Form 1099 MISC Rev January IRS Tax Forms 2022-2026

What is the fillable Form 1099 MISC?

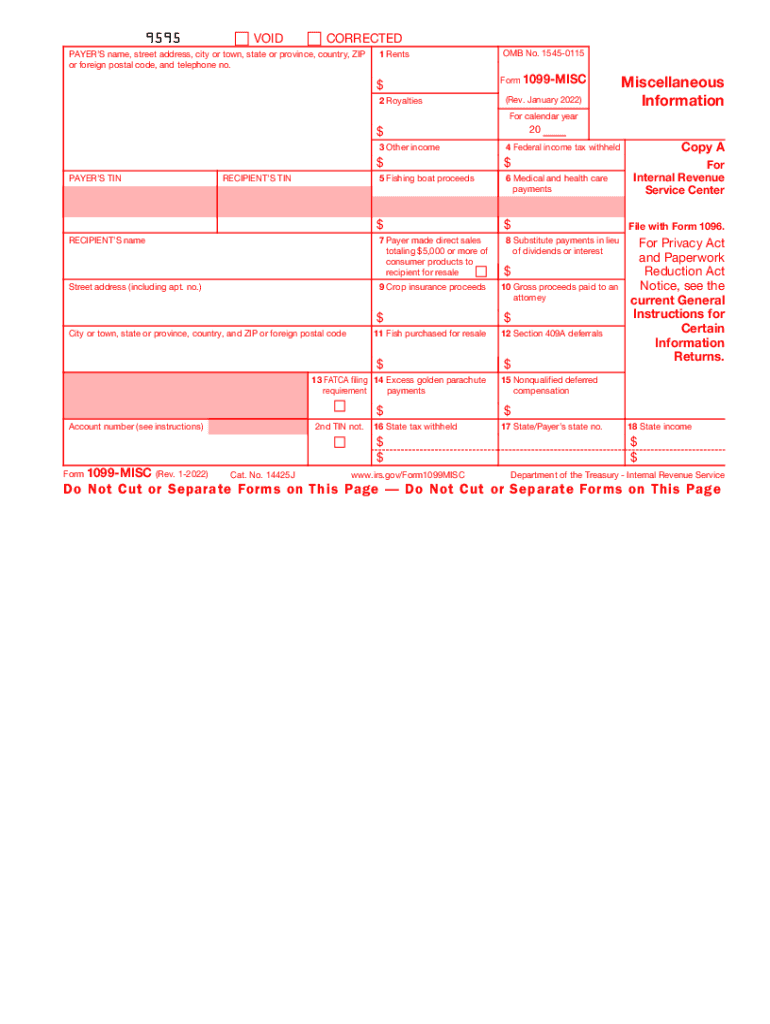

The fillable Form 1099 MISC is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is essential for businesses and individuals who have made payments to independent contractors, freelancers, or other non-employees. The IRS requires this form to ensure that all income is accurately reported and taxed. It includes information such as the payer's and recipient's details, the amount paid, and the nature of the payment.

Steps to complete the fillable Form 1099 MISC

Completing the fillable Form 1099 MISC involves several steps to ensure accuracy and compliance with IRS regulations. Start by gathering all necessary information, including the payer's and recipient's names, addresses, and taxpayer identification numbers (TIN). Next, accurately report the total amount paid in the appropriate boxes on the form. Ensure that you check the correct box to indicate the type of payment made, such as rents, royalties, or non-employee compensation. After filling out the form, review it for any errors before submitting it to the IRS and providing a copy to the recipient.

Filing deadlines for Form 1099 MISC

Filing deadlines for the fillable Form 1099 MISC are crucial to avoid penalties. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. If you are filing electronically, the deadline is typically extended to March second. Additionally, recipients should receive their copies by January thirty-first as well. It is important to stay informed about these deadlines to ensure timely compliance.

Legal use of the fillable Form 1099 MISC

The legal use of the fillable Form 1099 MISC is governed by IRS regulations. This form must be used to report payments made to non-employees, including independent contractors and freelancers, when the total payments exceed a specified threshold. Failing to use the form correctly can result in penalties for both the payer and the recipient. It is essential to understand the legal implications of using this form to ensure compliance with tax laws and regulations.

Examples of using the fillable Form 1099 MISC

Examples of using the fillable Form 1099 MISC include reporting payments made for services rendered by independent contractors, such as graphic designers or consultants. If a business pays an individual more than six hundred dollars in a year for their services, they are required to issue a Form 1099 MISC. Other examples include reporting rents paid to property owners or royalties paid to authors or artists. These examples illustrate the diverse scenarios in which the form is applicable.

Who issues the fillable Form 1099 MISC?

The fillable Form 1099 MISC is typically issued by businesses or individuals who make qualifying payments. This includes corporations, partnerships, and sole proprietors who have paid non-employees for services. The issuer is responsible for accurately completing the form and submitting it to the IRS while providing a copy to the recipient. Understanding who is required to issue the form is vital for compliance and proper tax reporting.

Quick guide on how to complete form 1099 misc rev january 2022 irs tax forms

Effortlessly Prepare Form 1099 MISC Rev January IRS Tax Forms on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any delays. Handle Form 1099 MISC Rev January IRS Tax Forms across any platform using the airSlate SignNow apps available for Android or iOS and enhance your document-related processes today.

How to Modify and eSign Form 1099 MISC Rev January IRS Tax Forms with Ease

- Obtain Form 1099 MISC Rev January IRS Tax Forms and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to submit your form via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1099 MISC Rev January IRS Tax Forms to ensure effective communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 misc rev january 2022 irs tax forms

Create this form in 5 minutes!

People also ask

-

What is a fillable form 1099, and how does it work?

A fillable form 1099 is a digital version of the 1099 tax form that allows you to enter and edit details electronically. With airSlate SignNow, users can easily complete and eSign these forms, ensuring accuracy and efficiency. This feature simplifies the process of filing taxes and keeps your financial data organized.

-

How can I create a fillable form 1099 using airSlate SignNow?

Creating a fillable form 1099 with airSlate SignNow is straightforward. Simply upload your 1099 template, use our intuitive editing tools to make it fillable, and then share it with your recipients for completion and eSigning. This enables fast processing and electronic submission, streamlining your tax reporting.

-

Are there any costs associated with using the fillable form 1099 feature?

airSlate SignNow offers a range of pricing plans that include access to fillable form 1099 capabilities. These plans are designed to be cost-effective, catering to businesses of all sizes. You can choose a plan that fits your budget while gaining essential features for document management and eSigning.

-

What are the benefits of using airSlate SignNow for fillable form 1099?

Using airSlate SignNow for your fillable form 1099 provides numerous benefits, including increased accuracy, reduced paperwork, and faster processing times. The ability to eSign and share forms electronically also minimizes risks related to lost documents or delays in filing. This streamlines your workflow and enhances productivity.

-

Can I integrate airSlate SignNow with other software for managing fillable form 1099?

Yes, airSlate SignNow seamlessly integrates with various software, allowing you to manage your fillable form 1099 and other documents effectively. Integrations with accounting software and CRMs ensure that data flows smoothly between platforms, helping you maintain accuracy and organization in your tax-related processes.

-

Is it secure to use airSlate SignNow for fillable form 1099?

Absolutely! airSlate SignNow prioritizes security, implementing top-notch encryption and authentication measures to protect your fillable form 1099 and all other documents. You can confidently eSign and share sensitive information, knowing that your data is secure and compliant with industry standards.

-

How can I track the status of my fillable form 1099 sent through airSlate SignNow?

Tracking the status of your fillable form 1099 is easy with airSlate SignNow. The platform provides real-time notifications and updates, allowing you to see when your forms are viewed, completed, or signed. This feature keeps you informed and helps you manage your document workflows effectively.

Get more for Form 1099 MISC Rev January IRS Tax Forms

- Nv letter landlord form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497320641 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair nevada form

- Letter tenant landlord form

- Nevada broken form

- Nevada demand form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497320646 form

- Nv tenant landlord form

Find out other Form 1099 MISC Rev January IRS Tax Forms

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself