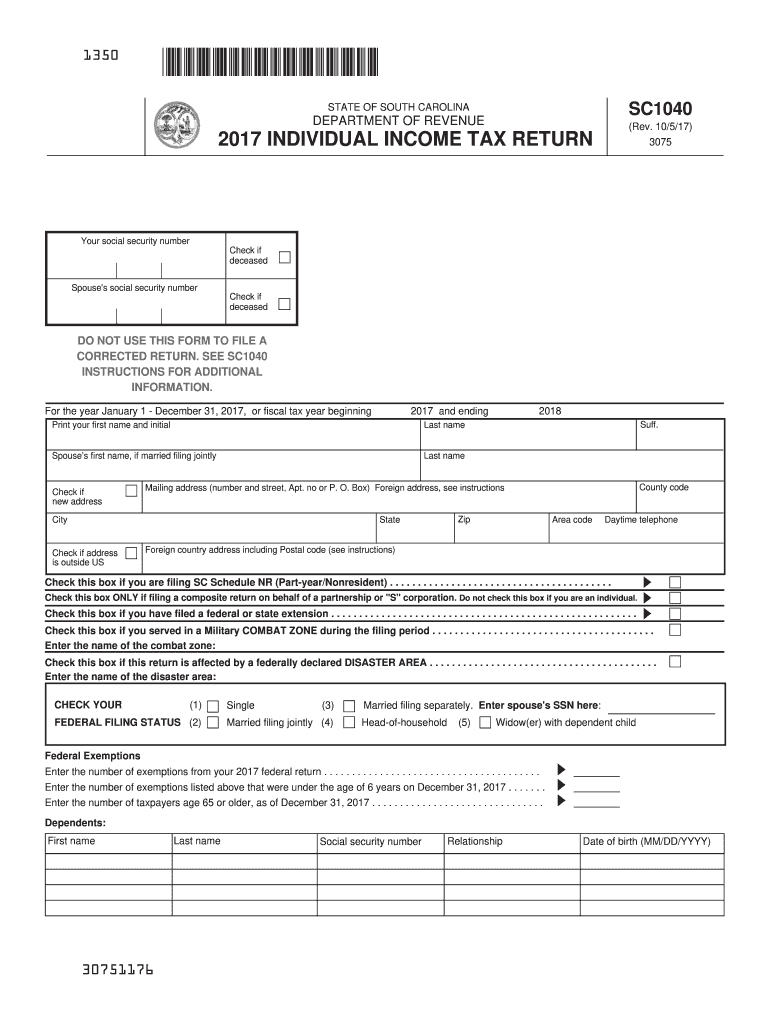

Sc Form 1040 2017

What is the Sc Form 1040

The Sc Form 1040 is a tax form used by individuals in the United States to report their annual income and calculate their tax liability. This form is essential for taxpayers who need to declare their earnings, claim deductions, and determine any tax refunds or payments owed to the Internal Revenue Service (IRS). The Sc Form 1040 is designed to accommodate various taxpayer situations, including those who are self-employed, retired, or have dependents. It is a key document in the tax filing process and must be completed accurately to ensure compliance with federal tax regulations.

How to use the Sc Form 1040

Using the Sc Form 1040 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. It is crucial to double-check your entries for accuracy. After completing the form, you can eSign it using a secure digital signature solution, which is now accepted by the IRS for many forms. Finally, submit the completed Sc Form 1040 either electronically or by mail, depending on your preference.

Steps to complete the Sc Form 1040

Completing the Sc Form 1040 involves a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all necessary documents, including income statements and deduction records.

- Begin filling out the form with your personal information, including your name, address, and Social Security number.

- Report your total income from various sources, such as wages, interest, and dividends.

- Claim any deductions or credits you qualify for, which can reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for any errors or omissions.

- eSign the form using a secure electronic signature method.

- Submit the form electronically or via mail to the IRS.

Legal use of the Sc Form 1040

The Sc Form 1040 is legally recognized as a valid document for reporting income and calculating taxes owed to the IRS. It must be filled out in accordance with IRS regulations and guidelines. The use of electronic signatures on this form is permissible under the ESIGN Act, which allows for the legal acceptance of eSignatures on tax documents. It is important to ensure that all information provided on the form is truthful and accurate, as any discrepancies can lead to penalties or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Sc Form 1040 are crucial for taxpayers to keep in mind. Typically, the deadline for submitting the form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, which allows an additional six months to file the form, though any taxes owed must still be paid by the original deadline to avoid penalties. Staying informed about these important dates helps ensure compliance and timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Sc Form 1040 can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online: Taxpayers can file electronically using IRS-approved e-filing software, which often simplifies the process and allows for faster processing times.

- Mail: The form can be printed and mailed to the appropriate IRS address, depending on the taxpayer's location and whether they are enclosing a payment.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices or authorized tax preparation services, where assistance is available.

Quick guide on how to complete sc form 1040 2017 2019

Your assistance manual on how to prepare your Sc Form 1040

If you’re interested in learning how to generate and submit your Sc Form 1040, here are some brief instructions to simplify the tax declaration process.

To get started, all you need to do is set up your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a highly intuitive and powerful document management system that allows you to modify, create, and finalize your tax documents effortlessly. With its editor, you can navigate between text, check boxes, and eSignatures, making it easy to update any necessary information. Streamline your tax oversight with advanced PDF editing, eSigning, and easy sharing options.

Follow the steps below to finalize your Sc Form 1040 in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax document; explore various forms and schedules.

- Click Obtain form to access your Sc Form 1040 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to affix your legally-recognized eSignature (if applicable).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Remember that submitting on paper can increase return inaccuracies and delay refunds. Before e-filing your taxes, make sure to check the IRS website for filing requirements in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc form 1040 2017 2019

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

Create this form in 5 minutes!

How to create an eSignature for the sc form 1040 2017 2019

How to generate an eSignature for your Sc Form 1040 2017 2019 online

How to generate an electronic signature for the Sc Form 1040 2017 2019 in Chrome

How to create an eSignature for putting it on the Sc Form 1040 2017 2019 in Gmail

How to make an eSignature for the Sc Form 1040 2017 2019 straight from your smart phone

How to create an electronic signature for the Sc Form 1040 2017 2019 on iOS

How to generate an eSignature for the Sc Form 1040 2017 2019 on Android devices

People also ask

-

What is the SC Form 1040 and why is it important?

The SC Form 1040 is a tax form used by South Carolina residents to report their annual income and calculate their tax liability. Understanding this form is crucial for ensuring accurate tax filing and compliance with state tax regulations. Properly completing the SC Form 1040 helps you maximize your deductions and credits, ultimately resulting in potential savings.

-

How can airSlate SignNow simplify the filing of SC Form 1040?

airSlate SignNow offers an intuitive platform that allows you to easily fill out and eSign your SC Form 1040 electronically. This digital approach streamlines the process, reducing the risk of errors and ensuring that your documents are securely stored. With airSlate SignNow, you can complete your SC Form 1040 from anywhere, saving time and effort.

-

What pricing options does airSlate SignNow offer for eSigning SC Form 1040?

airSlate SignNow provides flexible pricing plans to accommodate different user needs, making the eSigning of SC Form 1040 cost-effective. You can choose from monthly or annual subscriptions, each designed to offer signNow value with features tailored for individuals and businesses alike. Consider trying a free trial to explore how it fits your needs.

-

Are there any features specifically designed for handling SC Form 1040?

Yes, airSlate SignNow provides features specifically designed for handling SC Form 1040, including customizable templates and robust eSignature options. The platform also supports real-time collaboration, allowing multiple users to review and approve your SC Form 1040 seamlessly. These features enhance accuracy and efficiency in completing your tax filings.

-

Can airSlate SignNow integrate with other software I use for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax preparation software, allowing you to streamline your workflow when managing your SC Form 1040. These integrations enable seamless data transfer, reducing duplicate entries and minimizing the chances of errors. This functionality enhances your overall tax preparation experience.

-

How secure is my information when using airSlate SignNow for my SC Form 1040?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and extensive security protocols to protect your sensitive information, including your SC Form 1040. You can be confident that your data is secure, giving you peace of mind as you manage important documents online.

-

What benefits does eSigning the SC Form 1040 offer over traditional methods?

eSigning the SC Form 1040 offers numerous benefits over traditional paper methods, including enhanced speed and convenience. You can complete and submit your form from anywhere, eliminating the need for printing and mailing. Additionally, eSigning reduces the risk of errors and allows for quicker processing, making your tax season much smoother.

Get more for Sc Form 1040

- Ftb ca form

- 2015 form 3864 group nonresident return election ftb ca

- Form wht 434 vermont department of taxes tax vermont

- Pa uc appeal form

- Adoption summary and segregated information statement courts oregon

- Ldss 3668 form

- Ncyfl football form

- Insurance funded prepaid funeral benefits contract dob texas form

Find out other Sc Form 1040

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer