STATE of SOUTH CAROLINA SC1040TC DEPARTMENT of REVENUE 2020

Understanding the SC-1040 Tax Form

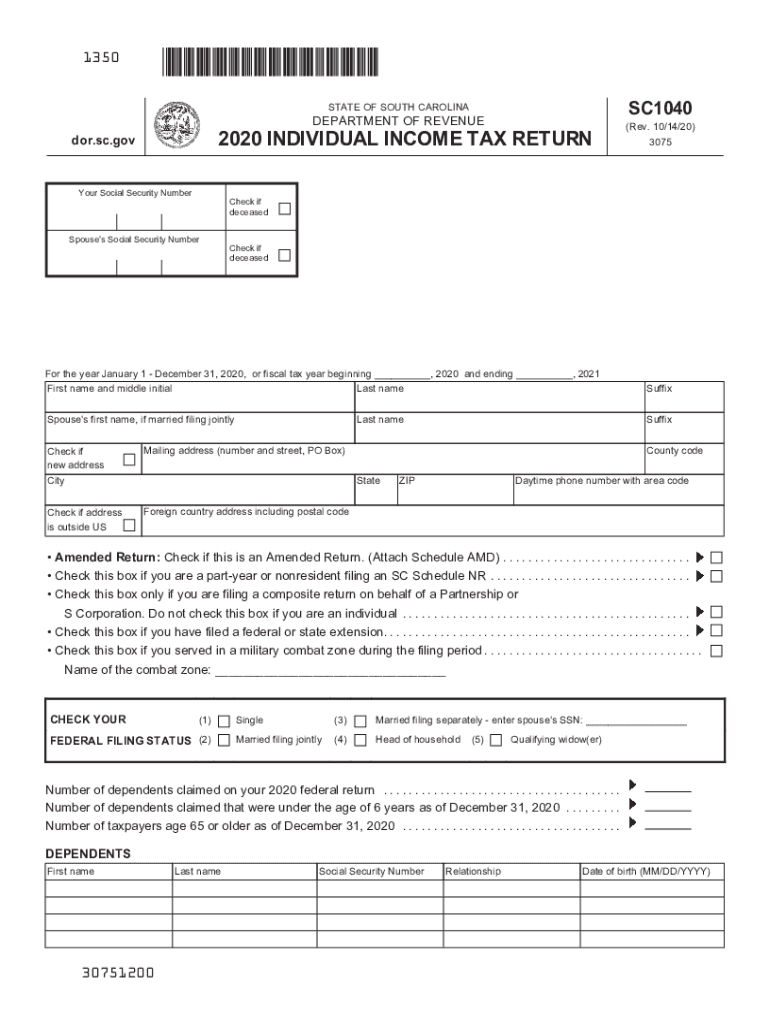

The SC-1040 is the primary income tax form used by residents of South Carolina to report their income and calculate their state tax liability. This form is essential for individuals and married couples filing jointly, as it consolidates various income sources, deductions, and credits applicable under South Carolina tax law. The SC-1040 form must be completed accurately to ensure compliance with state tax regulations and to avoid potential penalties.

Steps to Complete the SC-1040 Form

Filling out the SC-1040 form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Calculate your total income by adding all sources of income reported on your documents.

- Determine your allowable deductions, such as standard or itemized deductions, and apply them to your total income.

- Calculate your South Carolina taxable income by subtracting deductions from your total income.

- Apply the appropriate tax rates to your taxable income to determine your tax liability.

- Complete the SC-1040 form by entering all calculated figures in the appropriate sections.

- Review the form for accuracy and completeness before submission.

Filing Deadlines for the SC-1040 Form

It is important to be aware of the filing deadlines for the SC-1040 form to avoid penalties. Typically, the deadline for filing state income tax returns in South Carolina is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any extensions that may be available, which can provide additional time for filing but not for payment of any taxes owed.

Form Submission Methods

Taxpayers have several options for submitting the SC-1040 form:

- Online Submission: Many taxpayers choose to file their SC-1040 forms electronically through approved e-filing services, which can streamline the process and reduce errors.

- Mail: The SC-1040 form can also be printed and mailed to the South Carolina Department of Revenue. It is advisable to send the form via certified mail to ensure it is received by the deadline.

- In-Person: Taxpayers may also visit local Department of Revenue offices to submit their forms directly.

Key Elements of the SC-1040 Form

The SC-1040 form includes several key sections that taxpayers must complete:

- Personal Information: This section requires basic information such as name, address, and Social Security number.

- Income Section: Taxpayers must report all sources of income, including wages, dividends, and interest.

- Deductions and Credits: This section allows taxpayers to claim eligible deductions and tax credits that can reduce their overall tax liability.

- Signature: The form must be signed and dated by the taxpayer or authorized representative to be considered valid.

Legal Use of the SC-1040 Form

The SC-1040 form is legally binding once it is signed and submitted to the South Carolina Department of Revenue. It is crucial to ensure that all information provided is accurate and complete, as any discrepancies can lead to audits or penalties. Utilizing electronic signature solutions can enhance the security and legality of the submission process, ensuring compliance with state and federal regulations.

Quick guide on how to complete state of south carolina sc1040tc department of revenue

Complete STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE on any device with airSlate SignNow Android or iOS applications and improve any document-related process today.

The easiest method to modify and eSign STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE without effort

- Find STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of south carolina sc1040tc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the state of south carolina sc1040tc department of revenue

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What are the state of South Carolina tax forms available through airSlate SignNow?

AirSlate SignNow offers a variety of state of South Carolina tax forms, including individual income tax returns, business tax forms, and other required documentation. These forms can be easily accessed and filled out within our platform. This ensures that you have all necessary resources for accurate tax filing.

-

How can airSlate SignNow help me complete my state of South Carolina tax forms?

With airSlate SignNow, you can fill out and sign state of South Carolina tax forms electronically, streamlining the entire process. The platform allows for easy collaboration, enabling you to gather necessary signatures efficiently. This reduces the time and effort required while ensuring compliance with state regulations.

-

What are the pricing options for using airSlate SignNow with state of South Carolina tax forms?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, whether you are an individual or a corporation. Subscribers can access unlimited eSigning and document management features, including state of South Carolina tax forms. Explore our pricing page to find the plan that best fits your requirements.

-

Are there any features specific to the state of South Carolina tax forms on airSlate SignNow?

Yes, airSlate SignNow includes features tailored for the state of South Carolina tax forms such as customizable templates to fit specific filing requirements. Additionally, users can attach supporting documents and create reminders for due dates to ensure timely submissions. These features advocate for an efficient tax filing experience.

-

Can I integrate airSlate SignNow with other accounting software for filing state of South Carolina tax forms?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting software and tools, facilitating the management of state of South Carolina tax forms alongside your financial data. This integration allows for automatic updates, reducing manual entry and potential errors in tax filing. Check our integration page for specifics.

-

How does airSlate SignNow ensure the security of my state of South Carolina tax forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect all state of South Carolina tax forms and personal information during the signing process. Additionally, our platform is compliant with industry standards such as GDPR and HIPAA, ensuring your data remains secure.

-

What support is available for users filling out state of South Carolina tax forms on airSlate SignNow?

AirSlate SignNow provides robust customer support, including video tutorials, a comprehensive help center, and live chat assistance to guide users through the process of filling out state of South Carolina tax forms. Our team is committed to ensuring you have the help you need at every step to ensure a seamless experience.

Get more for STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE

Find out other STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors