Sc Form 1040 2016

What is the SC Form 1040

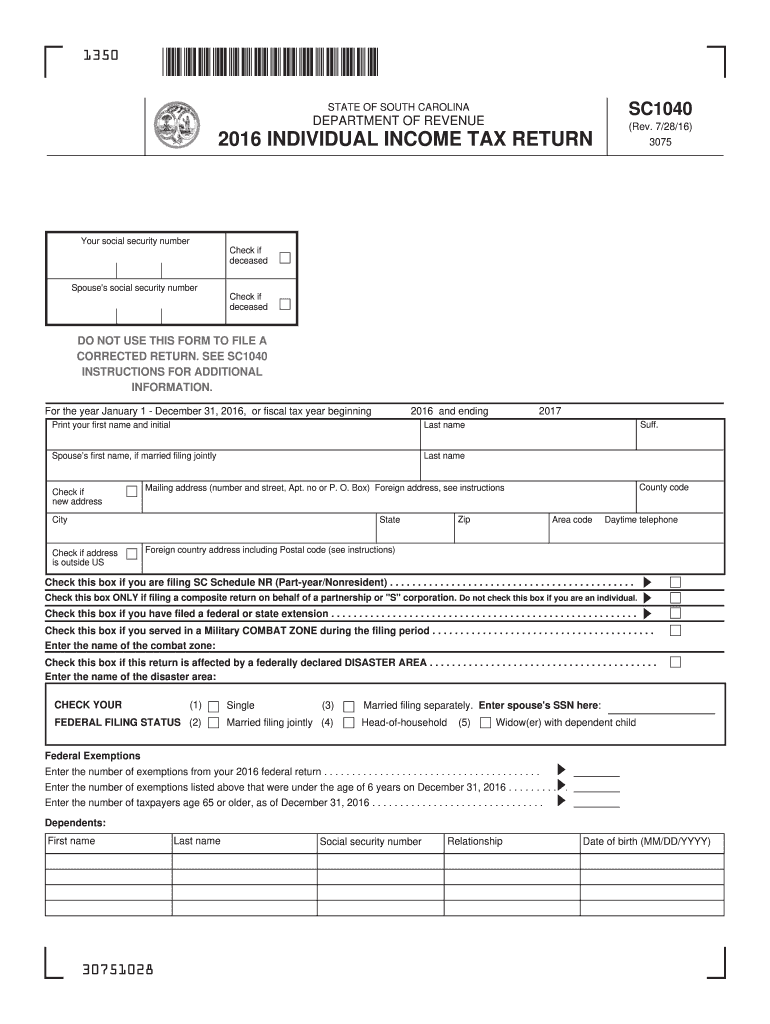

The SC Form 1040 is a tax form used by residents of South Carolina to report their income and calculate their state income tax liability. This form is similar to the federal Form 1040 but is tailored to meet the specific tax laws and regulations of South Carolina. It includes sections for reporting various types of income, deductions, and credits available to taxpayers within the state. Understanding the SC Form 1040 is essential for ensuring compliance with state tax obligations.

How to Use the SC Form 1040

Using the SC Form 1040 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form accurately, ensuring that all income sources are reported. It's important to claim any eligible deductions and credits to minimize tax liability. After completing the form, review it for accuracy before submitting it to the South Carolina Department of Revenue.

Steps to Complete the SC Form 1040

Completing the SC Form 1040 requires careful attention to detail. Here are the key steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim any applicable deductions, such as those for education or medical expenses.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for any errors or omissions.

- Submit the form by the appropriate deadline.

Legal Use of the SC Form 1040

The SC Form 1040 is legally binding when completed and submitted according to South Carolina tax laws. To ensure compliance, taxpayers must provide accurate information and adhere to filing deadlines. The form must be signed and dated, and any supporting documentation should be included as required. Failure to comply with these legal requirements may result in penalties or audits by the South Carolina Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the SC Form 1040 typically align with federal tax deadlines. For most taxpayers, the due date is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates and to file on time to avoid late fees and interest charges.

Required Documents

When filing the SC Form 1040, several documents are necessary to ensure accurate reporting. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for any deductions claimed, such as receipts or statements

- Previous year’s tax return for reference

Having these documents readily available can streamline the filing process and help prevent errors.

Quick guide on how to complete sc form 1040 2016

Effortlessly prepare Sc Form 1040 on any device

The management of documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the features needed to create, edit, and electronically sign your documents swiftly without delays. Manage Sc Form 1040 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign Sc Form 1040 without hassle

- Locate Sc Form 1040 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data with features that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Sc Form 1040 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc form 1040 2016

Create this form in 5 minutes!

How to create an eSignature for the sc form 1040 2016

How to make an electronic signature for the Sc Form 1040 2016 in the online mode

How to generate an electronic signature for the Sc Form 1040 2016 in Google Chrome

How to create an eSignature for putting it on the Sc Form 1040 2016 in Gmail

How to generate an eSignature for the Sc Form 1040 2016 right from your smartphone

How to generate an electronic signature for the Sc Form 1040 2016 on iOS

How to generate an electronic signature for the Sc Form 1040 2016 on Android

People also ask

-

What is the SC Form 1040 and how does it relate to airSlate SignNow?

The SC Form 1040 is a tax form used by individuals in South Carolina to report their income and calculate their state tax obligations. With airSlate SignNow, you can easily eSign and send your SC Form 1040 securely, ensuring that your sensitive information is protected while streamlining your tax filing process.

-

How can airSlate SignNow help with filing the SC Form 1040?

AirSlate SignNow simplifies the process of filing the SC Form 1040 by allowing users to electronically sign and send the form directly to the appropriate tax authorities. This not only speeds up the filing process but also reduces the risk of errors associated with manual signatures and paperwork.

-

Are there any costs associated with using airSlate SignNow for the SC Form 1040?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost-effectiveness of airSlate SignNow makes it an attractive solution for efficiently handling your SC Form 1040 and other document signing needs.

-

What features does airSlate SignNow offer for managing the SC Form 1040?

AirSlate SignNow provides features such as customizable templates, document tracking, and secure cloud storage that enhance the management of the SC Form 1040. These features ensure that you can easily access, edit, and send your tax documents whenever necessary.

-

Can I integrate airSlate SignNow with other tools for handling the SC Form 1040?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and other productivity tools. This allows you to streamline your workflow and manage your SC Form 1040 alongside your existing software solutions.

-

Is it safe to use airSlate SignNow for submitting the SC Form 1040?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect your data. When submitting your SC Form 1040 through the platform, you can trust that your information is encrypted and handled with the utmost care.

-

Do I need any special training to use airSlate SignNow for the SC Form 1040?

No special training is required to use airSlate SignNow for the SC Form 1040. The platform is designed to be user-friendly, allowing anyone to easily create, sign, and send documents without technical expertise.

Get more for Sc Form 1040

- Affidavit of birth information for out of hospital birth

- Biomedical waste operating plan form

- Morning call memoriam online form

- Pump it up application form

- Cms 1500 form for bluecard dgaplansorg dgaplans

- Lac la biche county the inspections group building permit form

- View status for enrollment and yuvasreespecial help line for yuvasreenoticelist of joint directors of employment in charge of form

- Able ride form

Find out other Sc Form 1040

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free