax return 2022 virginia resident form 760

Create this form in 5 minutes!

People also ask

-

What are Virginia state tax forms?

Virginia state tax forms are official documents required by the Virginia Department of Taxation for filing income and other taxes. These forms capture essential financial information from residents and businesses to ensure compliance with state tax laws. It's important to complete these forms accurately to avoid penalties and ensure timely processing.

-

How can airSlate SignNow help with Virginia state tax forms?

airSlate SignNow offers a streamlined solution for completing and eSigning Virginia state tax forms. With our platform, you can easily fill out, review, and send these forms electronically, saving you valuable time. Our user-friendly interface ensures that your tax forms are prepared accurately and securely.

-

Is there a cost associated with using airSlate SignNow for Virginia state tax forms?

Yes, airSlate SignNow operates on a subscription-based model, offering various pricing tiers to fit different needs. Our pricing includes unlimited electronic signatures and access to features that simplify the process of managing Virginia state tax forms. For a more detailed pricing plan, we recommend visiting our website.

-

Can I integrate airSlate SignNow with other software for managing Virginia state tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software, enhancing the management of Virginia state tax forms. This includes integration with accounting software, CRMs, and more, allowing for a smoother workflow and easier document management across platforms.

-

What features does airSlate SignNow offer for handling Virginia state tax forms?

airSlate SignNow provides features such as customizable templates, document tracking, and secure storage to effectively handle Virginia state tax forms. These tools enhance efficiency and ensure that all documentation is organized and accessible. Additionally, our platform supports various file formats for flexibility in your tax filing processes.

-

What are the benefits of using airSlate SignNow for Virginia state tax forms?

Using airSlate SignNow for Virginia state tax forms offers numerous benefits, including increased efficiency, enhanced security, and simplified compliance. Our platform enables users to manage documents from anywhere, with mobile access ensuring you can complete your forms on the go. Furthermore, our electronic signature feature accelerates the approval process.

-

How secure is my information when using airSlate SignNow for Virginia state tax forms?

Your security is our top priority. airSlate SignNow employs advanced encryption and security protocols to protect the personal and financial information associated with Virginia state tax forms. All documents are stored in secure cloud environments with restricted access, ensuring that your data remains confidential.

Get more for Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- Landlord tenant notice 497322252 form

- Oh landlord 497322253 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497322254 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair ohio form

- Letter from tenant to landlord containing notice that doors are broken and demand repair ohio form

- Letter from tenant to landlord with demand that landlord repair broken windows ohio form

- Letter tenant landlord 497322258 form

- Oh tenant landlord form

Find out other Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online