Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 2020

Overview of the Virginia Resident Form 760 Individual Income Tax Return

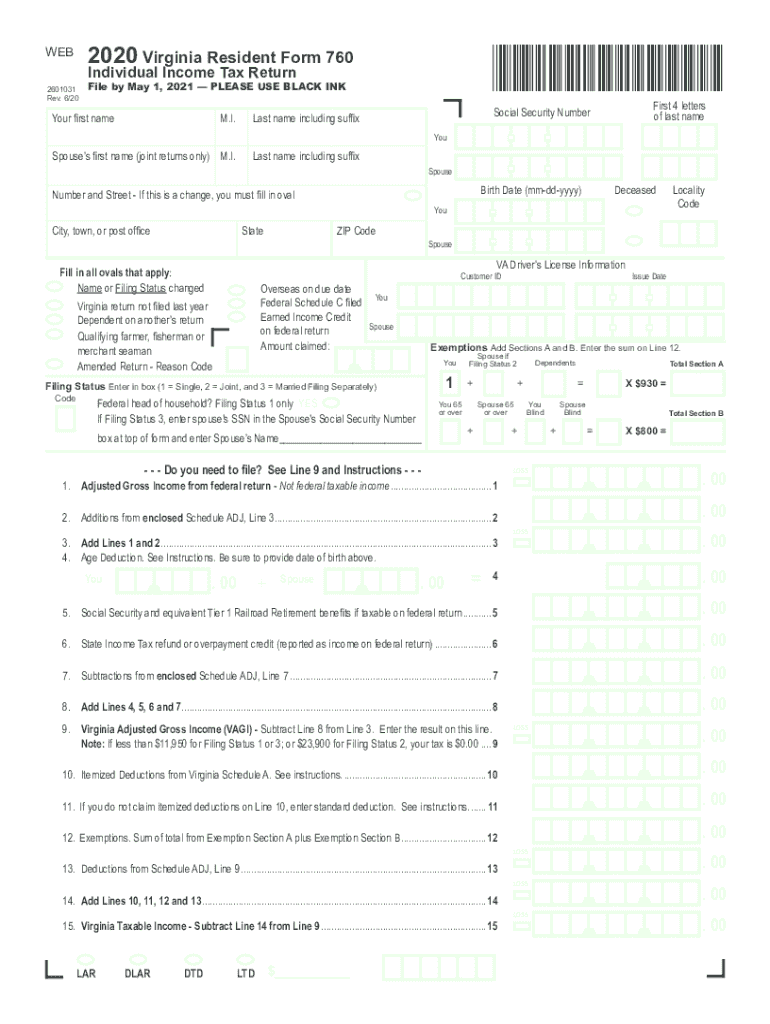

The Virginia Resident Form 760 is a crucial document for individuals who reside in Virginia and need to report their income for state tax purposes. This form is specifically designed for residents and must be completed accurately to ensure compliance with state tax laws. The form captures various income sources, deductions, and credits applicable to Virginia residents, making it essential for proper tax assessment.

Steps to Complete the Virginia Resident Form 760

Completing the Virginia Resident Form 760 involves several key steps:

- Gather necessary documents: Collect your W-2s, 1099s, and any other income statements.

- Determine your filing status: Identify whether you will file as single, married filing jointly, married filing separately, or head of household.

- Report your income: Fill in the income section with all applicable income sources, including wages, interest, and dividends.

- Claim deductions and credits: Review available deductions and credits to reduce your taxable income.

- Review and sign: Ensure all information is accurate and sign the form before submission.

Required Documents for Filing

To successfully file the Virginia Resident Form 760, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as medical expenses and mortgage interest

- Any relevant tax credit documentation

Filing Deadlines and Important Dates

It is important to be aware of the deadlines associated with the Virginia Resident Form 760 to avoid penalties:

- The standard filing deadline is May 1 for the previous tax year.

- If you need an extension, you may file for an extension, but any taxes owed must still be paid by the original deadline.

Form Submission Methods

The Virginia Resident Form 760 can be submitted through various methods:

- Online: Use the Virginia Department of Taxation’s online filing system.

- By mail: Print the completed form and send it to the appropriate address based on your location.

- In-person: Visit local tax offices for assistance and submission.

Legal Use of the Virginia Resident Form 760

The Virginia Resident Form 760 is legally binding and must be completed truthfully and accurately. Misrepresentation or failure to file can result in penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of submitting this form and to ensure compliance with all state tax regulations.

Quick guide on how to complete draft 2020 virginia resident form 760 individual income tax return 2020 virginia resident form 760

Effortlessly Prepare Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Manage Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 Smoothly

- Locate Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select relevant sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or errors that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct draft 2020 virginia resident form 760 individual income tax return 2020 virginia resident form 760

Create this form in 5 minutes!

How to create an eSignature for the draft 2020 virginia resident form 760 individual income tax return 2020 virginia resident form 760

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What are the va tax instructions for form 760?

The VA tax instructions for Form 760 provide guidance on how to correctly complete the Virginia Resident Income Tax Return. This includes information on income reporting, applicable deductions, and how to calculate your tax liability. Following these instructions ensures that your filing is accurate and minimizes the risk of errors.

-

How can airSlate SignNow assist in completing va tax instructions for form 760?

AirSlate SignNow streamlines the process of submitting your VA tax instructions for Form 760 by allowing you to electronically sign and send tax documents securely. The platform simplifies document management, ensuring you have all necessary forms and information at your fingertips. This efficiency can help you focus more on accurately completing your tax return.

-

What features does airSlate SignNow offer for handling tax documents?

AirSlate SignNow offers features such as eSigning, document templates, and cloud storage for managing tax documents like VA tax instructions for Form 760. The platform is user-friendly and designed to enhance productivity, making it easy to organize and send crucial documents without hassle. This ensures that your tax preparation process is both efficient and secure.

-

Is airSlate SignNow cost-effective for managing tax forms?

Yes, airSlate SignNow is a cost-effective solution for managing tax forms, including VA tax instructions for Form 760. With flexible pricing plans tailored for businesses of all sizes, users can benefit from a range of features that enhance document handling without breaking the bank. This allows you to allocate more resources toward other aspects of your tax preparation.

-

Can I integrate airSlate SignNow with other software for my tax needs?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, making it easier to manage your tax documents and adhere to VA tax instructions for Form 760. Popular integrations include CRMs and document management systems, allowing you to streamline workflows and improve overall efficiency when handling tax returns.

-

What are the benefits of using airSlate SignNow for tax preparation?

Using airSlate SignNow for tax preparation provides several benefits, including improved efficiency, security, and ease of use. The platform helps you stay organized when following VA tax instructions for Form 760 and ensures that your documents are signed and sent promptly. This can lead to faster processing times and a smoother overall tax filing experience.

-

How secure is airSlate SignNow for storing sensitive tax documents?

AirSlate SignNow prioritizes the security of your sensitive tax documents, including those related to VA tax instructions for Form 760. With advanced encryption and compliance with industry standards, your information is protected from unauthorized access. This level of security provides peace of mind while you manage your crucial tax filings.

Get more for Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- Ds 0011 form

- Familienversicherung aok po polsku form

- Ssm sample form

- Ss293 410078565 form

- 30 day no cause notice clark county courts clarkcountycourts form

- Vocabulary enricherword wizard form

- Corpus christi police department sequence no form

- Cocodoc comform98512543 workplace a first aidworkplace a first aid kit re order form st john ambulance

Find out other Draft Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy