Virginia Resident Form 760 WEB 2601031 Rev 1 2024-2026

Understanding the Virginia Resident Form 760

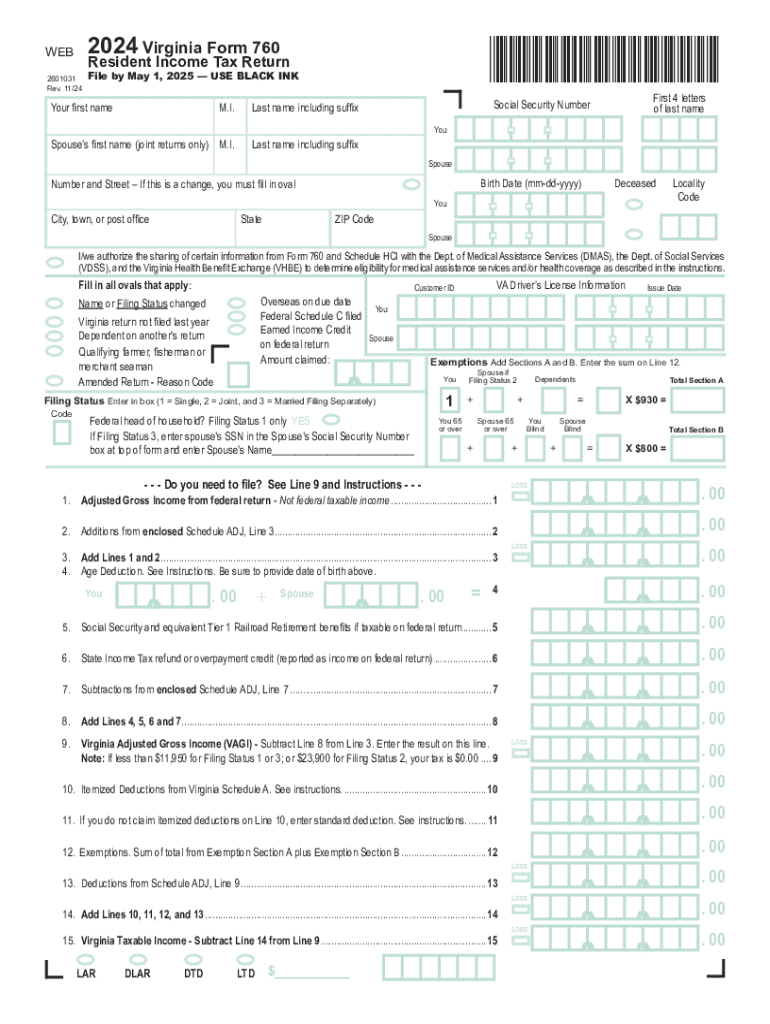

The Virginia Resident Form 760 is a state tax form used by residents of Virginia to report their income and calculate their tax liability. This form is essential for individuals who earn income in Virginia and need to fulfill their state tax obligations. It is specifically designed for residents, ensuring that all applicable income, deductions, and credits are accurately accounted for in the tax calculation process.

How to Complete the Virginia Resident Form 760

Filling out the Virginia Resident Form 760 involves several steps. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, enter your personal information at the top of the form, including your name, address, and Social Security number. Then, report your total income, including wages, interest, and dividends. After calculating your total income, apply any deductions and credits you qualify for, such as the standard deduction or personal exemptions. Finally, calculate your tax liability and determine if you owe additional taxes or are due a refund.

Important Dates for Filing the Virginia Resident Form 760

It is crucial to be aware of the filing deadlines for the Virginia Resident Form 760. Typically, the form must be submitted by May 1 of the year following the tax year. For example, the 2024 Virginia Form 760 will need to be filed by May 1, 2025. If you need additional time, you may request an extension, but it is important to pay any estimated taxes owed by the original deadline to avoid penalties and interest.

Required Documents for Filing the Virginia Resident Form 760

When completing the Virginia Resident Form 760, certain documents are necessary to ensure accurate reporting. You will need:

- W-2 forms from all employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Proof of any tax credits you are claiming

Having these documents ready will streamline the filing process and help in accurately reporting your financial information.

Submission Methods for the Virginia Resident Form 760

The Virginia Resident Form 760 can be submitted in several ways. You can file electronically using approved tax software, which is often the fastest method. Alternatively, you may print the completed form and mail it to the appropriate Virginia Department of Taxation address. In-person submissions are also accepted at designated tax offices, providing another option for those who prefer direct interaction.

Common Scenarios for Using the Virginia Resident Form 760

Various taxpayer scenarios may affect how the Virginia Resident Form 760 is completed. For instance, self-employed individuals may need to report additional income and expenses, while retirees might have different income sources, such as pensions or Social Security. Understanding these scenarios can help ensure that all income and deductions are accurately reported, leading to a correct tax liability calculation.

Legal Use of the Virginia Resident Form 760

The Virginia Resident Form 760 is legally required for residents of Virginia to report their income to the state. Filing this form accurately and on time helps avoid penalties and ensures compliance with state tax laws. It is important to provide truthful information and maintain records in case of an audit or review by the Virginia Department of Taxation.

Create this form in 5 minutes or less

Find and fill out the correct virginia resident form 760 web 2601031 rev 1

Create this form in 5 minutes!

How to create an eSignature for the virginia resident form 760 web 2601031 rev 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2011 Virginia 760 form?

The 2011 Virginia 760 form is the state's individual income tax return used by residents to report their income and calculate their tax liability. It is essential for ensuring compliance with Virginia tax laws and can be easily completed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the 2011 Virginia 760 form?

airSlate SignNow simplifies the process of completing and submitting the 2011 Virginia 760 form by allowing users to fill out, sign, and send documents electronically. This streamlines the workflow and reduces the time spent on paperwork, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 2011 Virginia 760?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides a cost-effective solution for managing documents, including the 2011 Virginia 760 form, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for the 2011 Virginia 760?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing the 2011 Virginia 760 form. These features enhance efficiency and ensure that all necessary steps are completed accurately.

-

Can I integrate airSlate SignNow with other software for the 2011 Virginia 760?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your documents related to the 2011 Virginia 760 form alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax documents like the 2011 Virginia 760?

Using airSlate SignNow for tax documents like the 2011 Virginia 760 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. These advantages make it easier to manage your tax filings and ensure compliance with state regulations.

-

Is airSlate SignNow user-friendly for completing the 2011 Virginia 760?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the 2011 Virginia 760 form. The intuitive interface guides users through the process, ensuring that even those with minimal tech experience can navigate it successfully.

Get more for Virginia Resident Form 760 WEB 2601031 Rev 1

Find out other Virginia Resident Form 760 WEB 2601031 Rev 1

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online