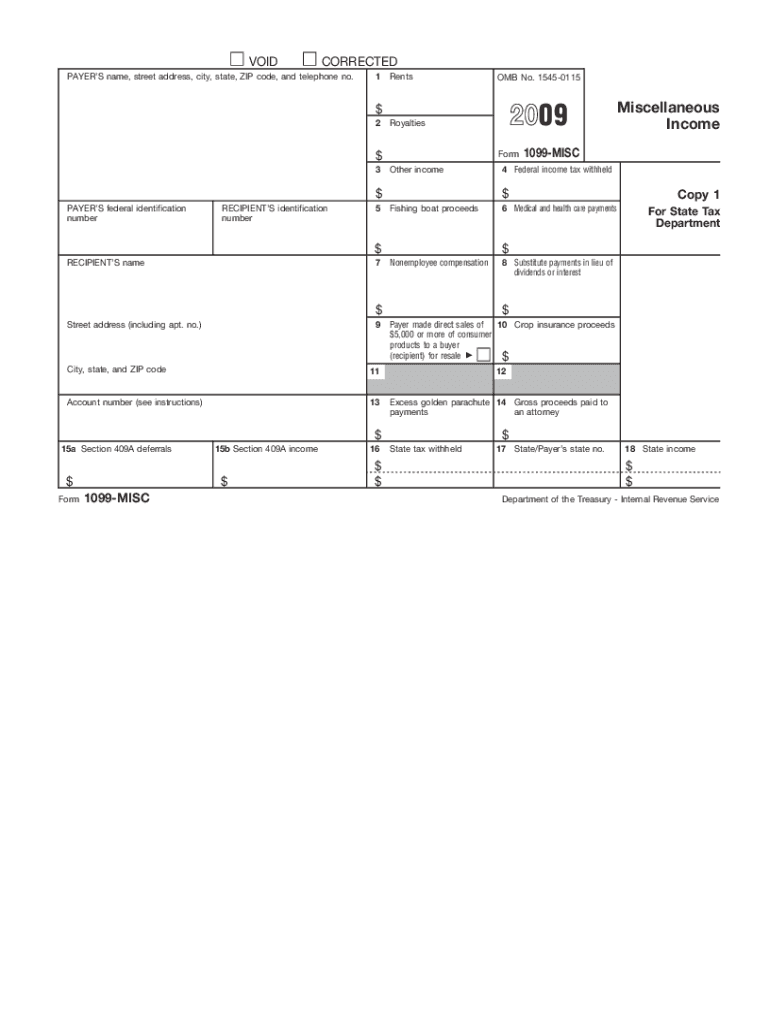

1099 Form 2009

What is the 1099 Form

The 1099 Form is a series of documents used in the United States to report various types of income other than wages, salaries, and tips. It is primarily utilized by businesses and individuals to report payments made to independent contractors, freelancers, and other non-employees. The most common variant of this form is the 1099-MISC, which is used to report miscellaneous income, while the 1099-NEC is specifically designed for reporting non-employee compensation. Understanding the purpose of the 1099 Form is essential for accurate tax reporting and compliance with Internal Revenue Service (IRS) regulations.

How to use the 1099 Form

Using the 1099 Form involves several key steps to ensure accurate reporting of income. First, businesses must determine if they need to issue a 1099 Form based on the payments made during the tax year. If a contractor or vendor is paid $600 or more, a 1099 Form is typically required. Next, the payer must gather the necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Once the form is completed, it must be distributed to the recipient and filed with the IRS by the designated deadline. Proper use of the 1099 Form helps maintain transparency and compliance in financial reporting.

Steps to complete the 1099 Form

Completing the 1099 Form involves a series of straightforward steps:

- Gather information: Collect the recipient's name, address, and TIN.

- Select the correct form: Choose the appropriate 1099 variant based on the type of payment.

- Fill in the details: Enter the payer's information, recipient's information, and the amount paid.

- Review for accuracy: Double-check all entries to ensure there are no errors.

- Distribute copies: Provide the recipient with their copy and send the appropriate copy to the IRS.

By following these steps, individuals and businesses can accurately report income and avoid potential penalties.

Legal use of the 1099 Form

The legal use of the 1099 Form is governed by IRS regulations, which require accurate reporting of income to ensure compliance with tax laws. It is essential for payers to issue the form to recipients who meet the reporting threshold, as failure to do so can result in penalties. Additionally, recipients must report the income listed on the 1099 Form on their tax returns. Understanding the legal implications of using the 1099 Form helps both payers and recipients fulfill their tax obligations and avoid issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Form are critical for compliance. Generally, the deadline for providing the form to recipients is January 31 of the year following the tax year in which payments were made. If filing electronically with the IRS, the deadline is typically extended to March 31. It is important to be aware of these dates to avoid late filing penalties and ensure that all tax obligations are met in a timely manner.

Penalties for Non-Compliance

Failure to comply with 1099 Form requirements can result in significant penalties. The IRS imposes fines for late filings, which can vary based on how late the form is submitted. Additionally, if a payer fails to issue a 1099 Form when required, they may face penalties for each form not filed. Understanding these potential consequences emphasizes the importance of adhering to IRS guidelines and ensuring accurate reporting of income.

Quick guide on how to complete 1099 2009 form

Complete 1099 Form effortlessly on any device

Online document management has become popular among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage 1099 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1099 Form with ease

- Obtain 1099 Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Craft your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you would like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 1099 Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 2009 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 2009 form

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a 1099 Form and why do I need it?

A 1099 Form is a tax form used in the United States to report income received by individuals or businesses that are not employees. It's essential for independent contractors, freelancers, or anyone earning non-wage income, as it helps ensure accurate tax reporting. Using airSlate SignNow, you can easily eSign and manage your 1099 Forms, making tax season smoother.

-

How can airSlate SignNow help me with my 1099 Form?

airSlate SignNow simplifies the process of sending, signing, and storing your 1099 Form electronically. With our intuitive platform, you can quickly prepare your forms, collect signatures, and ensure compliance with tax regulations. This streamlines your workflow, saving you time and reducing the risk of errors.

-

Is there a free trial available for using airSlate SignNow for 1099 Forms?

Yes, airSlate SignNow offers a free trial that allows you to explore all features, including the management of your 1099 Forms. This trial period gives you the opportunity to experience our user-friendly interface and robust functionality without any commitment. Sign up today to see how we can assist with your document needs.

-

What pricing plans does airSlate SignNow offer for managing 1099 Forms?

airSlate SignNow provides various pricing plans tailored to meet the needs of businesses handling 1099 Forms. Our plans are competitively priced, offering features that range from basic document signing to advanced integrations and workflows. You can choose a plan that best fits your requirements and budget, ensuring cost-effective management of your eSigning needs.

-

Can I integrate airSlate SignNow with accounting software for my 1099 Forms?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to automate the handling of 1099 Forms. This integration enhances your workflow by linking your financial records with eSignature capabilities, making it easier to manage your documents and track expenses.

-

What security features does airSlate SignNow provide for my 1099 Form?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the 1099 Form. We offer advanced encryption, secure storage, and compliance with regulations such as GDPR and HIPAA, ensuring that your documents are safe during transmission and storage. You can trust us to protect your important financial information.

-

How does airSlate SignNow improve the efficiency of 1099 Form processing?

With airSlate SignNow, the efficiency of processing your 1099 Form is greatly enhanced through automation and easy access. Our platform allows for quick document preparation, instant eSigning, and real-time tracking of all transactions. This reduces turnaround time and minimizes delays, allowing you to focus on your business.

Get more for 1099 Form

Find out other 1099 Form

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement