REVELATION 916 KJV 'And the Number of the Army of the 2019

IRS Guidelines

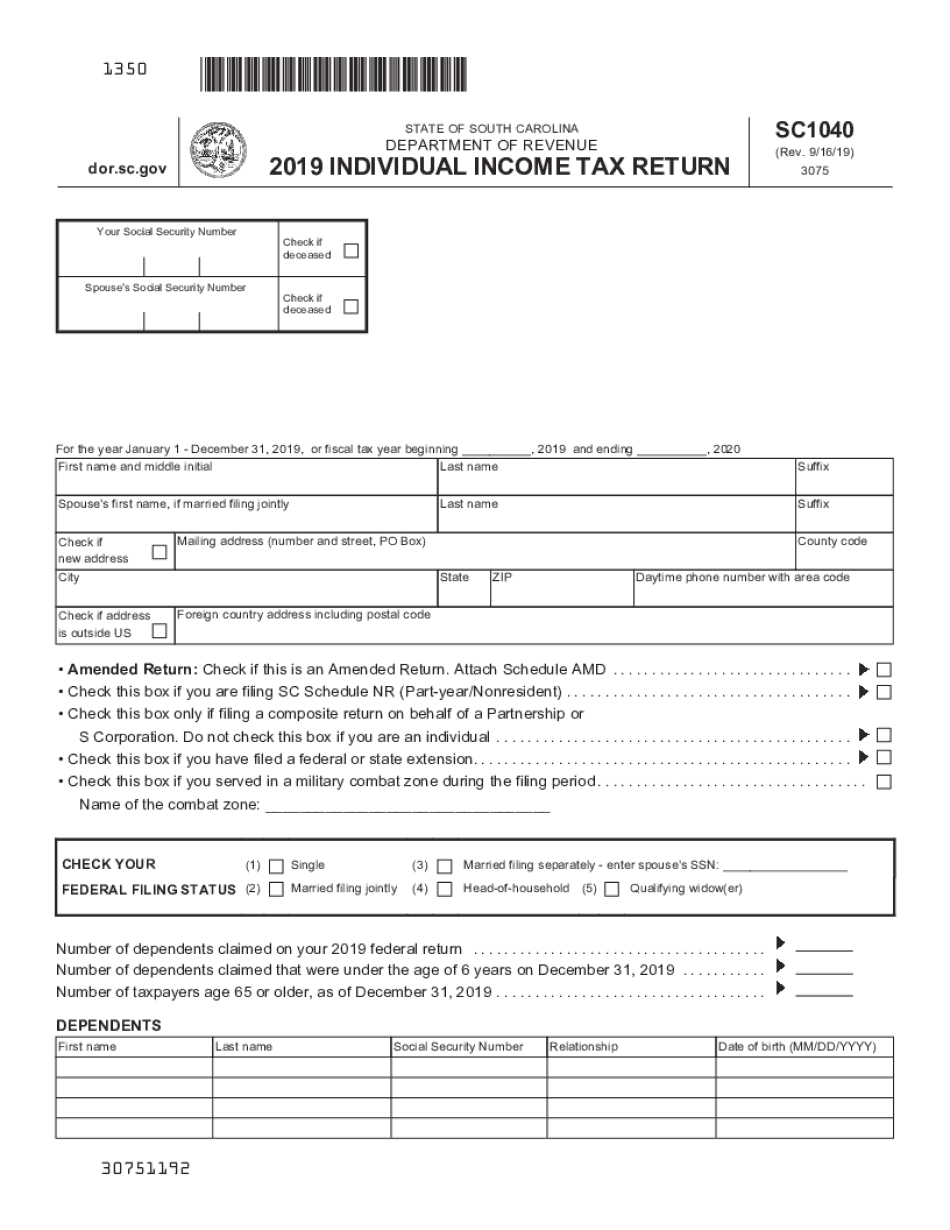

The South Carolina 1040 form is designed to help residents report their state income and calculate their tax liability. It is essential to follow the IRS guidelines when filling out this form to ensure compliance with federal tax laws. Taxpayers must accurately report their income, deductions, and credits. The IRS provides detailed instructions on how to complete the form, including what information is required and how to calculate taxes owed or refunds due. Familiarizing yourself with these guidelines can help prevent errors and potential penalties.

Filing Deadlines / Important Dates

Timely filing of the South Carolina 1040 form is crucial to avoid penalties. Generally, the deadline for submitting your state income tax return aligns with the federal tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates regarding filing deadlines each tax year, as they can change. Marking these important dates on your calendar can help ensure that you do not miss your filing deadline.

Required Documents

To complete the South Carolina 1040 form accurately, you will need several documents. These typically include your W-2 forms from employers, 1099 forms for any additional income, and records of any deductions or credits you plan to claim. It is also helpful to have your previous year’s tax return on hand for reference. Gathering these documents in advance can streamline the process and reduce the likelihood of errors during filing.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the South Carolina 1040 form. You can file online using e-filing services, which often provide a faster processing time and immediate confirmation of receipt. Alternatively, you can mail a paper copy of the form to the appropriate state tax office. For those who prefer in-person assistance, some local tax offices may offer help with filing. Each method has its advantages, so choose the one that best suits your needs.

Penalties for Non-Compliance

Failing to file the South Carolina 1040 form on time or inaccurately reporting your income can result in penalties. The state may impose late filing fees and interest on any unpaid taxes. It is important to understand these potential consequences and take steps to file accurately and on time. If you anticipate difficulties in meeting the deadline, consider filing for an extension to avoid penalties.

Digital vs. Paper Version

When completing the South Carolina 1040 form, you can choose between a digital or paper version. The digital version often allows for easier calculations and automatic error checking, while the paper version may be preferable for those who are more comfortable with traditional methods. Both formats require the same information, but digital submissions can expedite the processing time and provide a more efficient filing experience.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can affect how you fill out the South Carolina 1040 form. For instance, self-employed individuals may need to report additional income and expenses, while retirees might have different sources of income, such as pensions or Social Security. Students may qualify for specific deductions or credits related to education expenses. Understanding how your unique situation impacts your tax return can help ensure that you complete the form accurately and take advantage of any available benefits.

Quick guide on how to complete revelation 916 kjv ampquotand the number of the army of the

Effortlessly Prepare REVELATION 916 KJV 'And The Number Of The Army Of The on Any Device

Managing documents online has become increasingly preferred by both organizations and individuals. It offers a great eco-friendly replacement for traditional printed and signed paperwork, as you can easily find the necessary form and securely store it on the web. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle REVELATION 916 KJV 'And The Number Of The Army Of The on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to Edit and Electronically Sign REVELATION 916 KJV 'And The Number Of The Army Of The with Ease

- Locate REVELATION 916 KJV 'And The Number Of The Army Of The and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or censor sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign REVELATION 916 KJV 'And The Number Of The Army Of The and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revelation 916 kjv ampquotand the number of the army of the

Create this form in 5 minutes!

How to create an eSignature for the revelation 916 kjv ampquotand the number of the army of the

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the South Carolina 1040 form?

The South Carolina 1040 form is the official state income tax return form used by residents of South Carolina to report their income and calculate state taxes owed. It's important for ensuring compliance with state tax laws and can be easily completed online or through software that supports the South Carolina 1040 form.

-

How can I electronically sign the South Carolina 1040 form?

You can electronically sign the South Carolina 1040 form using airSlate SignNow, which provides a user-friendly platform for eSigning documents. This ensures that your submission is secure and legally binding, making it easier to file your taxes on time.

-

What features does airSlate SignNow offer for completing the South Carolina 1040 form?

airSlate SignNow offers a variety of features for completing the South Carolina 1040 form, including customizable templates, real-time collaboration, and secure storage. These tools streamline the tax filing process and help ensure accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the South Carolina 1040 form?

Yes, airSlate SignNow operates on a subscription basis with various pricing plans to meet different needs. This cost-effective solution provides access to various features that simplify the completion and signing of the South Carolina 1040 form.

-

Can I integrate airSlate SignNow with other software for filing the South Carolina 1040 form?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of software applications, making it easier to file the South Carolina 1040 form alongside your preferred accounting and tax software. This enhances your workflow efficiency and ensures that all your financial documents are in one place.

-

What are the benefits of using airSlate SignNow for the South Carolina 1040 form?

Using airSlate SignNow for the South Carolina 1040 form comes with multiple benefits, such as faster completion times, enhanced security features, and the ability to track document progress. This solution simplifies the tax filing process, allowing you to focus on other important tasks.

-

How secure is the submission of the South Carolina 1040 form through airSlate SignNow?

airSlate SignNow prioritizes security, ensuring that your submission of the South Carolina 1040 form is encrypted and protected. Advanced security measures ensure the confidentiality and integrity of your sensitive information during the eSigning process.

Get more for REVELATION 916 KJV 'And The Number Of The Army Of The

- Stipulation agreement form

- Vt divorce form

- Office lease agreement vermont form

- Commercial sublease vermont form

- Residential lease renewal agreement vermont form

- Vt purchase form

- Assignment of lease and rent from borrower to lender vermont form

- Assignment of lease from lessor with notice of assignment vermont form

Find out other REVELATION 916 KJV 'And The Number Of The Army Of The

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple