Virginia Resident Form 760 2018

What is the Virginia Resident Form 760

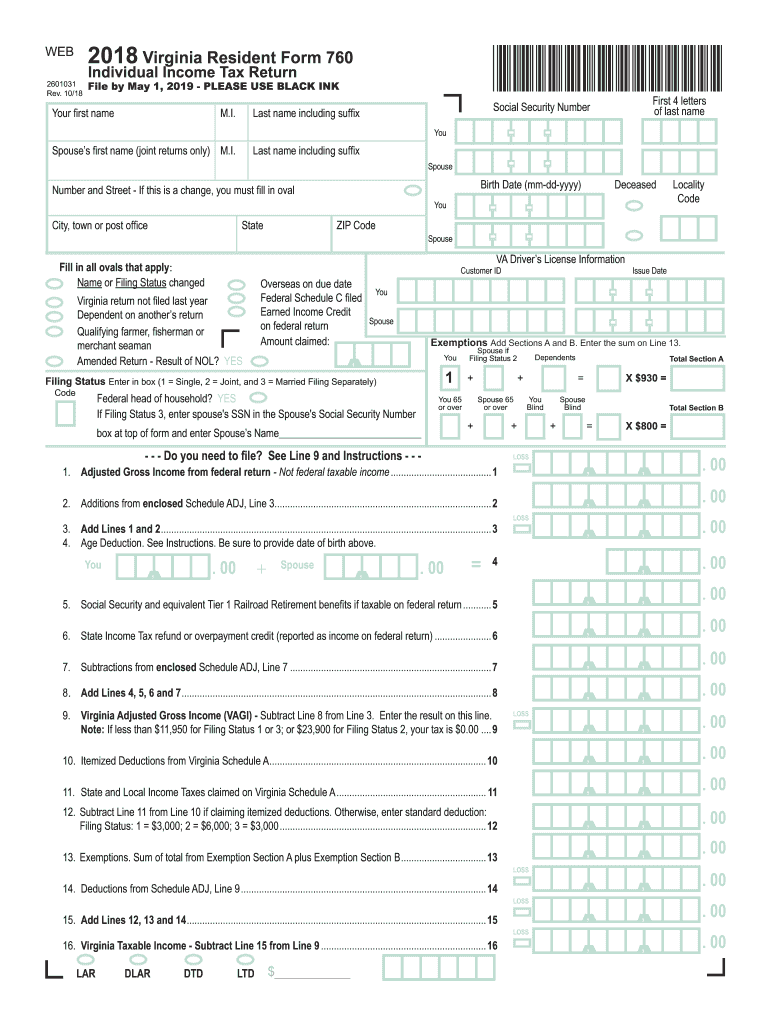

The Virginia Resident Form 760 is the primary tax form used by residents of Virginia to report their income and calculate their state tax liability. This form is designed for individuals who have established residency in Virginia and need to report their income earned during the tax year. It includes various sections for reporting wages, interest, dividends, and other sources of income, as well as deductions and credits that may apply. Understanding the purpose of this form is essential for accurate tax filing and compliance with state tax regulations.

Steps to complete the Virginia Resident Form 760

Completing the Virginia Resident Form 760 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, ensuring that your name, address, and Social Security number are correct. Then, report your income in the designated sections, including wages and any additional income sources. After reporting income, apply any eligible deductions and credits. Finally, double-check all entries for accuracy before signing and dating the form.

How to obtain the Virginia Resident Form 760

The Virginia Resident Form 760 can be obtained through several channels. It is available for download from the official Virginia Department of Taxation website, where you can find both printable and fillable versions. Additionally, many tax preparation software programs include the form as part of their offerings. If you prefer a physical copy, you can request one from your local tax office or library. Ensure you have the correct version for the tax year you are filing, as forms may change annually.

Legal use of the Virginia Resident Form 760

The Virginia Resident Form 760 must be used in accordance with state tax laws. It is legally binding, meaning that all information provided must be accurate and truthful. Misrepresentation or failure to report income can lead to penalties and interest charges. Taxpayers are responsible for ensuring that they meet all filing requirements and deadlines. Using the form correctly helps maintain compliance with Virginia tax regulations and avoids potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Resident Form 760 typically align with federal tax deadlines. Generally, the form is due on May 1 of the year following the tax year. If May 1 falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these dates, as they can affect your tax obligations. Filing on time helps avoid penalties and ensures that you remain in good standing with the Virginia Department of Taxation.

Form Submission Methods (Online / Mail / In-Person)

The Virginia Resident Form 760 can be submitted through various methods. Taxpayers have the option to file online using the Virginia Department of Taxation's e-file system, which provides a quick and efficient way to submit your return. Alternatively, you can mail a completed paper form to the appropriate address specified in the form instructions. For those who prefer in-person submissions, visits to local tax offices are also an option. Each method has its own processing times and considerations, so choose the one that best fits your needs.

Quick guide on how to complete 760 virginia tax form 2018 2019

Your assistance manual on how to prepare your Virginia Resident Form 760

If you’re interested in understanding how to fill out and submit your Virginia Resident Form 760, here are a few straightforward guidelines to streamline the tax processing experience.

To begin, simply create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to edit, generate, and finalize your tax documents seamlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and revisit to modify any details as necessary. Enhance your tax organization with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow these steps to complete your Virginia Resident Form 760 in just a few minutes:

- Sign up for your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through different versions and schedules.

- Click Obtain form to access your Virginia Resident Form 760 in our editor.

- Complete the necessary fillable sections with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized electronic signature (if needed).

- Review your document and rectify any errors.

- Save the modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting paper forms may lead to mistakes on your return and delay refunds. Of course, before electronically filing your taxes, consult the IRS website for filing guidelines in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct 760 virginia tax form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the 760 virginia tax form 2018 2019

How to make an electronic signature for your 760 Virginia Tax Form 2018 2019 in the online mode

How to create an eSignature for your 760 Virginia Tax Form 2018 2019 in Chrome

How to generate an electronic signature for signing the 760 Virginia Tax Form 2018 2019 in Gmail

How to generate an electronic signature for the 760 Virginia Tax Form 2018 2019 straight from your smart phone

How to generate an eSignature for the 760 Virginia Tax Form 2018 2019 on iOS

How to generate an eSignature for the 760 Virginia Tax Form 2018 2019 on Android

People also ask

-

What are the va tax instructions for form 760?

The VA tax instructions for form 760 provide guidance on how Virginia residents should fill out their state income tax return. This form is essential for reporting your income and claiming deductions. You can find detailed va tax instructions for form 760 on the Virginia Department of Taxation website or obtain assistance from a tax professional.

-

How can airSlate SignNow help with completing form 760?

AirSlate SignNow can simplify the process of completing form 760 by enabling users to eSign and send documents securely. Our platform ensures that all necessary information is accurately captured and easily accessible. With our templates and streamlined signing process, handling your va tax instructions for form 760 has never been easier.

-

Are there any costs associated with using airSlate SignNow for my tax forms?

AirSlate SignNow offers competitive pricing plans designed to fit different budgets. You can choose from various subscription tiers, allowing you to select the features you need for efficiently managing your tax documents, including your va tax instructions for form 760. Free trials are also available to help you explore our services before committing.

-

What features does airSlate SignNow provide to manage my tax documents?

AirSlate SignNow offers a range of beneficial features for managing your tax documents, including customizable templates, secure eSigning, and automated workflows. These features make it easy to follow the va tax instructions for form 760 efficiently. Users can also track document status and collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various software applications, enabling you to streamline your tax preparation processes. Whether you use accounting software or document management systems, our platform supports these integrations to help you efficiently manage your va tax instructions for form 760 and related documents.

-

What benefits does eSigning provide for submitting form 760?

ESigning through airSlate SignNow offers efficiency and streamline submission of form 760. It ensures your documents are signed quickly and securely, reducing turnaround time. Additionally, eSigning provides a secure way to handle sensitive information while adhering to the va tax instructions for form 760.

-

Is there support available for using airSlate SignNow with tax documents?

Absolutely! AirSlate SignNow provides customer support to assist users in efficiently using the platform for their tax documents. Whether you need help understanding the va tax instructions for form 760 or require technical assistance with our features, our support team is ready to help through various channels.

Get more for Virginia Resident Form 760

Find out other Virginia Resident Form 760

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors