Tax and Special Benefits for People with Disabilities in 2015

Understanding the SC 1040 Tax Form

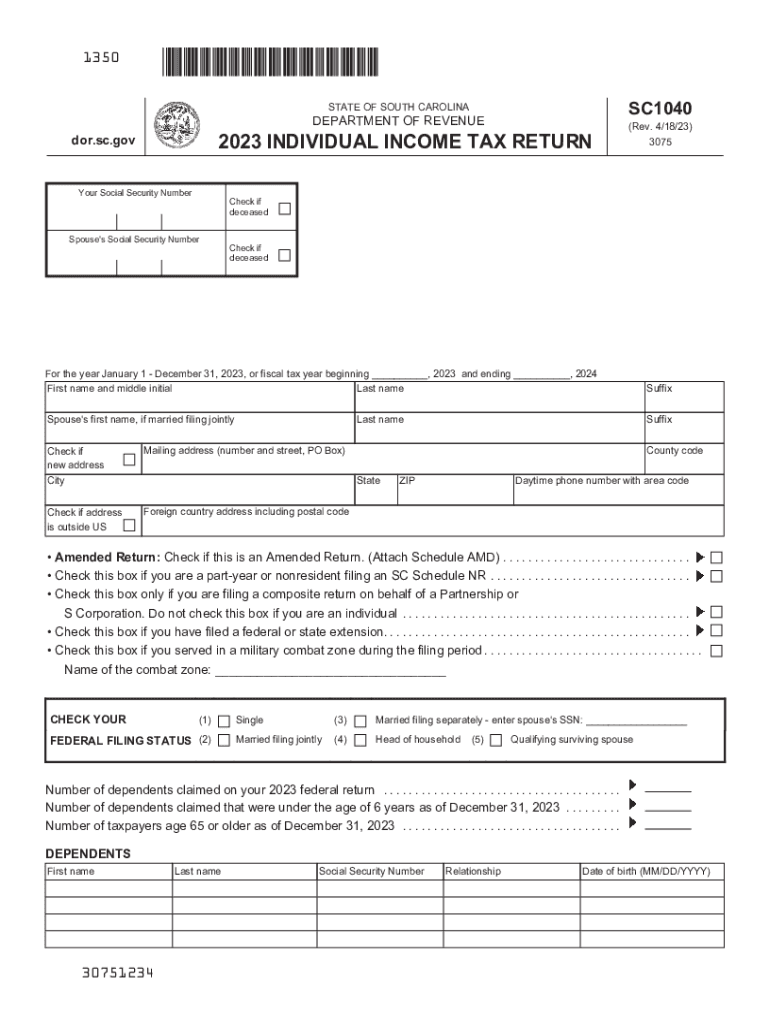

The SC 1040 tax form is the primary document used by residents of South Carolina to file their state income tax returns. This form is essential for reporting income earned during the tax year, claiming deductions, and determining the amount of tax owed or refund due. The SC 1040 is specifically designed for individual taxpayers, including those who may have income from various sources, such as wages, self-employment, or investments.

Eligibility Criteria for Filing the SC 1040

To file the SC 1040 tax form, taxpayers must meet certain eligibility criteria. Generally, individuals who are residents of South Carolina and have earned income during the tax year are required to file. This includes full-time residents, part-time residents, and those who qualify as non-residents but have income sourced from South Carolina. Additionally, taxpayers must ensure their income exceeds the minimum threshold set by the South Carolina Department of Revenue to be obligated to file.

Steps to Complete the SC 1040 Tax Form

Completing the SC 1040 tax form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which could be single, married filing jointly, married filing separately, or head of household.

- Calculate your total income by adding all sources of income reported on your documents.

- Claim any applicable deductions and credits, such as the standard deduction or itemized deductions.

- Compute your total tax liability using the current SC tax tables.

- Complete the SC 1040 form with all required information and calculations.

- Review the form for accuracy before submitting it to ensure all information is correct.

Form Submission Methods for the SC 1040

Taxpayers have several options for submitting the SC 1040 tax form. The form can be filed electronically using approved tax software, which often simplifies the process and speeds up the refund time. Alternatively, individuals may choose to print the completed form and mail it to the South Carolina Department of Revenue. In-person submissions are also possible at designated tax offices, although this method may vary based on local regulations and availability.

Filing Deadlines for the SC 1040

It is essential to be aware of the filing deadlines for the SC 1040 tax form. Typically, the deadline aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may be available, allowing additional time to file while still ensuring any owed taxes are paid by the original deadline to avoid penalties.

Required Documents for Filing the SC 1040

To accurately complete the SC 1040 tax form, taxpayers must gather several key documents, including:

- W-2 forms from employers for reporting wages and salary.

- 1099 forms for reporting income from self-employment, interest, dividends, or other sources.

- Records of any deductions or credits claimed, such as receipts for charitable donations or medical expenses.

- Any additional documentation required to support claims made on the tax return.

Quick guide on how to complete tax and special benefits for people with disabilities in

Prepare Tax And Special Benefits For People With Disabilities In seamlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without any delays. Manage Tax And Special Benefits For People With Disabilities In on any device using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

How to modify and eSign Tax And Special Benefits For People With Disabilities In effortlessly

- Find Tax And Special Benefits For People With Disabilities In and click Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize key sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign Tax And Special Benefits For People With Disabilities In and maintain exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax and special benefits for people with disabilities in

Create this form in 5 minutes!

How to create an eSignature for the tax and special benefits for people with disabilities in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC 1040 tax form?

The SC 1040 tax form is a specific tax document used by residents of South Carolina to report their income and calculate their state tax liability. This form is essential for individuals filing their state taxes and helps ensure compliance with state tax laws.

-

How do I complete the SC 1040 tax form using airSlate SignNow?

You can easily complete the SC 1040 tax form using airSlate SignNow by uploading your document and utilizing our intuitive editing tools. With features like eSignature and document collaboration, completing the form becomes a breeze, allowing you to focus on other important tasks.

-

Is there a cost associated with using airSlate SignNow for the SC 1040 tax form?

Yes, airSlate SignNow offers flexible pricing plans that accommodate different needs. You can choose a plan based on your usage frequency, ensuring you get the best value while efficiently managing documents like the SC 1040 tax form.

-

What features does airSlate SignNow provide for handling the SC 1040 tax form?

airSlate SignNow provides a range of features including eSigning, secure document storage, and customizable templates specifically designed for forms like the SC 1040 tax form. These features enhance the efficiency and security of your tax filing process.

-

Can I integrate airSlate SignNow with other applications for completing the SC 1040 tax form?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive and Dropbox, making it easy to access and manage your SC 1040 tax form. This seamless integration enhances your workflow and document management capabilities.

-

What are the benefits of using airSlate SignNow for the SC 1040 tax form?

Using airSlate SignNow for the SC 1040 tax form simplifies the eSigning and document management process, saving you time and effort. With its user-friendly interface and efficient features, airSlate SignNow helps ensure that your tax documents are processed quickly and accurately.

-

Is airSlate SignNow safe to use for submitting the SC 1040 tax form?

Yes, airSlate SignNow prioritizes security and compliance, implementing advanced security measures to protect sensitive information while you fill out the SC 1040 tax form. You can trust that your documents are safe during the eSigning process.

Get more for Tax And Special Benefits For People With Disabilities In

- 49 us code chapter 327 odometersus codeus law form

- United states district court for the southern district govinfo form

- Constitutional decision rules for juries penn law legal form

- Caci no 3041 violation of prisoners federal civil rights form

- Ninth circuit modifies deliberate indifference analysis for form

- Tweaking antitrusts business model form

- United states antitrust law wikipedia form

- Department of labor enronbrief 8 30 02federal rules of form

Find out other Tax And Special Benefits For People With Disabilities In

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF