1099 Form 1999

What is the 1099 Form

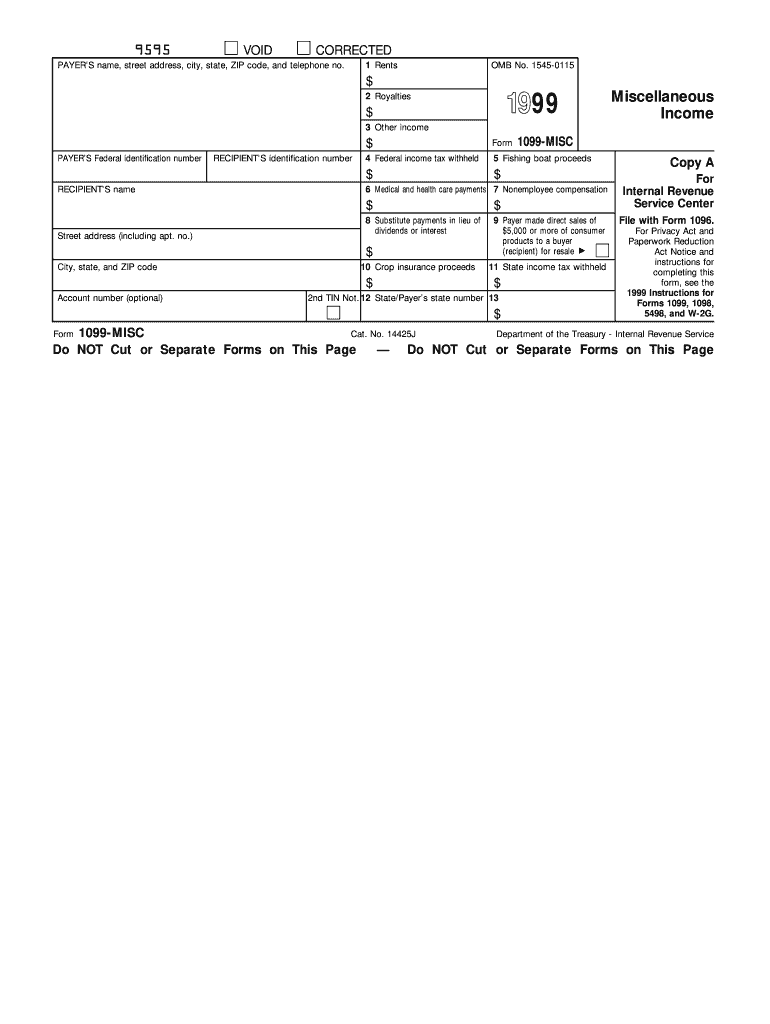

The 1099 Form is a series of documents used in the United States to report various types of income other than wages, salaries, and tips. These forms are essential for taxpayers to report income received from non-employment sources, such as freelance work, rental income, or interest and dividends. The most common variant is the 1099-MISC, which is used to report payments made to independent contractors. Each type of 1099 form serves a specific purpose and is crucial for accurate tax reporting.

How to use the 1099 Form

Utilizing the 1099 Form involves several steps, beginning with determining which variant of the form is applicable to your situation. Once identified, you must gather the necessary information, including the recipient's name, address, and taxpayer identification number. After completing the form, it is essential to send copies to both the recipient and the Internal Revenue Service (IRS) by the designated deadline. This ensures compliance with tax regulations and helps avoid potential penalties.

Steps to complete the 1099 Form

Completing the 1099 Form requires careful attention to detail. Follow these steps for accurate completion:

- Identify the correct 1099 variant based on the type of income being reported.

- Gather all necessary information, including the recipient's name, address, and Social Security number or Employer Identification Number.

- Fill out the form, ensuring that all amounts are accurate and correctly categorized.

- Review the form for any errors before submitting.

- Distribute copies to the recipient and the IRS by the required deadline.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Form are crucial for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the income was paid. If you are filing electronically, the deadline may extend to March thirty-first. It is important to note that recipients should also receive their copies by the end of January to allow for timely tax preparation.

Key elements of the 1099 Form

The key elements of the 1099 Form include the payer's information, the recipient's information, and the amount of income being reported. Additionally, the form includes specific boxes for different types of income, such as non-employee compensation, rent, or royalties. Accurate completion of these elements is essential for ensuring that the form is processed correctly by the IRS and that the recipient can report their income accurately.

IRS Guidelines

The IRS provides detailed guidelines for the completion and submission of the 1099 Form. These guidelines include instructions on which form to use, how to fill it out, and the deadlines for submission. It is important for taxpayers to familiarize themselves with these guidelines to ensure compliance and avoid penalties. The IRS also offers resources and assistance for those who may have questions regarding the form.

Penalties for Non-Compliance

Failing to file the 1099 Form on time or providing incorrect information can result in significant penalties. The IRS imposes fines for late filings, which can increase based on how late the form is submitted. Additionally, incorrect information may lead to further scrutiny from the IRS, resulting in audits or additional fines. Ensuring timely and accurate filing is essential to avoid these consequences.

Quick guide on how to complete 1999 1099 form

Effortlessly Prepare 1099 Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers a great environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage 1099 Form on any device using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign 1099 Form with Ease

- Locate 1099 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form scrolling, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 1099 Form and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1999 1099 form

Create this form in 5 minutes!

How to create an eSignature for the 1999 1099 form

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a 1099 Form and why do I need it?

A 1099 Form is a tax form used in the United States to report income received by individuals or businesses that are not employees. It's essential for independent contractors, freelancers, or anyone earning non-wage income, as it helps ensure accurate tax reporting. Using airSlate SignNow, you can easily eSign and manage your 1099 Forms, making tax season smoother.

-

How can airSlate SignNow help me with my 1099 Form?

airSlate SignNow simplifies the process of sending, signing, and storing your 1099 Form electronically. With our intuitive platform, you can quickly prepare your forms, collect signatures, and ensure compliance with tax regulations. This streamlines your workflow, saving you time and reducing the risk of errors.

-

Is there a free trial available for using airSlate SignNow for 1099 Forms?

Yes, airSlate SignNow offers a free trial that allows you to explore all features, including the management of your 1099 Forms. This trial period gives you the opportunity to experience our user-friendly interface and robust functionality without any commitment. Sign up today to see how we can assist with your document needs.

-

What pricing plans does airSlate SignNow offer for managing 1099 Forms?

airSlate SignNow provides various pricing plans tailored to meet the needs of businesses handling 1099 Forms. Our plans are competitively priced, offering features that range from basic document signing to advanced integrations and workflows. You can choose a plan that best fits your requirements and budget, ensuring cost-effective management of your eSigning needs.

-

Can I integrate airSlate SignNow with accounting software for my 1099 Forms?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to automate the handling of 1099 Forms. This integration enhances your workflow by linking your financial records with eSignature capabilities, making it easier to manage your documents and track expenses.

-

What security features does airSlate SignNow provide for my 1099 Form?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the 1099 Form. We offer advanced encryption, secure storage, and compliance with regulations such as GDPR and HIPAA, ensuring that your documents are safe during transmission and storage. You can trust us to protect your important financial information.

-

How does airSlate SignNow improve the efficiency of 1099 Form processing?

With airSlate SignNow, the efficiency of processing your 1099 Form is greatly enhanced through automation and easy access. Our platform allows for quick document preparation, instant eSigning, and real-time tracking of all transactions. This reduces turnaround time and minimizes delays, allowing you to focus on your business.

Get more for 1099 Form

- Introductory course waiver form depaul university cdm depaul

- Rn fall 2019 form

- Part i academic affairs tulane university form

- Minors in laboratory consent form

- Human resources department unc ashevilles human form

- Employee complaint form for reporting sexual harassment 00044741docx

- Office of student affairsstate university college at fredoniaoffice of financial aid form

- Coronavirus covid 19 church planning template form

Find out other 1099 Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe