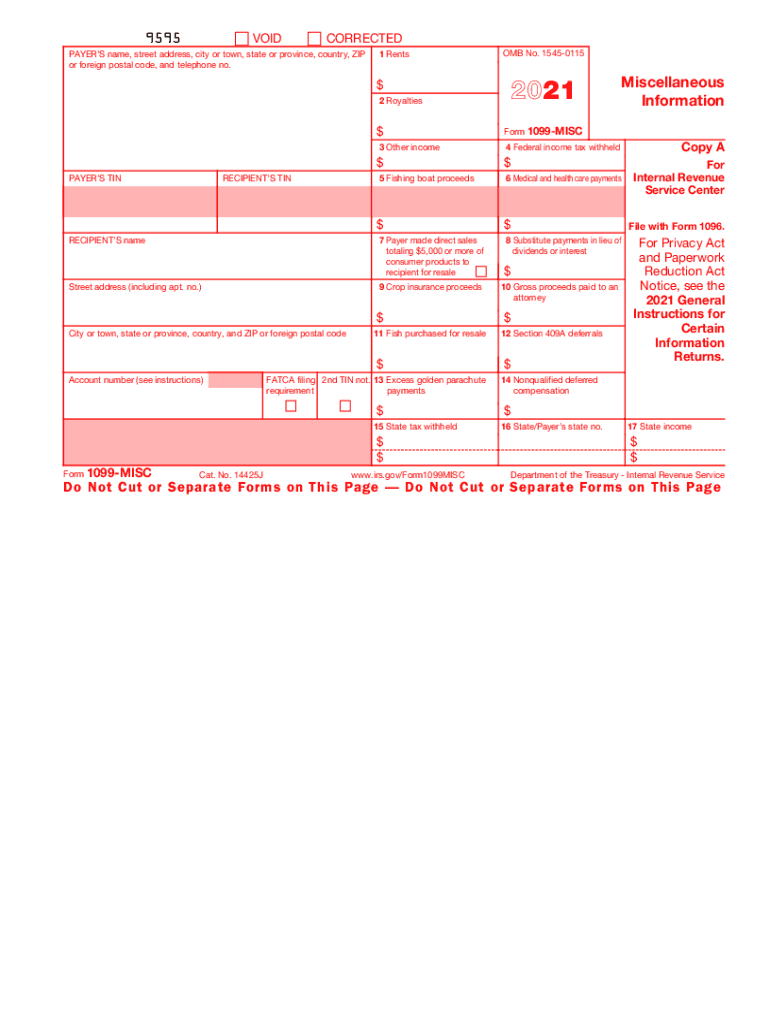

Form 1099 MISC Miscellaneous Income 2021

What is the Form 1099 MISC Miscellaneous Income

The Form 1099 MISC is an essential tax document used in the United States to report various types of income that are not classified as wages, salaries, or tips. This form is typically issued to independent contractors, freelancers, and other non-employees who receive payments for services rendered. The 1099 MISC is particularly important for reporting miscellaneous income, which can include payments for services, rent, prizes, and awards. Understanding the purpose of this form is crucial for both payers and recipients to ensure accurate tax reporting and compliance with IRS regulations.

Steps to complete the Form 1099 MISC Miscellaneous Income

Completing the Form 1099 MISC involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, enter the total amount paid to the recipient in the appropriate box, ensuring that you categorize the payment correctly, such as for services or rents. After filling in all required fields, review the form for any errors. Finally, submit the completed form to the IRS and provide a copy to the recipient by the specified deadline. Following these steps will help facilitate a smooth filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 MISC are critical to avoid penalties. Typically, the form must be submitted to the IRS by January 31 of the year following the tax year in which payments were made. If you are filing electronically, the deadline may vary slightly, so it is important to check the IRS guidelines. Additionally, recipients should receive their copies by the same deadline to ensure they can accurately report their income on their tax returns. Keeping track of these important dates is essential for compliance.

IRS Guidelines

The IRS provides specific guidelines for the use and submission of the Form 1099 MISC. These guidelines outline who must file the form, the types of payments that must be reported, and the necessary information to include. It is important to refer to the IRS instructions for the 1099 MISC to ensure compliance with all regulations. This includes understanding the thresholds for reporting, as not all payments may require a 1099 MISC to be issued. Adhering to these guidelines helps avoid potential penalties and ensures accurate tax reporting.

Penalties for Non-Compliance

Failing to comply with the requirements for filing the Form 1099 MISC can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide copies to recipients. The penalties can vary based on how late the form is filed and whether the errors are corrected. It is crucial for businesses and individuals to understand these potential penalties to encourage timely and accurate filing of the 1099 MISC. Being proactive in compliance can save both time and money in the long run.

Who Issues the Form

The Form 1099 MISC is typically issued by businesses or individuals who make payments to non-employees for services rendered. This includes corporations, partnerships, and sole proprietors who hire independent contractors or freelancers. It is the responsibility of the payer to ensure that the form is completed accurately and submitted to the IRS by the designated deadlines. Understanding who is responsible for issuing the form is essential for maintaining compliance with tax regulations.

Quick guide on how to complete 2021 form 1099 misc miscellaneous income

Complete Form 1099 MISC Miscellaneous Income effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documentation, as you can access the appropriate template and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 1099 MISC Miscellaneous Income on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

The easiest way to modify and electronically sign Form 1099 MISC Miscellaneous Income effortlessly

- Locate Form 1099 MISC Miscellaneous Income and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to confirm your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 1099 MISC Miscellaneous Income and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1099 misc miscellaneous income

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1099 misc miscellaneous income

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is 1099 filing electronically and why is it important?

1099 filing electronically refers to the digital submission of 1099 forms to the IRS, streamlining the reporting process for income paid to non-employees. Doing so not only ensures timely submission but also can reduce errors associated with paper forms. It’s an essential process for businesses looking to maintain compliance and avoid penalties.

-

How does airSlate SignNow assist with 1099 filing electronically?

airSlate SignNow simplifies 1099 filing electronically by allowing users to generate, send, and eSign 1099 forms directly from the platform. This eliminates the need for manual processes and signNowly reduces the time spent on paperwork. Additionally, you can easily track each document's status to ensure timely submissions.

-

What are the pricing plans for using airSlate SignNow for 1099 filing electronically?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs, making 1099 filing electronically cost-effective. Plans typically include various features such as unlimited document signing and customizable templates. Pricing details can be found on our website, which allows prospective users to choose the best option for their requirements.

-

Are there any integrations available for 1099 filing electronically with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various accounting and finance software, making 1099 filing electronically more efficient. Integration with platforms like QuickBooks or Xero simplifies data import and export, reducing manual entry errors. These integrations enhance your workflow, enabling you to manage your financial documents effortlessly.

-

What are the benefits of using airSlate SignNow for 1099 filing electronically?

Using airSlate SignNow for 1099 filing electronically offers numerous benefits, including increased accuracy, reduced processing time, and enhanced security. The platform's user-friendly interface ensures that even those without technical expertise can file forms quickly and efficiently. Moreover, eSigning provides a legally binding option that accelerates the entire process.

-

Is it secure to file 1099 electronically with airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security, implementing top-tier encryption to protect sensitive information during 1099 filing electronically. The platform complies with all relevant regulations, ensuring your data remains confidential and safe throughout the filing process. Users can file with confidence, knowing their information is secure.

-

Can I track the status of my 1099 filings electronically?

Yes, airSlate SignNow provides a comprehensive tracking feature that allows you to monitor the status of your 1099 filings electronically. You will receive notifications for completed, pending, and signed documents, ensuring that you are always aware of your filing status. This feature helps you avoid missed deadlines and stay organized.

Get more for Form 1099 MISC Miscellaneous Income

- Montana no fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without form

- Mt legal documents form

- Montana standby form

- Montana montana bankruptcy guide and forms package for chapters 7 or 13

- Montana contractors forms package

- Premarital agreements prenuptial 481375984 form

- Montana agreement form

- Nc legal documents form

Find out other Form 1099 MISC Miscellaneous Income

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form