Carolina Tax Form 2021

What is the Carolina Tax Form

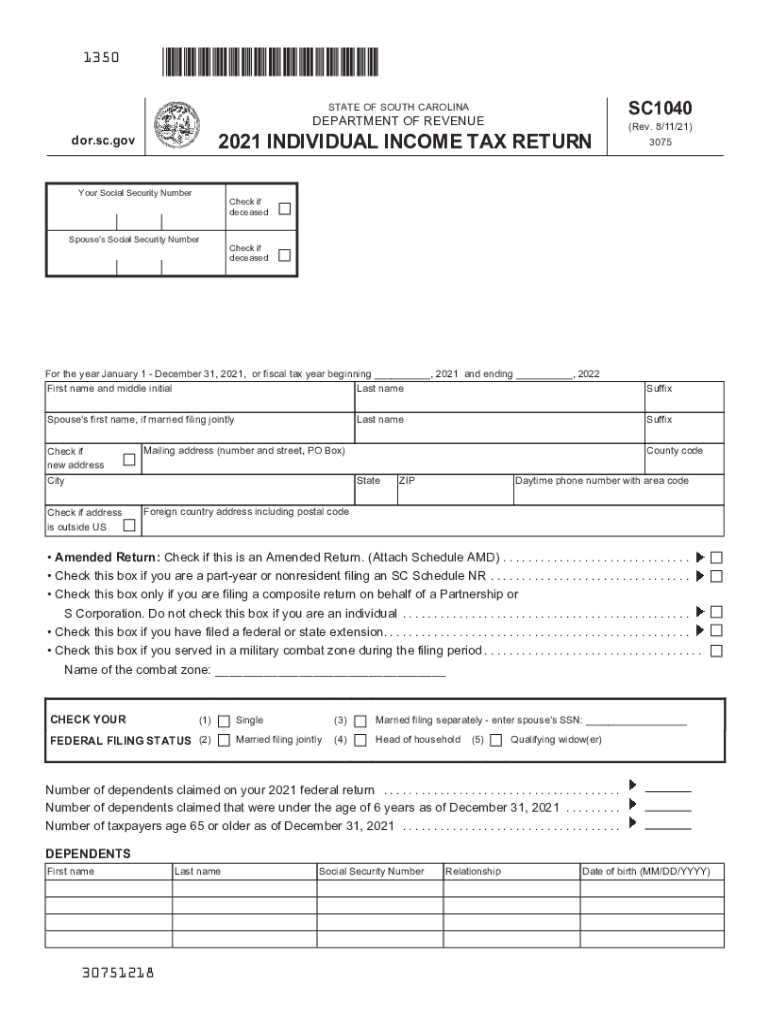

The Carolina Tax Form, commonly referred to as the SC 1040, is the primary document used by residents of South Carolina to report their income and calculate their state tax obligations. This form is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The SC 1040 includes various sections where taxpayers can report income, claim deductions, and calculate their tax liability. Understanding the purpose and structure of this form is crucial for accurate tax filing.

How to use the Carolina Tax Form

Using the Carolina Tax Form involves several steps to ensure accurate completion and submission. Taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, individuals must fill out the SC 1040, ensuring they provide accurate information regarding their income, deductions, and credits. Once completed, the form can be submitted electronically or by mail, depending on the taxpayer's preference. Utilizing an electronic signature solution can streamline this process, making it easier to submit the form securely.

Steps to complete the Carolina Tax Form

Completing the Carolina Tax Form involves a series of methodical steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income, using the appropriate sections of the SC 1040.

- Claim eligible deductions and credits to reduce taxable income.

- Calculate the total tax liability based on the provided information.

- Review the completed form for accuracy before submission.

Following these steps carefully can help ensure that the form is filled out correctly and submitted on time.

Legal use of the Carolina Tax Form

The legal use of the Carolina Tax Form is governed by South Carolina state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated filing deadline. Electronic signatures are legally recognized in South Carolina, provided they comply with the requirements set forth by the ESIGN Act and UETA. Utilizing a trusted electronic signature solution can enhance the legitimacy of the submitted form, ensuring that it meets all legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Carolina Tax Form are crucial for taxpayers to observe. Typically, the deadline for filing state taxes in South Carolina aligns with the federal tax deadline, which is usually April 15 each year. However, taxpayers should verify any changes to deadlines, especially in light of special circumstances or extensions. Meeting these deadlines helps avoid penalties and ensures compliance with state tax regulations.

Required Documents

To complete the Carolina Tax Form accurately, taxpayers must gather several essential documents:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for deductions and credits, such as receipts for charitable contributions.

- Previous year’s tax return for reference.

Having these documents on hand will facilitate a smoother filing process and help ensure that all income and deductions are accurately reported.

Quick guide on how to complete carolina tax form

Complete Carolina Tax Form effortlessly on any device

Digital document management has become widely favored among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Carolina Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Carolina Tax Form with ease

- Locate Carolina Tax Form and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details carefully and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Carolina Tax Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct carolina tax form

Create this form in 5 minutes!

People also ask

-

What is SC state tax and how does it affect my business?

SC state tax refers to the taxes imposed by the state of South Carolina on business earnings. Understanding SC state tax is crucial for compliance and financial planning. By effectively managing your tax obligations, you can ensure your business stays in good standing with the state.

-

How can airSlate SignNow help me with SC state tax documentation?

airSlate SignNow streamlines the process of signing and managing documents related to SC state tax. Our platform allows you to easily send, receive, and store signed tax documents securely. This can help ensure that your tax filings are accurate and timely.

-

What are the pricing options for airSlate SignNow related to SC state tax services?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, our solutions for SC state tax documentation are cost-effective and scalable. You can choose the plan that best aligns with your tax filing and document management requirements.

-

Are there any features in airSlate SignNow that specifically assist with SC state tax compliance?

Yes, airSlate SignNow includes features that facilitate SC state tax compliance, such as template creation for tax documents and automatic reminders for deadlines. Additionally, our platform ensures secure storage and easy access to all your tax-related documents. This makes it easier to stay organized and compliant with SC state tax regulations.

-

Can I integrate airSlate SignNow with other tools for managing SC state tax?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management tools that can help you manage SC state tax more efficiently. Integrating our eSignature solution with your existing systems allows for a smoother workflow and reduces the chances of errors in tax documentation.

-

What benefits does airSlate SignNow provide for handling SC state tax documents?

Using airSlate SignNow to handle SC state tax documents offers several benefits, including increased efficiency and enhanced security. Our platform allows for faster document turnaround times, helping you meet important tax deadlines. Additionally, documents are stored securely, minimizing the risk of loss or unauthorized access.

-

Is airSlate SignNow user-friendly for those unfamiliar with SC state tax processes?

Yes, airSlate SignNow is designed to be user-friendly, even for those not familiar with SC state tax processes. Our intuitive interface makes it easy to navigate through document management and eSignature features. We also provide resources and support to help you understand the SC state tax requirements applicable to your business.

Get more for Carolina Tax Form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497296574 form

- Legal separation and property settlement agreement with adult children marital parties may have joint property or debts divorce form

- Legal separation and property settlement agreement with adult children marital parties may have joint property or debts 497296576 form

- Arkansas dissolve form

- Arkansas dissolve 497296578 form

- Living trust for husband and wife with no children arkansas form

- Living trust for individual as single divorced or widow or widower with no children arkansas form

- Trust single form

Find out other Carolina Tax Form

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document