1099 Form 2008

What is the 1099 Form

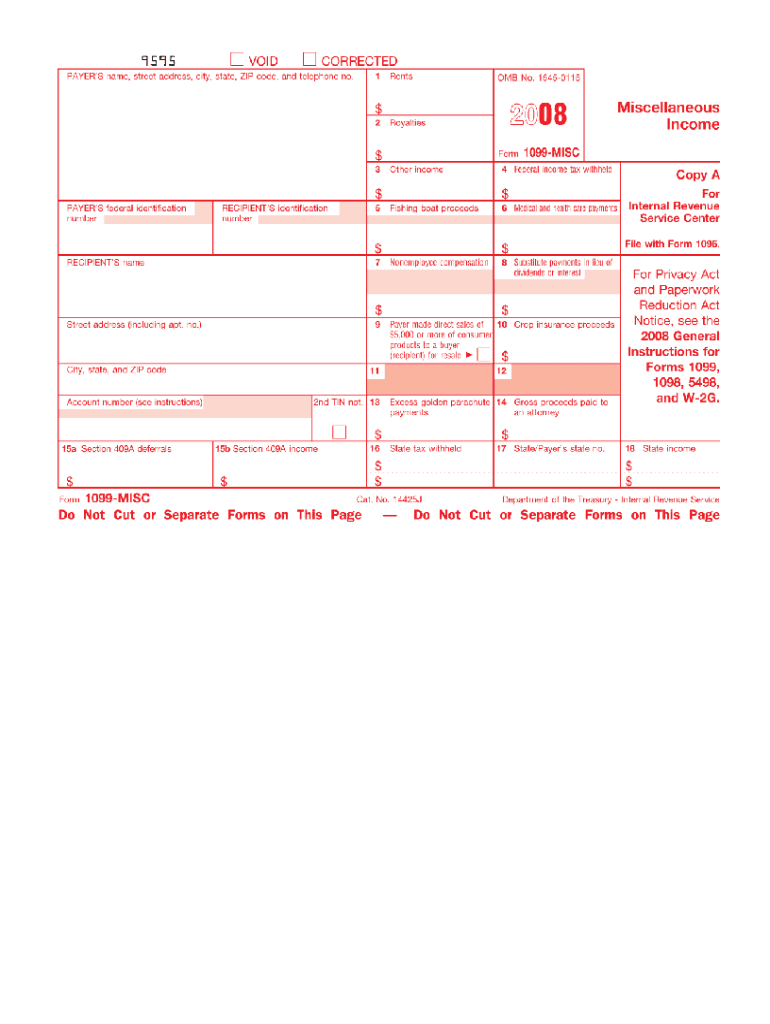

The 1099 Form is a crucial tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is essential for freelancers, independent contractors, and other non-employees who receive payments from businesses or individuals. The Internal Revenue Service (IRS) requires this form to ensure that all income is reported and taxed appropriately. There are several variants of the 1099 Form, each designated for specific types of income, such as interest, dividends, and non-employee compensation.

How to Use the 1099 Form

Using the 1099 Form involves several key steps. First, the payer must accurately fill out the form, detailing the amount paid and the recipient's information. The payer then submits the form to the IRS and provides a copy to the recipient. Recipients use the information on the 1099 Form to report their income on their tax returns. It is important for both payers and recipients to ensure that the information is correct to avoid potential issues with the IRS.

Steps to Complete the 1099 Form

Completing the 1099 Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect the recipient's name, address, and taxpayer identification number (TIN).

- Choose the appropriate 1099 variant: Determine which type of 1099 Form is needed based on the nature of the payment.

- Fill out the form: Enter the payer's information, recipient's information, and the amount paid in the designated fields.

- Review for accuracy: Double-check all entries to ensure there are no errors.

- Submit the form: Send the completed form to the IRS and provide a copy to the recipient by the required deadlines.

Legal Use of the 1099 Form

The legal use of the 1099 Form is governed by IRS regulations. It is essential for payers to issue the form when payments exceed a specific threshold, typically six hundred dollars in a calendar year. Failure to issue a 1099 Form can lead to penalties for the payer. Additionally, recipients must report the income listed on the form when filing their taxes. Proper use of the 1099 Form helps maintain compliance with tax laws and ensures that all income is accounted for.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Form are critical to avoid penalties. Generally, the deadline for providing the 1099 Form to recipients is January thirty-first of the following year. Payers must submit the form to the IRS by the end of February if filing by paper or by March thirty-first if filing electronically. It is advisable to keep track of these dates to ensure timely compliance with IRS requirements.

Who Issues the Form

The 1099 Form is typically issued by businesses or individuals who make payments to non-employees. This includes companies hiring freelancers, independent contractors, or anyone who receives payments for services rendered. It is the responsibility of the payer to ensure that the form is completed accurately and submitted on time to both the IRS and the recipient.

Quick guide on how to complete 2008 1099 form

Effortlessly Prepare 1099 Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage 1099 Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Edit and eSign 1099 Form with Ease

- Find 1099 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign 1099 Form while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 1099 form

Create this form in 5 minutes!

How to create an eSignature for the 2008 1099 form

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is a 1099 Form and why do I need it?

A 1099 Form is a tax document used to report income received by non-employees, such as freelancers or contractors. Businesses are required to issue a 1099 Form to any individual or entity to whom they have paid $600 or more in a calendar year. Using airSlate SignNow simplifies the process of preparing and sending 1099 Forms, ensuring compliance with tax regulations.

-

How can airSlate SignNow help me with my 1099 Form?

airSlate SignNow streamlines the process of creating and signing 1099 Forms electronically. Our platform allows you to easily fill out, send, and e-sign these forms, making it quicker and more efficient than traditional methods. Moreover, our secure cloud storage keeps your documents safe and accessible.

-

Is there a cost associated with using airSlate SignNow for 1099 Forms?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs. You can choose from monthly or annual subscriptions, which provide access to features like electronic signatures and document templates for 1099 Forms. This cost-effective solution helps you save time and resources in managing your paperwork.

-

What features does airSlate SignNow offer for managing 1099 Forms?

airSlate SignNow provides features such as customizable templates for 1099 Forms, real-time tracking of document status, and the ability to collect signatures online. Additionally, you can automate reminders for your signers and ensure that your forms are processed in a timely manner. These features enhance your efficiency in handling tax documents.

-

Can I integrate airSlate SignNow with other accounting software for 1099 Forms?

Absolutely! airSlate SignNow offers integrations with popular accounting and financial software like QuickBooks and Xero. This capability allows you to seamlessly import and export 1099 Form data, making your workflow more cohesive and reducing the chances of errors.

-

How secure is the information I provide in my 1099 Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and adhere to strict compliance standards to ensure that your 1099 Form data is protected from unauthorized access. Our platform provides a secure environment for e-signatures and sensitive tax documents.

-

Can I use airSlate SignNow for multiple 1099 Forms at once?

Yes, airSlate SignNow allows you to batch send multiple 1099 Forms effectively. This means you can prepare and dispatch several forms at the same time to different recipients, streamlining the process and reducing the time spent on manual entry and sending.

Get more for 1099 Form

Find out other 1099 Form

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself